The Stubby Club

- Type: Retail

- Total Round Size (min): AUD$255,000

- Total Round Size (max): AUD$1,000,025

- Price per share: AUD$0.85

The Stubby Club

Your one-stop-shop for branded sports merchandise!

- Fees Paid by Issuer: 6%

- Cooling Off Rights: 5 working days

- Minimum Parcel Size: $255

Offer Overview

Key Documents

What is The Stubby Club

The Stubby Club is an Australian online retailer specialising in licensed merchandise for major sporting codes including the AFL, NRL, A-League, Cricket Australia, NFL, and EPL. With products ranging from beanies, scarves, beer growlers, stubby holder dispensers, golf bags and accessories, whiskey stones, beer pong tables and much more, The Stubby Club is building a one-stop shop for all sporting merchandise needs.

Launched in 2018 by three mates, Dean, Jon and Dylan, the team is now joined by a passionate community of over 30,000 customers that love its brand and products. This has led to revenue having grown 10x over 2 years, with the team on target to hit $1.9m in sales in FY22. With a range of exciting expansion opportunities in the works with major retailers and various new revenue streams being explored, this is a pivotal stage in the company’s growth.

Investment Highlights

- Phenomenal Traction

The Stubby Club’s growth has been nothing short of phenomenal. In two short years it has grown from $190k revenue in FY20, to a revenue run rate of $1.9m in FY22 with plenty to come. The company's lean operating model has enabled it to fund most of its expansion and growth from operating cash flows with profitability forecast for FY23. This growth is forecast to continue as the company looks to capitalise on a range of growth opportunities.

- Strong Unit Economics and Passionate Customers

With an average order value of $120 and an 11% customer return rate, The Stubby Club has already amassed over 30,000 happy customers and thousands of 5 star reviews. Their customer lifetime value (CLV) to customer acquisition cost (CAC) ratio currently sits at just over 5, pointing to a sustainable growth trajectory.

- Unique Value Proposition and Licenses

With official licenses across major Australian sporting organisations, the EPL and one of the only Australian licensees of the NFL, The Stubby Club provides a unique collection of products that you can’t find at other major retailers. The team are currently finalising licensing arrangements with a major US sporting code which will further strengthen its position.

- Wholesale Distribution Opportunities

The Stubby club is currently in talks with a number of major Australian retailers seeking to sell a range of products for which The Stubby Club currently holds official licenses. These sales channels will provide The Stubby Club national distribution coverage and complement its direct-to-consumer sales channel which has been the focus to date.

- Growing Demand for Custom Merchandise

The team has seen strong demand for custom branded merchandise. This B2B sales channel is predicted to be one of the largest contributors to future revenue. To realise this opportunity, the team are bringing custom printing capabilities in house to meet demand. Bringing this capability inhouse will also have significant cost benefits for the rest of Stubby Club’s products, improving overall profitability and cash flow.

- A Growing Market

In Australia, online sporting merchandise has experienced annualized market size growth of 17.5% between 2017 and 2022, and the market size has reached $361.4m in 2022.

Support across sports such as AFL, NRL, and Soccer have experienced significant growth in supporter bases too, with AFL club membership numbers increasing in 28 of the past 30 years. With the uptick in sports followers across the board, this presents a new market for fans and followers who want to show off their team’s colours. This is strengthened by the surge in popularity of e-commerce and the shift to online retail which The Stubby Club is perfectly positioned to benefit from.

- Strong M&A Activity

The global licensed sports merchandise sector has seen extensive funding and acquisition activity over the past decade, with American powerhouse Fanatics leading the charge. Having acquired 5 organisations since 2019, their valuation has reached a staggering $27 billion USD in early 2022 and is evidence of the extreme growth potential for sporting merchandise companies around the world.

Official Licenses

We hold licensing agreements with a range of Australian and international sporting organisations that enable us to design, manufacture and sell branded merchandise unique to The Stubby Club.

For further detail on our licensing agreements please see Section 2.3.3 of the Offer Document.

Core Business Model

Since launch in 2018 we have operated a direct-to-consumer business model, built around our online e-commerce store (thestubbyclub.com.au). This model enables us to achieve high product margins across our extensive range of branded merchandise. It also allows us to build a relationship directly with our customers and a brand that reflects their interest and values. Over 30,000 customers have purchased from The Stubby Club since our first trading year in 2020, and we’ve generated thousands of 5 star reviews for our exceptional customer service.

Over the last year our gross margins on products sold has increased from 53% in FY21 to 64% in the first half of FY22. We anticipate that these margins on products sold through our online store will continue to increase in the next few years as we increase our production capacity, look to move our printing in-house and continue to negotiate lower royalty rates with the sporting codes as we continue to hit sales targets. Our target average gross margins for FY23 is 70%.

Our ability to manufacture and sell branded sports merchandise is made possible by our licensing agreements with major sporting codes domestically and internationally outlined in section 2.3.3 of the Offer Document. Conversations with the NBA, NHL and MLB will see The Stubby Club be one of the largest licensees of US sports in Australia.

To complement our D2C business model, we are expanding into wholesale distribution and have already signed two of Australia's largest retailers to sell The Stubby Club products.

For further information see Section 2.5 of the Offer Document.

Growth Strategy

For further information see Section 2.6 of the Offer Document.

Currently we rely on our strong relationships with manufacturers to provide the custom printed products we design and sell to customers. This can place restrictions on the business due to high minimum order quantities.

In order to more efficiently deliver custom branded merchandise for our customers, we have already started to bring custom printing capability in-house. This will enable us to be more agile with new product developments and custom branding, and require us to hold less stock on hand. It will also enable us to reduce COGS and improve margins as we drive towards achieving profitability in FY23.

Our unique and differentiated range of licensed products are in demand from major retailers. We recently signed an agreement with Pet Circle to sell our licensed NRL pet products. Pet Circle is a leading online retailer of pet products with 700,000 customers across Australia. Australian expenditure on pets has grown consistently over the recent years, accelerated noticeably by COVID. Self-reported expenditure on pet related products and services is now estimated at more than $13 billion. Our growing range of licensed pet products that aren’t in the market yet provide a strong opportunity to capitalise on this growing trend.

We have also brought on SportsPower, one of Australia's largest sports apparel and equipment retailers, providing us a truly national footprint with 110 stores Australia wide.

The addition of this sales channel to supplement our online, direct-to-consumer platform will diversify our revenue streams and By 2023 our aim is for this channel to account for 30% of total revenue. We intend to hire dedicated experienced staff focused on expanding our wholesale network and channel partners.

Our success to date has largely been built on providing customers with fun, innovative products, separating us from the outdated sports merchandise dominating the market. Continually innovating and delivering products that customers love and that no one else is providing is critical to our competitive advantage and future success. We have several new product ranges in the pipeline including: AFL, NRL, and NFL mini table tennis tables, corn hole tables, Mini table tennis bats and balls, can crushers, and a full pet range which will be available for the NRL and NFL later this year. These pre-production samples are all approved by the relevant licensors and will be at market in the second half of the year.

A key focus of ours has always been to have a product for (almost) everyone. With our growing list of official licenses, we see strength in our breadth of products to appeal to fans of all sports. With the increase in support for US based sports, we are looking to bring on the NHL, MLB and NBA shortly which will make us one of the largest holders in Australia of US sporting code licenses. In addition, European football codes are a key focus for us along with Formula 1 other auto sports in response to recent growth in support and popularity. We are also moving into other licensing opportunities including Marvel, Disney, Star Wars and various bands and opening up other revenue streams and engaging with more customers that aren’t necessarily sports fans which will only increase market share and brand awareness.

The last 18-months has seen a dramatic increase in the area of digital sports memorabilia. Most noticeably, blockchain technology is being harnessed to provide sports media and experience NFTs (Non-Fungible Tokens), with major sporting codes around the world starting to explore this nascent sector. The best example of this is US behemoth Fanatic’s launch of Candy Digital. The market in Australia is relatively nascent and we believe that there is a strong opportunity to leverage our engaged audience and relationships with major Australian sporting codes to expand into this space. The Stubby Club is at the very early stages of exploring how it can partner with an appropriate tech partner to leverage its brand equity and engaged customer base and introduce a new revenue stream focused on digital memorabilia and other products.

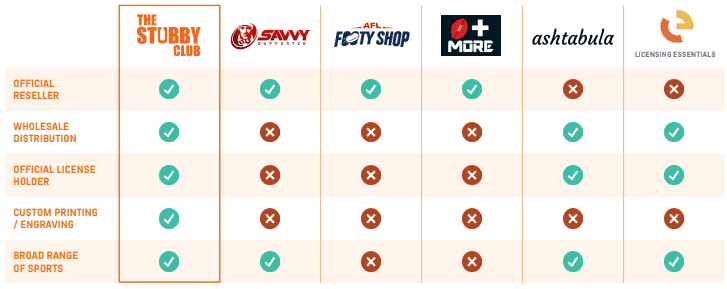

Competitive Landscape

In the online retail space, there are a range of companies that are official resellers and compete with The Stubby Club, but who aren’t licensees.

What sets us apart is our multi-faceted business model. We are a wholesale distributor, official reseller and (uniquely) have our own licensed products. Managing these separate parts of the business calls for independent strategies, and the combination introduces complexity. Effectively managing these complexities and delivering organisational synergies sets us apart from the competition and is driving our rapid growth.

For more information see Section 2.9.2 of the Offer Document

Why Equity Crowdfunding

In order to accelerate and continue to grow the business, The Stubby Club will be investing in printing equipment, skilled personnel and stock to help us through this next phase and to continue to smash our revenue targets.

We’ve always been committed to building a loyal and passionate community of customers that mirrors their dedication and loyalty to the sporting clubs they support. Equity crowdfunding is a fantastic opportunity to raise capital while inviting our supporters to come along for the ride as part owners of our business.

Key Team Members

Dean Snoxell

Prior to launching the Stubby Club brand in 2018, Dean had over 7 years of experience running a chain of successful Hudson Coffee Cafes. Having come up with many of the initial product ideas ahead of the launch of The Stubby Club, Dean is now responsible for product development, manufacturing and commercials ensuring that The Stubby Club continues to differentiate itself with unique products.

Jon Marshall

As Director, Jon leads the growth and marketing engine behind The Stubby Club brand. Recently Jon has spearheaded the wholesale revenue stream signing on major retailers such as SportsPower and Pet Circle to sell The Stubby Club’s unique and exclusive range of licensed products. Jon’s experience prior to launching The Stubby Club is shared with his co-founders Dean and Dylan.

Dylan Waugh

Dylan leads the website development and tech optimisation for The Brand Licensing Group. His focus on customer experience also extends to leading inventory management and logistics for The Stubby Club, to ensure the seamless experience for customers from landing on the webpage through to receiving orders. Prior to The Stubby Club, Dylan worked alongside Dean and Jon in owning and managing a successful cafe chain.

Financial Information

For further information see Section 2.13 of the Offer Document.

Investor Rewards

See section 2.15 of the Offer Document for further information.

Use of Funds

For further information see Section 3.2 of the Offer Document.

Key Risks

The company currently holds licenses from major Australian and international sporting organisations that enable us to sell branded merchandise. Should these licenses be cancelled upon renewal this will impact the companies ability to sell branded merchandise in the future.

The company currently provides a wide and unique selection of products. However the licenses held are not exclusive, and should companies receive licensees and design similar branded products this increased competition may impact sales, growth and market share.

As an online e-commerce brand, we hold inventory on-hand in our Melbourne warehouse to meet the needs of customers. Inability to sell through stock will impact profitability.

The company currently sources products from various manufacturers globally. A significant proportion of our products are shipped from manufacturers in China. Current supply chain and political issues in the region could impact our ability to supply customers in a timely manner.