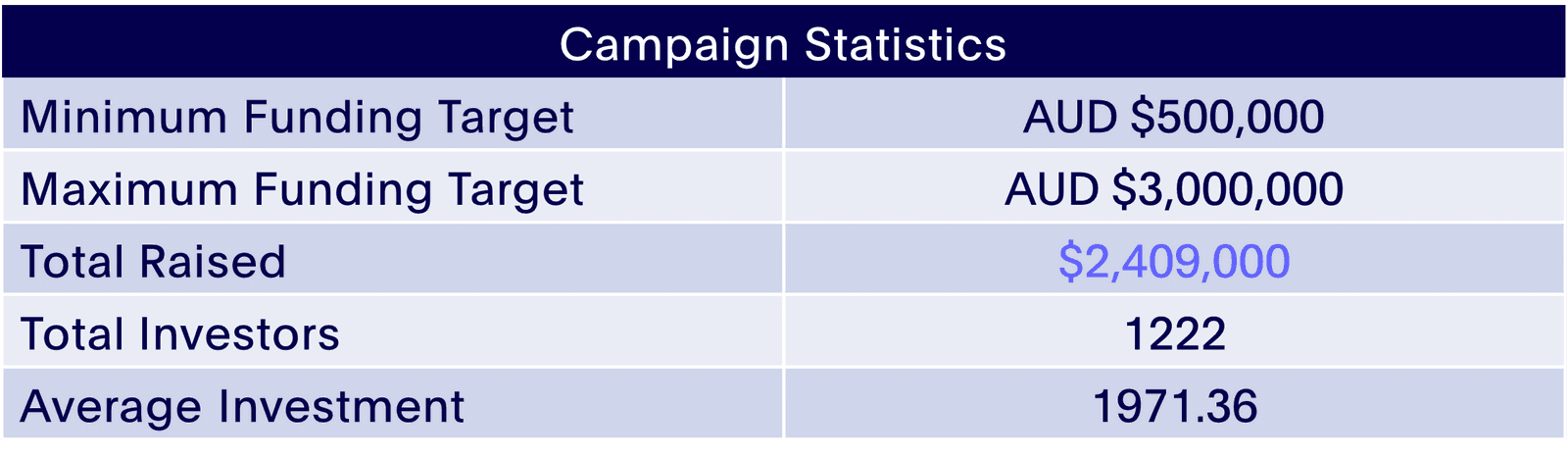

After we were one of the first platforms to receive our retail equity crowdfunding license on January 11 2018, we quickly launched our first offer, Xinja, making it the first ever retail equity crowdfund in Australia. It went on to raise over $2.4 million exceeding expectations and acting as a proof of concept for both neobanks and equity crowdfunding.

What is Xinja?

Xinja is building Australia’s first independent ‘neobank’, designed from the ground up for mobile. As of August 2018, the company is not a bank yet, but is working closely with regulators to become one. This means it will be one of Australia’s first truly independent banks, giving Australians a choice between the traditional banks and a new, transparent, digital banking experience. It’s revolutionising the customers’ banking experience, making it quick and fun while helping them manage their money more effectively.

Xinja's Raise

Equitise investors participated in Xinja’s $10 million Series B fundraise, of which $5 million had already been raised outside of the Equitise platform. Prior to the launch, Equitise and Xinja launched extensive marketing efforts through both traditional and online channels to raise awareness and build a community around the Xinja brand and educate people on the equity crowdfunding model. This was a huge success as demand from the retail crowd was phenomenal upon launch, with the offer reaching the minimum of $500,000 from 269 investors within 18 hours of the public launch. The story gained further awareness by making headlines at the AFR and Business Insider, amongst others. By the end of the first week, we had hit the $1 million mark for Xinja from a total of 501 investors, demonstrating the power and interest of the crowd in supporting innovative Australian businesses.

Strong engagement with the offer continued with our inaugural keynote event, the “Equity Crowdfunding Masterclass.” Joining our own Chris Gilbert on the panel was Daniel Scotti, Partner at MinterEllison, and Xinja Founder and CEO, Eric Wilson. This event had an impressive turn out with nearly 100 attendees, and the crowd got the opportunity to learn more about both Xinja and the equity crowdfunding space over pizza and beers.

Over the following weeks we also had our Sophisticated Investor Luncheon and webinar with Eric Wilson whilst continuing digital marketing.

After a 69 day long campaign, Xinja successfully closed having raised over $2.4m from more than 1,200 unique investors. The offer was 488.1% funded, representing the success of the campaign and wider public interest in investing in early-stage companies. The result also underlines the democratising power of equity crowdfunding in creating a new asset class to retail investors. Equitise raised a further $360,000 through wholesale investors.

For a full breakdown of the Xinja retail equity crowdfund, check out our infographic.