There’s been a lot of talk in the Australian media lately about the lack of funding for female founders, with many female-led startups looking at alternative sources of capital and steering away from venture capital firms. In particular, equity crowdfunding has risen in popularity amongst startups run by women, allowing them to raise capital with lower barriers to entry whilst also building a loyal and passionate customer base in the process.

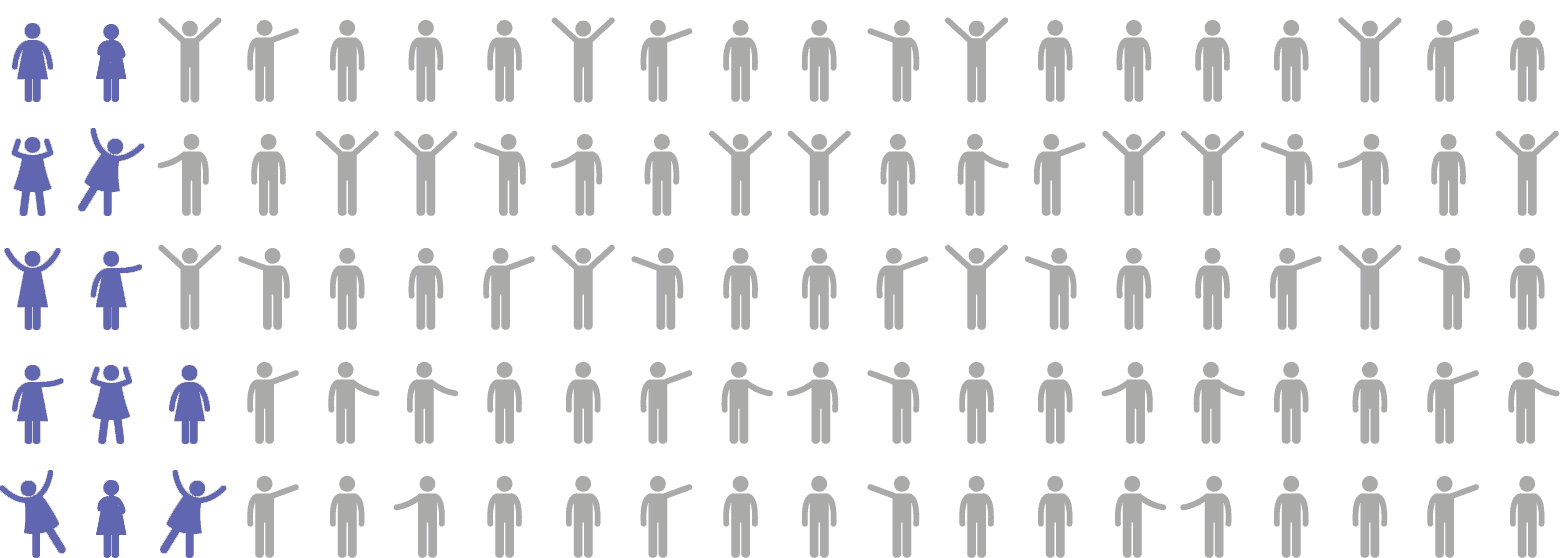

The numbers are there to show this, with a significant decline in venture capital investment globally for women-led firms. In fact, women-led businesses in Australia and New Zealand only received 5.3% of the $2.7b in venture capital funding in the first half of this year. Furthermore, just approximately 12% of decision makers at VC companies are women, and most businesses still don't have a single female partner.

12% of decision makers at VC companies are women

The lack of gender equality in funding startups is causing real problems for female founders. While it has long been accepted that women must compete with men in the marketplace for resources, the lack of gender equality in venture capital has created an unconscious bias that negatively affects female entrepreneurs.

Harnessing The Power Of The Crowd

Female founders are increasingly turning to equity crowdfunding to raise money for their early-stage companies. While equity crowdfunding has been growing in popularity for several years, it’s only recently emerged in Australia as a viable alternative to traditional funding sources for SMEs like angel investing and venture capital.

Not only is equity crowdfunding giving these female founders access to capital that has been traditionally denied by venture capital, but it is also creating brand awareness and loyal brand advocates by allowing them to raise capital through their network and a broad database of retail and wholesale investors. These individuals will often spread the word, purchase the company’s products and be a great source of feedback.

For businesses with already established customer bases, it’s a great way to reward your loyal customers as to who better to invest and stand to profit from your success than those who backed you from the start.

Whether you were a loyal customer or not to begin with, there are a number of advantages in investing in female-founded startups and companies. Female founders routinely outperform those managed only by men, delivering higher profitability and returns on investment, according to research. Female-led businesses generated 12% higher yearly revenues than male-led businesses, according to a study by BCG and MassChallenge. They also used a third less capital on average. Female-founded startups generated 78 cents for every dollar invested, whereas male-founded startups created only 31 cents – less than half.

Celebrating our current female founders

Threadicated is a pioneering fashion-tech company, bringing AI-powered personalised styling services direct-to-consumers. After wanting to gift her mum, who lived regionally, a personal stylist session, Danielle realised a major gap in the market for online stylist help.

Tbh skincare is a rapidly growing, digitally-native skincare brand disrupting the adult acne and skincare industry through scientifically backed and patented technology. The mother-daughter team created tbh after Rachel suffered from teenage acne and noticed a major gap in the market for scientifically proven but consumer focussed skincare.

Your Food Collective delivers better tasting, insanely fresh, locally & ethically sourced groceries right to your door. They are currently raising now. The company was founded by cousins Cara and Lauren, who believe in the power of good food to nourish our bodies and our planet. As mothers as well, they are passionate about feeding families with the highest quality and sustainably sourced food.

Equitise Alumni - Case Studies

Emperor Champagne is an e-commerce platform which offers an expertly curated collection of champagne with superior service and knowledge.

They raised $559,360 from 87 investors in 2019

Choovie is an independent digital platform that matches moviegoers with the cheapest empty seats using its own proprietary dynamic pricing algorithm.

They raised $294,250 from 116 investors in 2018.