AYLA

- Type: Retail

- Total Round Size (min): AUD$100,000

- Total Round Size (max): AUD$2,000,000

- Price per share: AUD$5

AYLA (formerly noobill)

AYLA is building the first AI-assistant that allows for price-comparison, management and payment of all recurring services within the one mobile app.

- Fees paid by issuer: 6% of funds raised

- Cooling-Off Rights: 5 working days

- Minimum Parcel Size: $500

Offer Overview

Key Documents

What is AYLA?

AYLA is an Australian fintech that aims to help people better their financial wellbeing by empowering them to take control of their household finances.

AYLA is building the first AI-assistant that allows for price-comparison, management and payment of all recurring services within the one mobile app. By conducting over 400 interviews and surveys to better understand the frustrations and needs of the market, AYLA discovered that young Australians do not feel in control of their financial world. Inexperience and the increasing cost of living, means the job of managing and paying for recurring services is adding to the already burdensome lives of young people — AYLA aims to change this.

At a minimum, AYLA reduces time spent managing recurring services by 10x compared to traditional management tools and empowers young people to build better financial habits, at zero out-of-pocket cost).

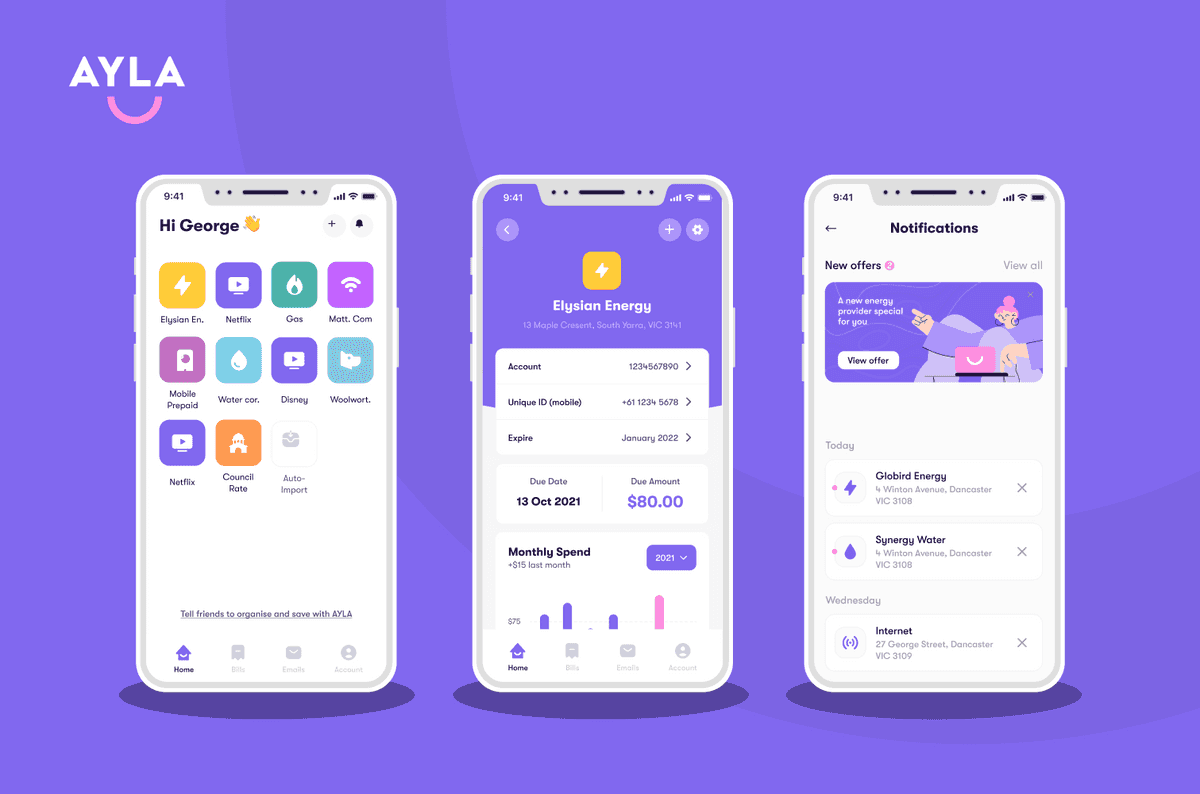

The app offers a seamless experience that ensures recurring services are always stress-free and paid on time by users (a.k.a. “member”). At the same time, the AI-powered price comparison tool ensures that members always receive the best value rates available.

Free for its members, AYLA will generate revenue by charging providers ongoing small fees to deliver their service through the app or anywhere on the internet. Unlike existing price- comparison websites, AYLA will connect providers with highly qualified leads, without any significant up-front investment in marketing or customer acquisition costs.

As a first-mover of AI assistant for combined recurring services, AYLA will not only provide an unparalleled automated personal finance experience; it will go beyond, with the goal of becoming a financial wellness tool to improve overall financial wellbeing.

This investment is ESIC Eligible.

Recent Achievements

- AYLA has fully launched with over 3000+ registered users. Try here: Download iOS Download Android

- AYLA has issued its first industry reports and covered 147 Australian suburbs based on a successful beta launch. Check here

- Innovation Patent has been granted for our self-learning AI system. Check here

- AYLA Energy is on track to be launched in early March. Preview here Password: Tkgi

Investment Highlights

- First AI-assistant to auto manage life admin

Using patent applied AI technology, AYLA has created the first AI-assistant to make price-comparison, bill management and switching providers, fast and straightforward. AYLA’s AI also reviews individual usage consumption and history to provide customised products and provider recommendations to increase members’ lifetime savings on recurring services.

- Ecommerce model aligned with consumers and providers

AYLA’s unique ‘Ecommerce for recurring services’ model aligns its business objectives with the long-term goals of consumers and providers, unlike the current ‘agency’ model employed by competitors that does not deliver value for consumers, prioritises high-profits but also has high marketing and acquisition costs that ultimately get passed onto the end-customer.

- Consumers are a ‘sticky’ member base for recurring services

In providing a holistic service that helps members manage life’s recurring services, AYLA creates a ‘sticky’ audience by ensuring they always receive the best value and a seamless experience. Convenience and usability are further embedded over time as members integrate multiple services with AYLA, cultivating loyal brand ambassadors.

- Backed by prominent technology investors

Backed by prominent technology investors Interest in AYLA’s disruptive product and significant market potential led to a successful pre-seed funding round with investment from prominent tech investors, and a successful equity crowd funding showed support from the public. AYLA is also proud to be part of the Stone & Chalk accelerator and a member of Fintech Australia.

Current Industry Landscape

Outdated Model and Archaic Systems

Industry research suggests that the largest 3–4 providers in essential services industries own 70–90% of the market, have high profits, but also high costs, inflexible legacy systems and a business model that does not deliver increasing value for consumers in line with their gradually increasing prices (continued price hikes, much higher than CPI).

The Supply Chain Myth

Essential services providers are not the product/service owners. In most essential services industries, providers do not impact the core product delivered. Their main activities are marketing and billing, rather than developing the core product or service for the benefit of consumers. Due to the competitive nature of the industry, providers need to spend big on marketing and distribution agents to compete; these costs are then passed onto consumers.

The Problem

Recurring service providers like Energy, Telecommunications, Insurance and Banking are facing huge problems. Their customer acquisition and call centre costs are through the roof, but inefficient and not adding value to customers.

Dissatisfied Market

Through over 400 interviews and surveys, we discovered that people are confused about their options and lack time to manage their recurring services properly. It can take 5 to 10 minutes to locate past bills; calls to providers can be upwards of 30 minutes and the stressful task of researching and then switching providers can mean days of complex pricing and voluminous contracts to read and understand. Multiply this by ten, for the average number of recurring services supplied to each Australian household.

Model in Conflict with Consumers and Providers

Estimates show that recurring services providers are charging Australian households over $25 billion in avoidable fees and payments every year.

That is a massive $2,500 in out-of-pocket expenses household21-29. The current business model is set up to make profits at the expense of consumers. Providers are trapped in a system that forces competition on marketing spend. Long-time customers are punished, instead of rewarded, with regular price hikes to cover marketing costs and further maximise profits.

In addition, dominant providers are outdated, with legacy systems incapable of innovation or requiring upgrades at the expense of billions of dollars.

Financial Burdens on Young People

Research shows that young Australians are struggling to take control of their financial world. Inexperience and the rising cost of living mean that financial management is more financial survival, with the fear of the next unexpectedly large bill looming overhead.

Stressed by increasing expenses and frustrated by the lack of digitalisation, young people want a support system to help them find stability and gain overall financial wellbeing.

Outdated Model and Archaic Systems

Industry research suggests that the largest 3–4 providers in essential services industries own 70–90% of the market, have high profits, but also high costs, inflexible legacy systems and a business model that does not deliver increasing value for consumers in line with their gradually increasing prices (continued price hikes, much higher than CPI).

The Supply Chain Myth

Essential services providers are not the product/service owners. In most essential services industries, providers do not impact the core product delivered. Their main activities are marketing and billing, rather than developing the core product or service for the benefit of consumers. Due to the competitive nature of the industry, providers need to spend big on marketing and distribution agents to compete; these costs are then passed onto consumers.

The Solution

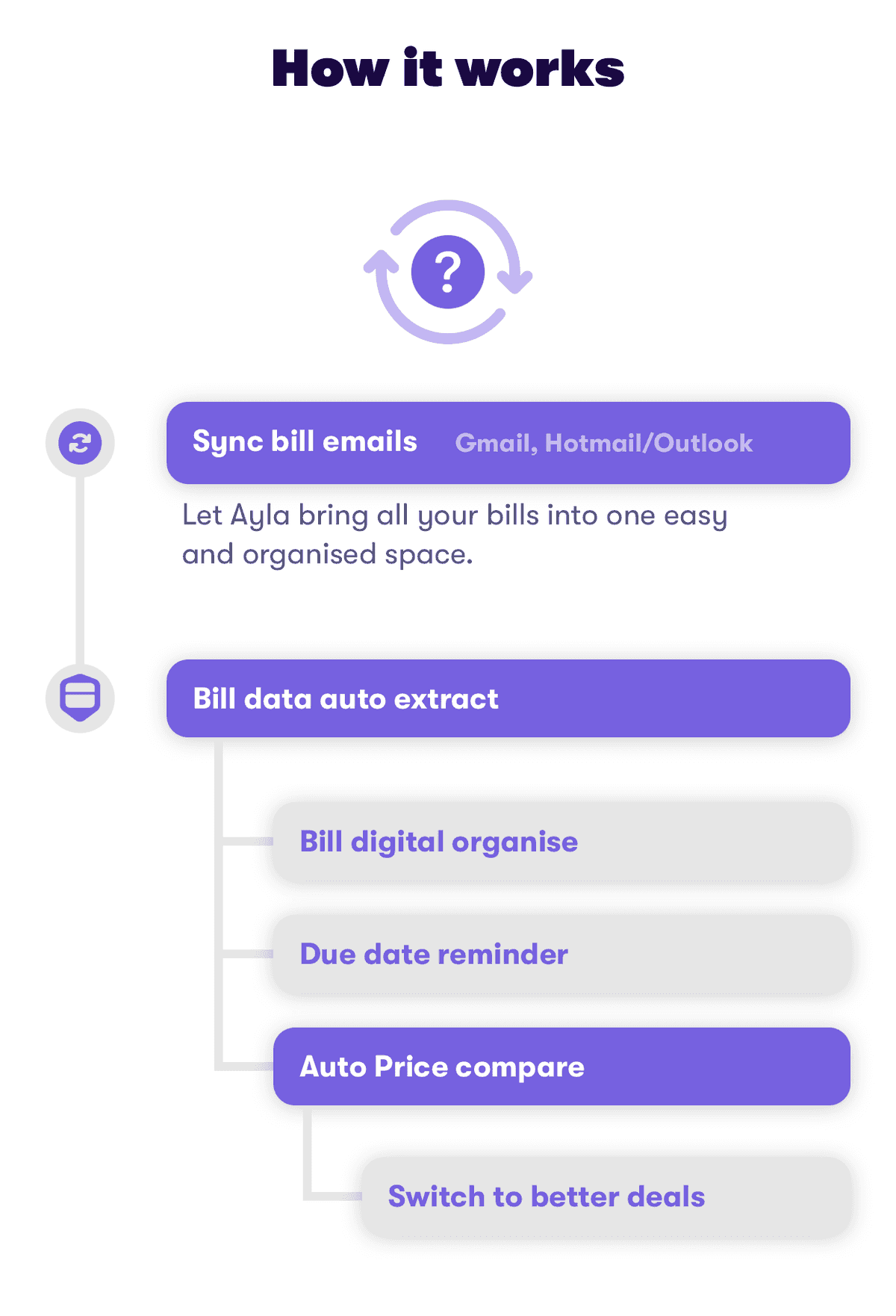

AYLA is changing the way recurring services are delivered and managed.

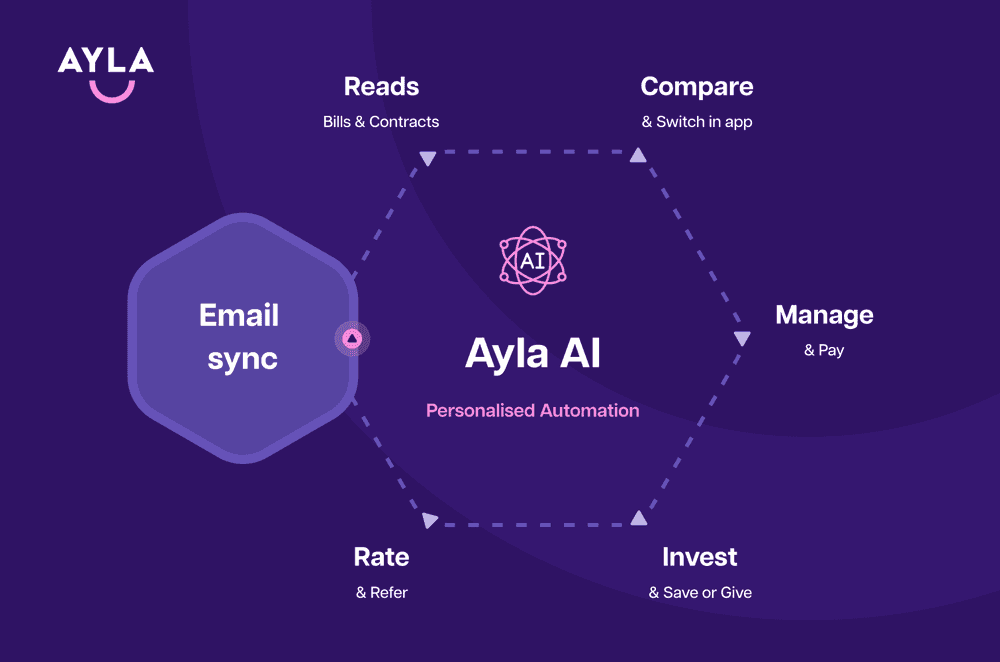

Powered by AYLA’s patent applied AI technologies, members only need to link their email and bank accounts to Ayla, and she will do the rest. It includes price comparison, provider switch, digital customer service, payment reminder, and optional bill pay later. Users can then use bill savings and spare change to invest. Higher-user rated providers will be rewarded with more customers and happy users will also introduce Ayla to their friends and families.

Product Strategy

AYLA’s product strategy decisions are centred around members, their experiences and interests. For example, what do AYLA members want to achieve? How can technology, data and AI be utilised to make AYLA more efficient, better at solving problems and a delight?

This strategy not only applies to the design of AYLA’s product but is also employed to empower its partner providers to deliver a high level of service to AYLA members.

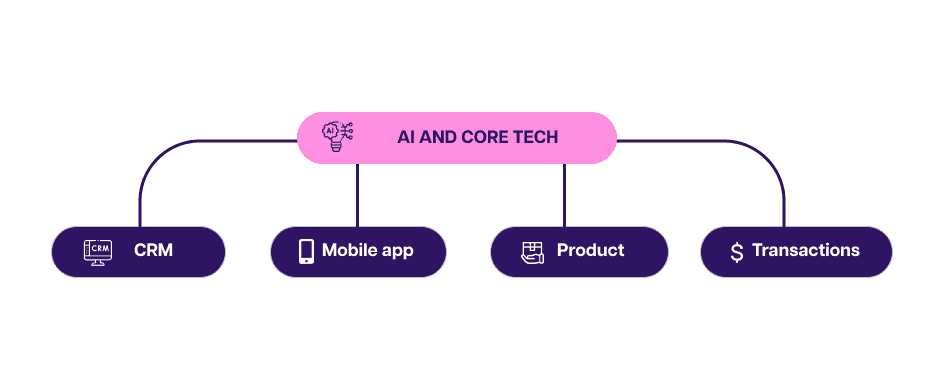

Achieving member goals using the power of AI, data analytics and behavioural economics. AYLA begins by developing a customer journey map of member goals to formulate how AI can automate the journey with better results for the end-member. This practice has been developed by AYLA from the ground up as the AI technology implemented required training and maturity to build processes not possible before now.

Product Overview

AYLA has launched with core recurring services and functions in Australia. Later, it will enter into more services and expand to the US, introducing more and smarter features as it’s AI learns.

By focusing on the AI technologies, it delivers a high degree of automation for personal finance. A member only needs to take minimal steps, such as linking their email and bank account to AYLA, to enjoy the full benefits.

AYLA is planning both vertical and horizontal expansion for future growth.

AYLA’s core features already provide significant value for members and are ready for rapid adoption Australia-wide. Additionally,

the product development pipeline continues to grow with plans to develop new features and services that will launch later in 2021.

AYLA will also utilise its technologies in the B2B space, enabling partner providers to sell their products anywhere on internet.

Go-To-Market Strategy

AYLA is an AI-assistant for management of recurring services on mobile. This positions AYLA as the only holistic utilities and financial management app in the market.

AYLA’s strategy is to continue optimising based on member data, needs and feedback to improve usefulness and to provide an unparalleled member experience. It is expected the AYLA app will provide a far superior experience over methodologies currently employed for recurring services management, so that the product will lend itself to growth driven organically by members. Members also can rate their services in app, and understand that more members there are, the better bargaining power for all, as a key incentive to drive the referral.

Key Team Members

George Wang has broad experience as a founder and in senior management roles within multinationals, across cost management, international trade, eCommerce, cross-border payments, retail, and wholesale.

George began his career as a Graduate Accountant, very quickly making his way up to become the Senior Cost Analyst at GM Holden, managing costs for over 50,000 parts. Later in his career, after identifying the growing demand for Australian produce in Asia, George founded a premium food and beverage manufacturing and export business to supply retail and eCommerce channels in Asia with high-quality produce direct from Australian farms.

The export business snowballed, becoming a BRW Fast 100 company in 2013 and an Australian business representative to APEC in 2014. In 2016, the export business established a JV partnership with GOME, one of the largest retailers and eCommerce players in China. George went on to become the CEO of GOME, Australia.

In 2018, frustrated with the limitations of essential services providers, George created noobill, what he envisioned to be the eCommerce platform for everyday essential services.

George has a Master’s Degree in Commerce, is a registered Chartered Accountant and is a Member of the Australian Institute of Company Directors (MAICD).

Harry Sun

Harry Sun has over 20 years of hands-on software engineering experience, specialising in AI, machine learning and complex databases.

Before joining noobill, Harry designed and built large scale enterprise systems for multinationals like Oracle and ANZ and managed several development teams. Harry has also held other lead engineering roles at various technology startups. Harry is passionate about discovering and delivering innovative technology products to optimise businesses and user processes.

Harry completed a Computational Mathematics and Applied Software Degree in 1997 at Nanjing University, has completed Machine Learning at Stanford University and Neural Networks for Machine Learning at the University of Toronto.

Historical Financials

Use of Funds

Key Risks Facing the Business

AYLA operates under the Ecosystem Model and relies on its partner providers to deliver essential services to its members. Also, AYLA's primary revenue stream is derived from its partner providers.

- Providers decide not to join AYLA's ecosystem.

- Partner providers default on transaction fee payments to AYLA.

- Partner providers refuse to make transaction fee payments to AYLA.

- Partner providers are unable to deliver adequate products and services.

- Partner providers experience business failure.

Should AYLA be unable to find suitable providers to join its ecosystem, or be unable to maintain a mutually beneficial relationship with its partners, it may fail to achieve its business objectives.

There is a level of education required regarding AYLA's Ecosystem Model. If the market and potential customers fail or refuse to understand and buy into AYLA's product, service and business value, AYLA may be unable to meet its business objectives.

Many essential services sectors are highly regulated. Regulations can be burdensome to meet and are subject to change. To operate in some industries, noobill will have to adhere to industry regulations and must be flexible and dynamic to adjust with regulation modifications.

Regulation changes may mean a disruption to the noobill’s ability to provide a product or service, which could impact meeting its business objectives. Additionally, noobill must secure an AFSL or partner with an AFSL licensor to be able to manage increased transaction volumes on its app. A failure or a delay in obtaining the licence may result in noobill not achieving its business objectives.

AYLA faces risks concerning technology failures; this includes failures within partner providers and third party providers technology and failures within its own technology, i.e. cyber-attacks.

As AYLA grows and hires more people, there is potential that some team members may not follow policy and procedure or not act in the best interest of the business and its members. This may temporarily impact the quality of the products and services AYLA offers its members.

AYLA also faces key person risk. If a key person were to leave, they would need to be replaced, which may temporarily impact AYLA's ability to meet its business objectives.

AYLA's business model is capital-light but still requires adequate funding to build and grow. If AYLA is unable to raise the funding it needs, that will impact its ability to achieve its business objectives.

There are general risks relating to the execution of AYLA's growth strategy. These include, but are not limited to, executing AYLA's marketing, customer service, partnerships, and technology strategies; which may result in AYLA being unable to achieve its business objectives.

Building trust with the community (both partners and members) is an important aspect of AYLA's strategy. If AYLA's brand and reputation is negatively impacted due to a real or perceived breach of trust, membership growth could slow and AYLA may fail to achieve its business objectives.