Maqro Investment Group

Maqro Investment Group

Maqro Investment Group successfully raised a first tranche in this offer of $3.1m through Equitise and the shares have been issued. This second tranche of up to $1m is now open for investment, on the same terms as the first.

This offer is exclusively open to wholesale, sophisticated and accredited investors.

All investments will be held through the Equitise Nominee. The Equitise Nominee is a Bare Trust structure that holds securities on behalf of the investor. The Nominee is in place to handle administrative responsibilities on behalf of the company and to limit total shareholder numbers. Investors are entitled to the same rights as they would directly on the share register. More information can be found in the Investment Agreement, accessible at the final stage of investing.

The minimum investment for this offer is $50,000.

Key Documents

The Existing Maqro Business

We're not a Startup anymore.

Maqro’s full-spectrum service is quite unlike anything that is currently on the market.

The company's mobile investment platform is designed to offer investors a new age investing experience. With a forward looking app created with an eye on the next generation of investors, Maqro is serving millennial and mature investors with market news, updates and analysis with customisable watchlists and full service broking (including tailored trade recommendations and execution of trades, direct access to expert advisors via messaging functions and options to request meetings). Its full suite of services, fuelled by technology, creates possibilities for new levels of unreached scalability. But here’s what we have already built:

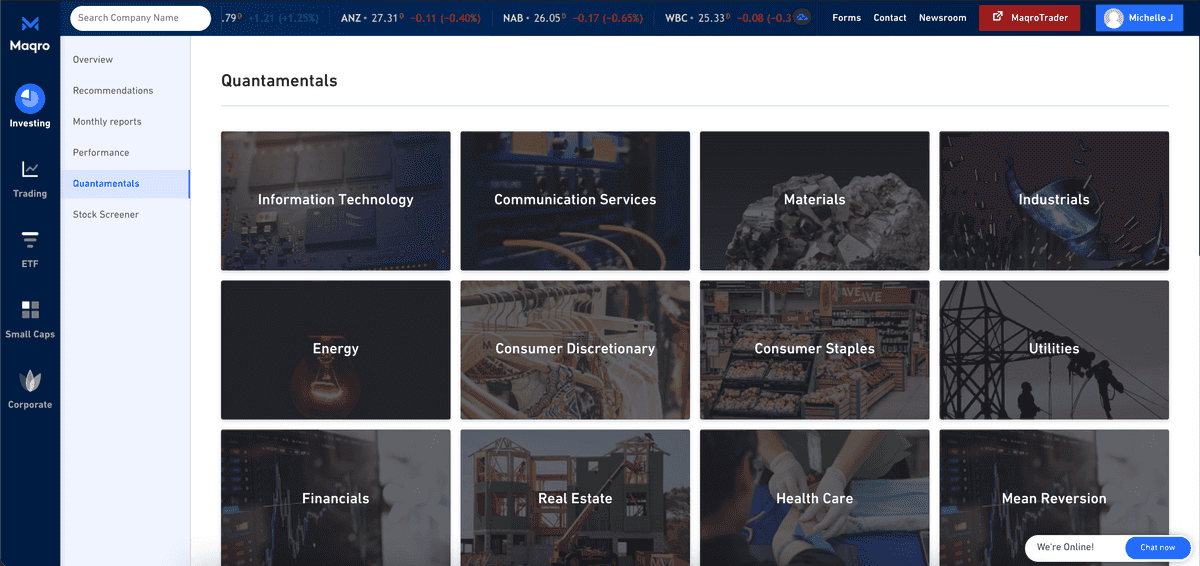

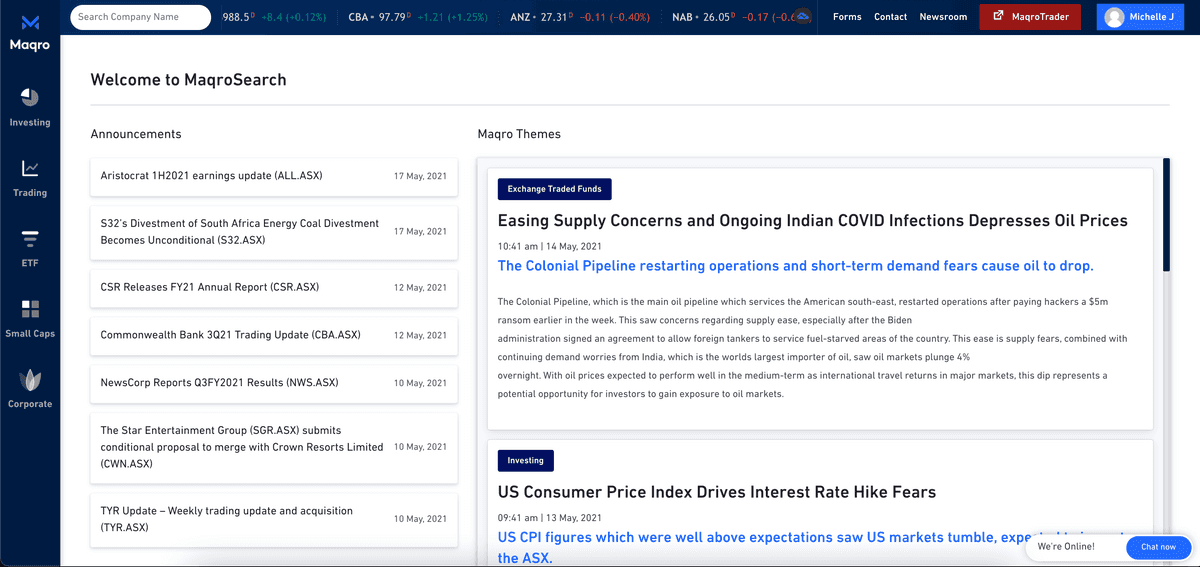

MaqroSearch

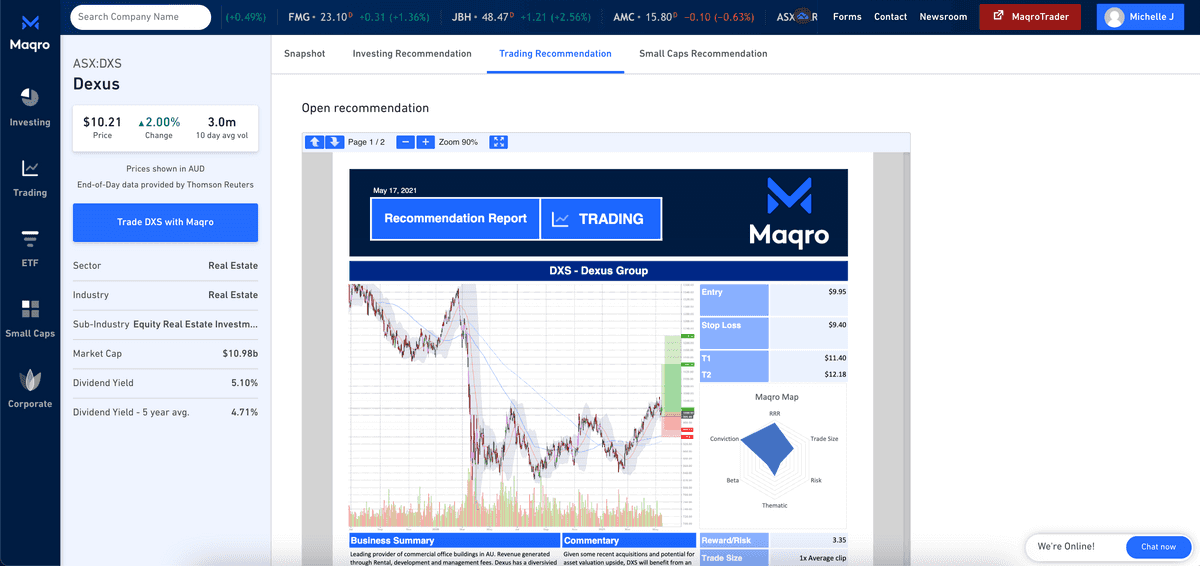

After conducting a deep-dive into how different investors make investment decisions, Maqro has developed a flagship digital platform that offers clients diligent, expert-level sources of actionable recommendations on publicly traded equities and equity markets. The platform is specifically designed to be a ‘one-stop-shop’, whereby clients have the ability and tools to cater for all steps within the investment process. Clients have access to a variety of analytical tools depending on whether they are engaged in short, medium, long-term or small caps trading (i.e. fundamental, technical and quantamental).

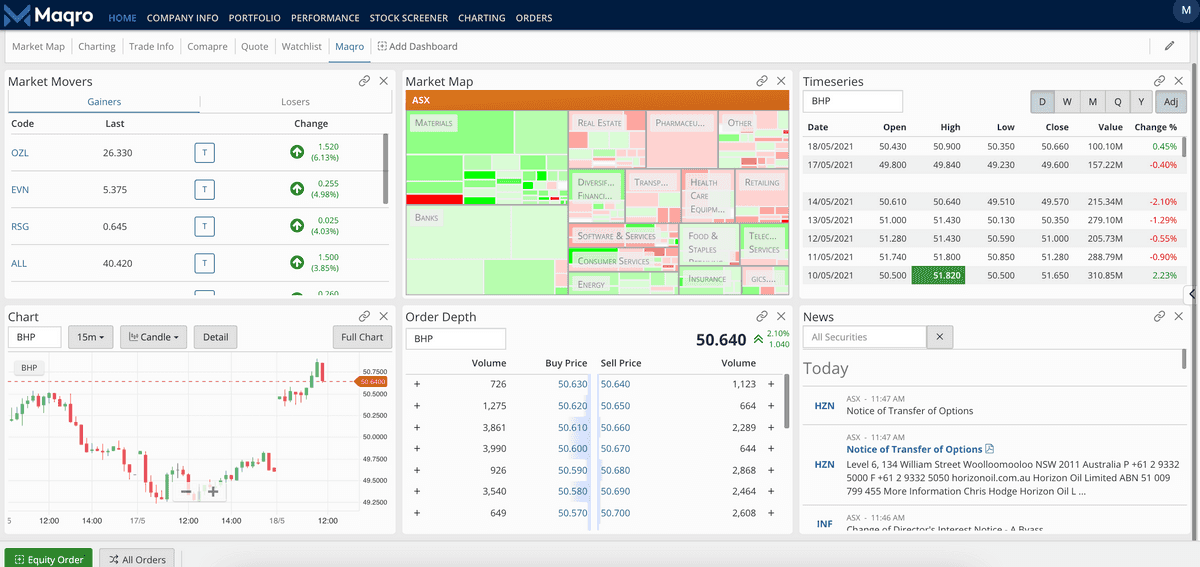

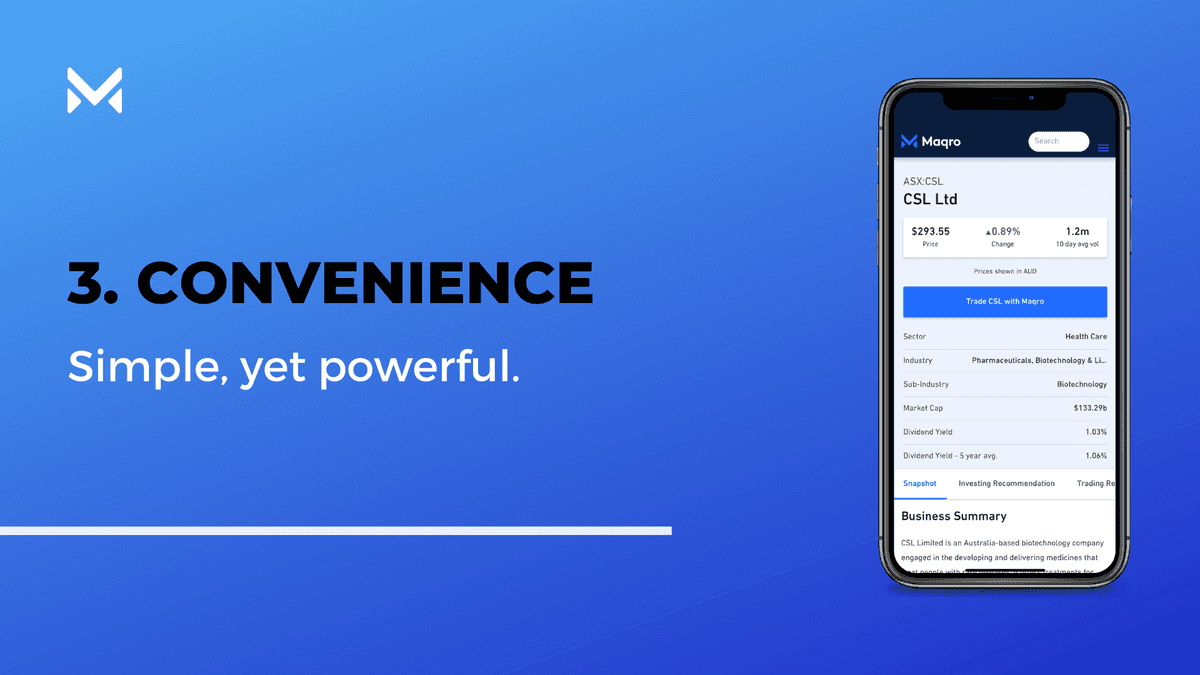

MaqroTrader

In partnership with one of Australia’s leading ASX clearing houses, Openmarkets, MaqroTrader offers a new and comprehensive Trading Execution Platform. Directed at both advised and self-directed clients, live orders are executed with the click of a button at competitive brokerage rates. As an all-in-one trading platform, our investors execute their trades with ease and flexibility. All investors holding a membership with Maqro are eligible to open a MaqroTrader with no additional account opening fees to be paid. To execute a trade, members may utilise a text-to-trade service, which is available with a trading account with Maqro (OpenMarkets).

Corporate Finance

Our corporate division has been delivered to our clients upon their request to have access to wholesale opportunities for pre-IPO and capital raising events in the Australian market. To ensure the best return for our clients, companies that match Maqro's investment criteria will be selected through a vigorous vetting process undertaken by our research team. The companies will then have the chance to present the opportunity to our advisory team. If approved by our research and advisory team, we then provide the opportunity to our clients.

The Fintech Opportunity

The Sanlam Private Wealth AFSL - Some of Australia’s most promising Fintechs

Financial technology (Fintech) has been growing at a rapid pace in recent years, making it one of the fastest growing sectors in the global financial services industry. Total investment activity in Fintech companies within Australia has exploded from $73 million in 2012 to over $2.9 billion in 2019, compared to $1.14 billion invested in 2018.

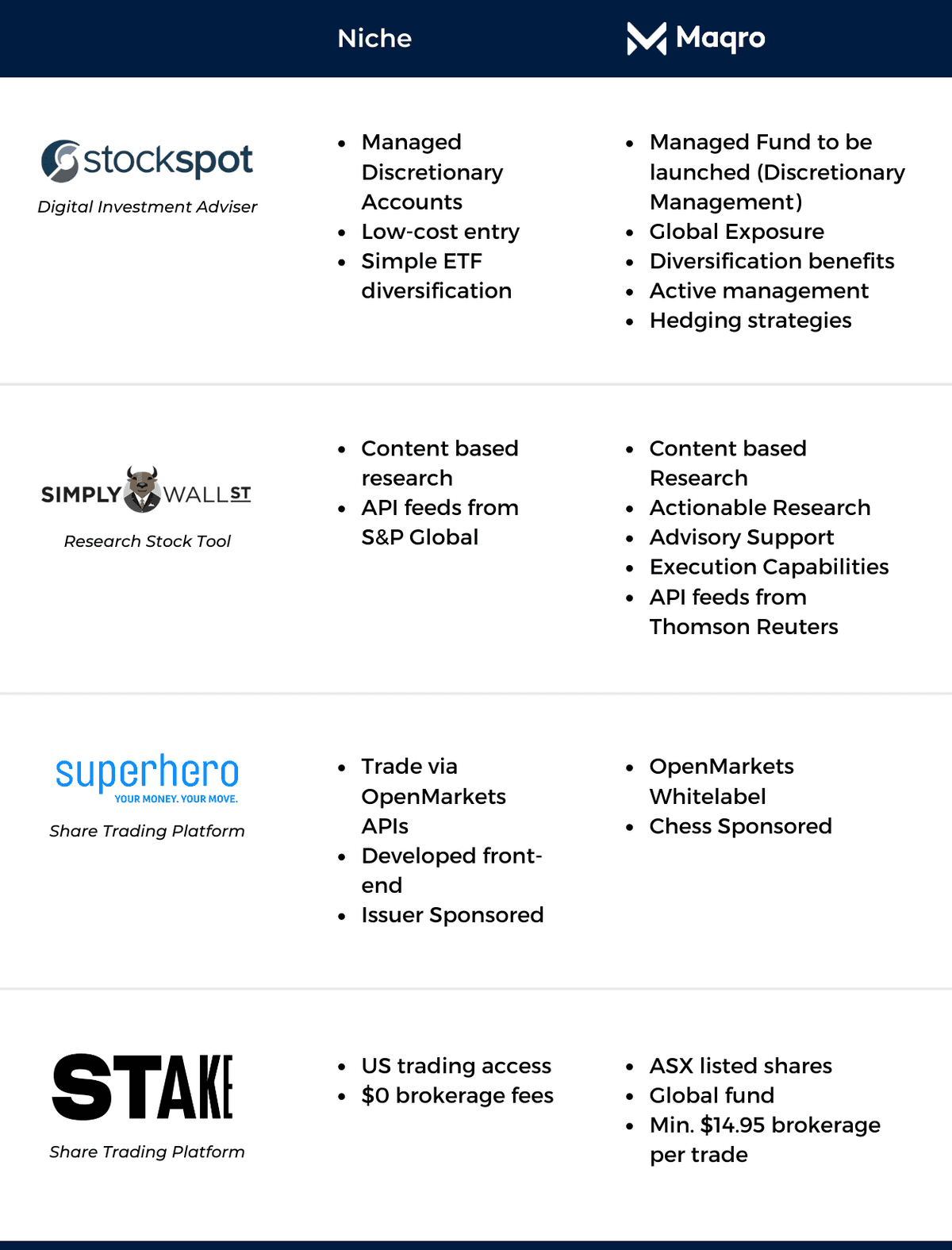

How Maqro Stacks up to the competition

Maqro is proud to share the Sanlam Private Wealth AFSL (Australian Financial License) alongside some of Australia’s fastest growing and promising Fintech Companies including; Stockspot, Superhero, Simply Wall Street & Stake.

The next generation of Wealth Creators - Click here.

Comprehensive, End-to End.

Maqro has focused on identifying the most effective and cost-efficient strategies to provide an end-to-end solution. However a key focus has been ensuring that we don’t sacrifice quality in the pursuit of a broad product suite. Specifically, Maqro has leveraged corporate relationships and strategic capital allocation to ensure not only a spot on the table for Research, Trade Execution, Funds Management & Corporate Finance, but also present a unique selling point for each division (as seen in the comparison above).

Our role as Joint-Lead Broker for an Initial Public Offering for a company to the ASX is a very good example - an achievement that marks a major milestone for our Corporate Division.

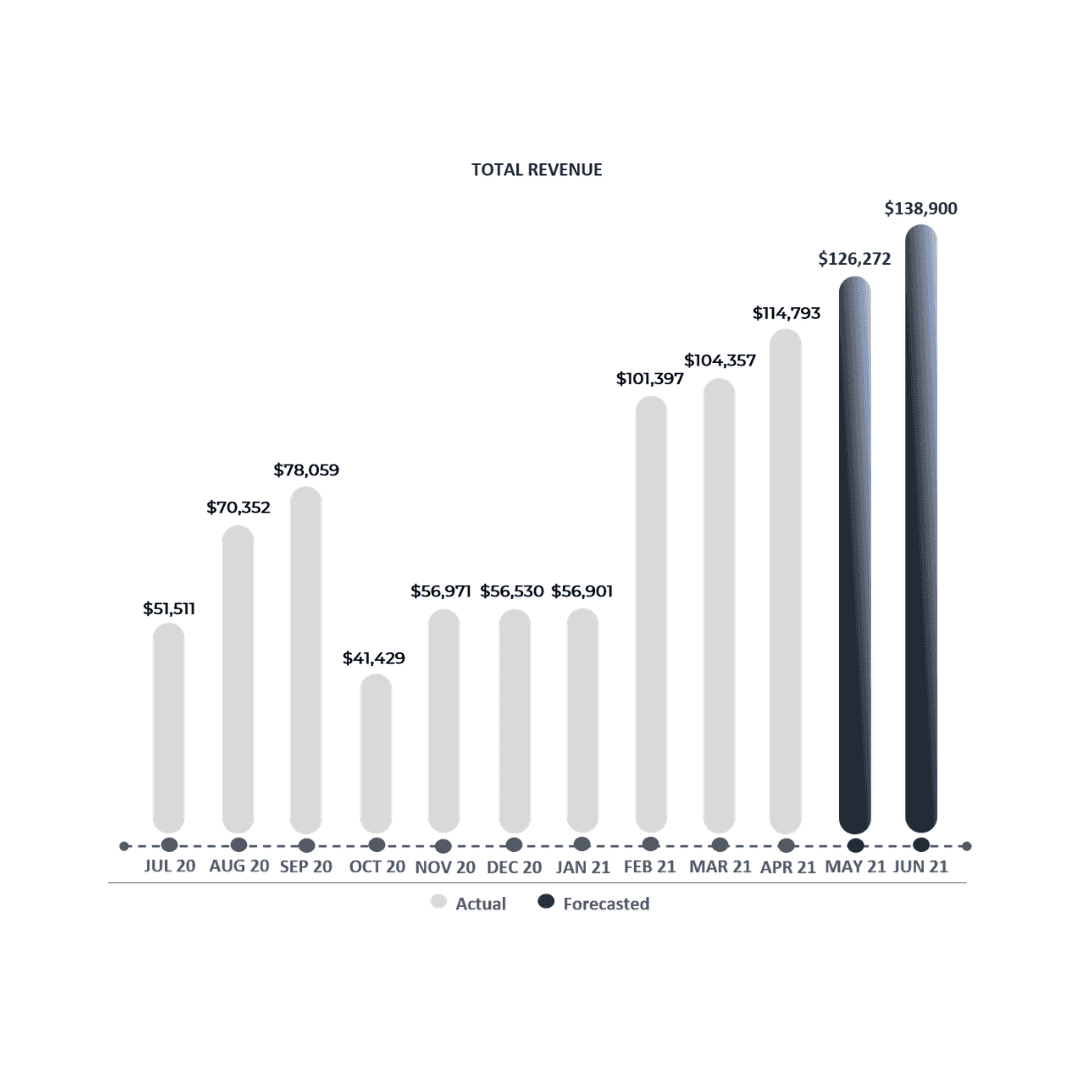

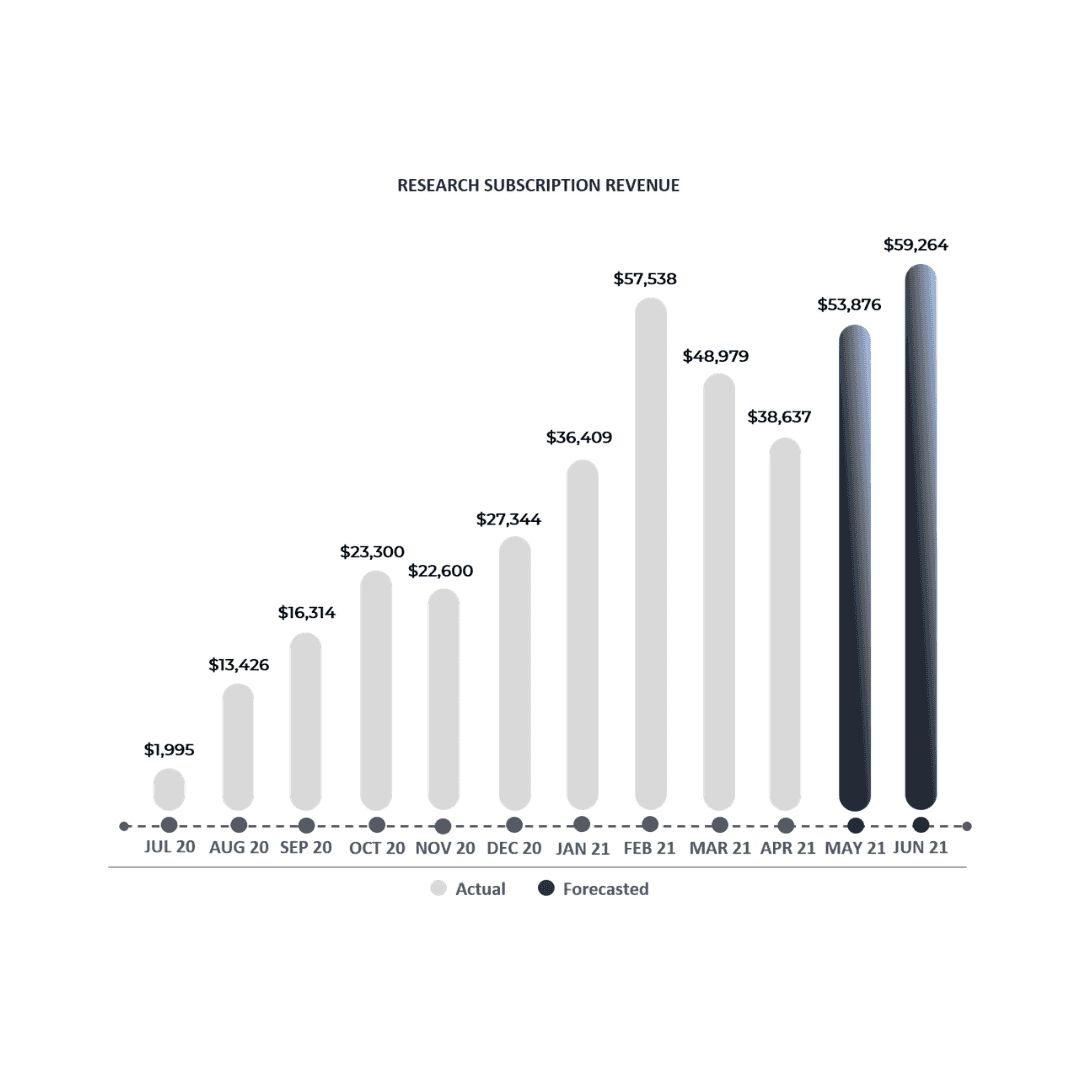

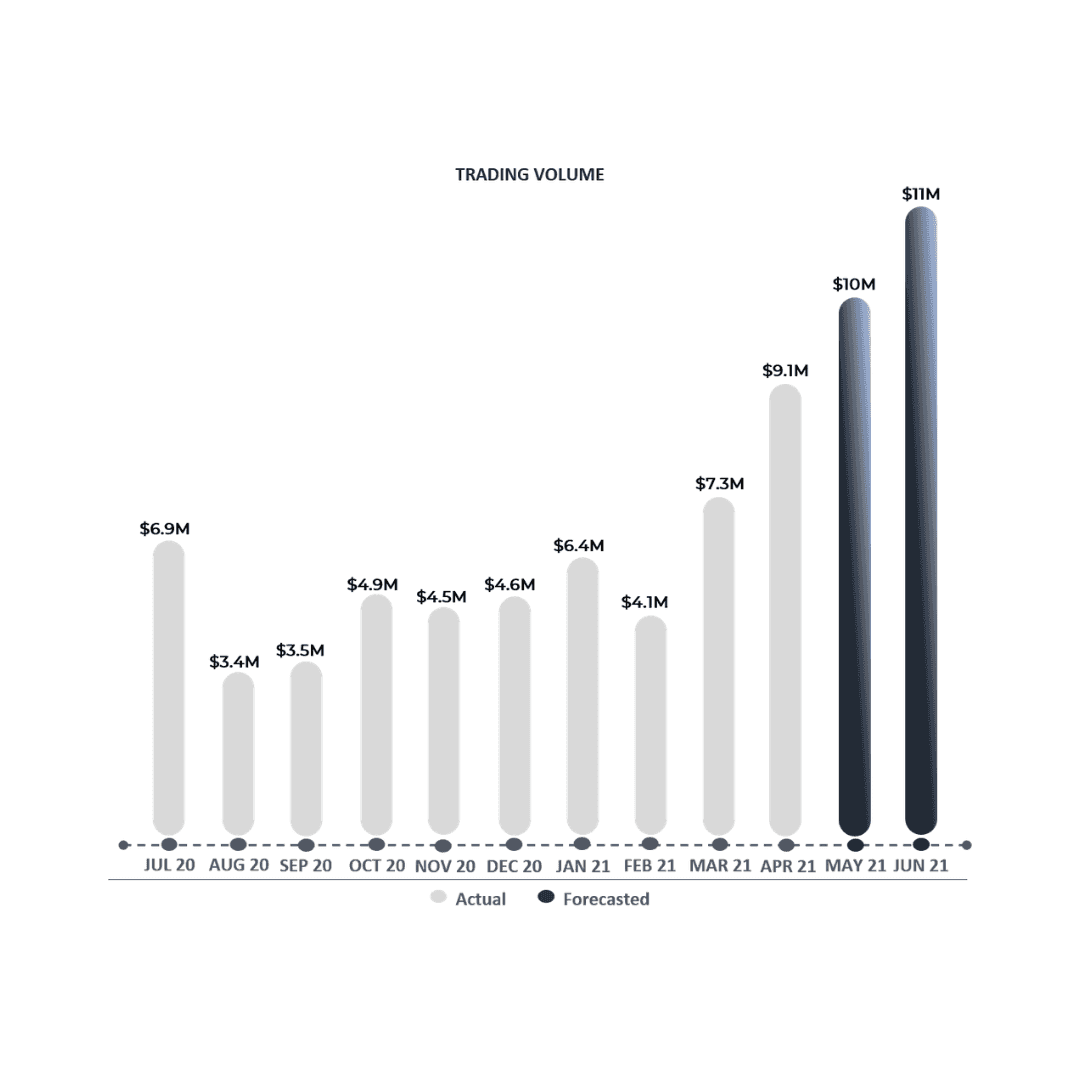

Current Growth Metrics

Here is the current status, and we are just getting warmed up.

The Funnel Metrics

Improving a validated Funnel using three growth levers.

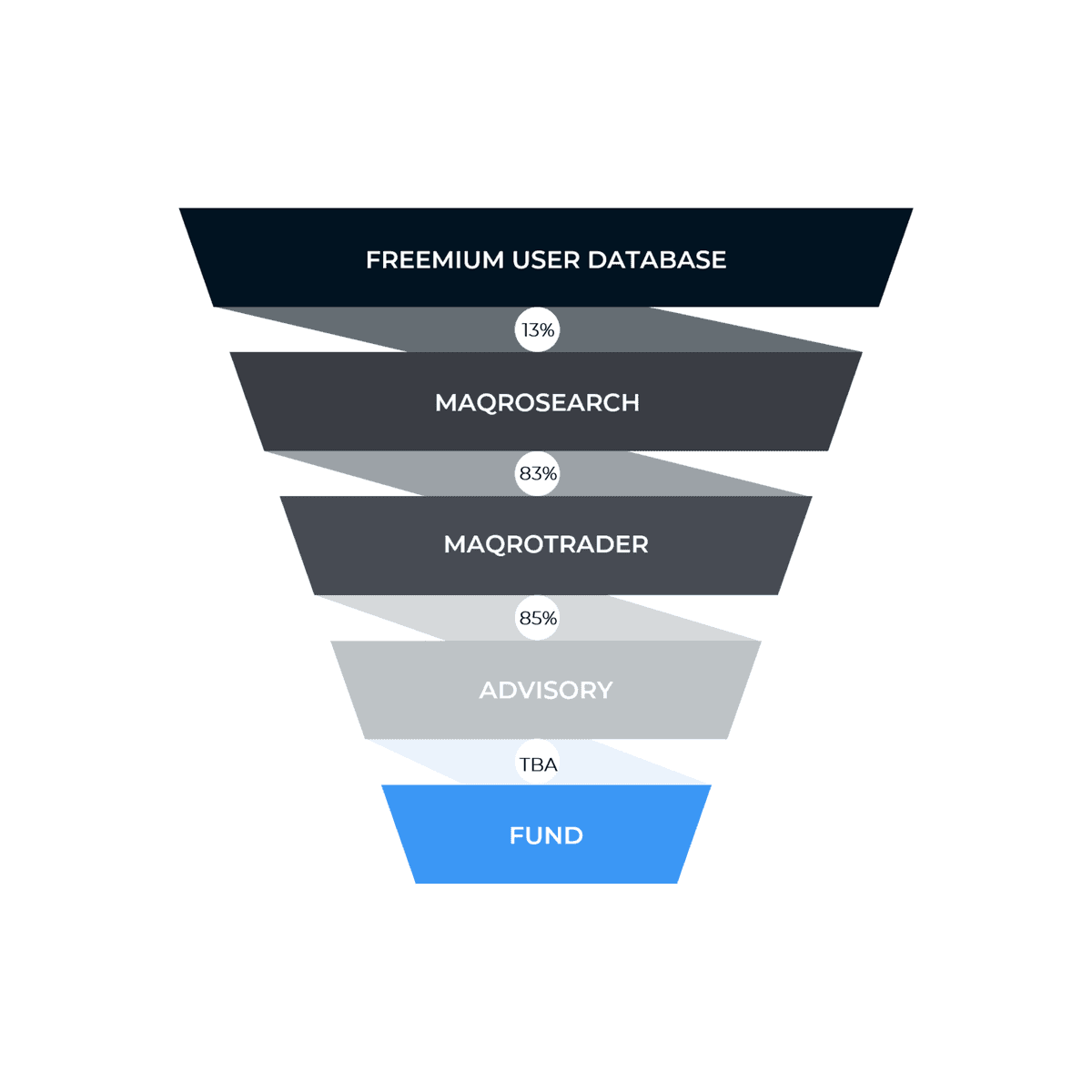

A key indicator for a company's ability to grow and increase Shareholder Value is their scalability. The scalability of Maqro is best described through our Revenue Funnel:

A broad product suite has allowed Maqro to see improved customer satisfaction as Investors have more optionality when it comes to their investment decisions. This has provided Maqro with higher retention rates, and an increase in multiple-product adoption by clients.

Lever 1 - Increased Freemium Users

Digital Marketing focused on Traffic for Lead Generation.

The key advantage to a Revenue Funnel is the ability for Maqro to scale through targeted Marketing Strategies and identify opportunities to improve conversion rates.

As seen in the diagram above, Maqro begins the customer journey through a low-barrier to entry avenue - the ‘Freemium User’. Keeping conversion rates constant, Maqro has the ability to increase revenues by pulling the ‘growth lever’ - increasing the Freemium User Base.

Lever 2 - Lower Barriers to Entry for Subscription Revenue

Free Mobile Application Downloads and Monthly Pricing Options.

Conversion rates between each customer stage can also be improved to increase revenues. Currently, Maqro operates a yearly up-front membership option, which has been crucial in generating cash flows for the business during the initial growth phase. However, upon the establishment of conversion data, Maqro now aims to improve the conversion rates by presenting an even lower barrier to entry. Maqro believes that the launch of the IOS and Android Mobile Application, accompanied with a monthly membership option will allow for a significant improvement in the conversion from Freemium Users to Paid Users.

Lever 3 - Lower Barriers to Entry for Brokerage Revenue

Free MaqroTrader (Self-Directed) Accounts via OpenMarkets White-label Platform.

A major advantage gained from our successful white-label agreement with OpenMarkets Group’s Trading Platform, is our ability to open up our Self-Directed Membership option. Marketing strategies focused towards the ‘call to action’ of opening up low-cost Trading accounts without the need to pay for a membership is expected to further increase our user-base, and consequently our brokerage revenues for our Self-Directed product offering.

Aggressive Market Launch

Building a foundation in Stealth Mode. Now we are ready to Scale.

Following the completion of the Capital Raise, Maqro will begin executing on three key initiatives over the next 12 months:

- User Growth - Shifting focus and priority to client acquisition and growing the MaqroSearch user base through mass adoption from free-user access and digital marketing to generate exposure to the key demographics.

- Product Development - Maqro is currently developing three key additional products and offerings to further add value to our ‘end-to-end’ platform. See section 5.6 of the information memorandum.

- Existing Product Feature Improvements - Maqro will also be investing heavily into increasing and improving the existing product suite, namely MaqroSearch. As an example, our development team is currently working to complete active coverage features within MaqroSearch. This will provide clients with dynamic research reports that reflect price sensitive announcements/actions in real-time.

Use of Funds

The Road to an ASX Listing

Crowdfunding Raise - Two birds, one stone.

Maqro has strategically partnered with Equitise to launch the current raising via an SPV. In doing so, we expect, upon the successful application to launch a crowdfunding raise, Maqro will be able to open up the offer to retail investors.

IPOs - We’ve done this before.

Our understanding of what needs to be done to list a company comes from our experience as Lead broker for one. A key requirement is spread - ie. number. of investors. To ensure we are prepared, Maqro will conduct an Equity Crowdfunding raise, which has benefits of further capital to support growth, but also ticks a major requirement (‘Shareholder Spread’ - minimum 300 shareholders) by the ASX for a successful listing. Not only that, but Maqro believes that investors who show interest in transactions in the Unlisted Equity sphere, may potentially have an existing interest in the Direct Equities market.

Key Team Members

Conrad started his career at Duxton Asset Management Singapore, a Private Equity firm focusing on the analysis and valuation of Agricultural Assets. His professional background has exposed him to previous roles in Startups, such as MoneyMe (now listed on the ASX), which led him to pursue a career in Entrepreneurship. He currently acts as an Advisor in the Antler program, assisting founders create and develop ideas into successful startups. He also acts as an Advisor to the Board for large companies seeking to raise capital and list on the ASX.

Conrad has also been involved with Futures and Equities analysis during his tenure at a Hedge Fund located in Sydney. Conrad founded Maqro Investment Group with the pursuit of fixing a ‘broken industry’, which was something he discovered in his experience as a Stockbroker in 2014-15.

Robert is the CEO at Maqro Capital, a subsidiary of Maqro Investment Group, bringing a wealth of knowledge and experience to the team. Robert has held previous roles as Head of Derivatives at APSEC and Credit Manager/Senior Trading Representative at Westpac Broking and holds a Graduate Diploma in Applied Finance, Diploma in Technical Analysis, RG146 qualifications in Generic Knowledge, Securities, Managed Investments and ADA 1&2.

Arman focuses on product strategy for the Group, operating as the CTO of Maqro Technologies, a subsidiary of Maqro Investment Group. Offering insights into UX and UI design and product development, Arman is responsible for managing the strategic development, launch and management of technology-based products that are offered within the Group.

Edward is the Head of Research and manages our Research Division at Maqro. He holds a Bachelor of Engineering and Commerce, majoring in Finance and Economics, at the University of New South Wales. Edward has an impressive background in programming, statistical analysis and complex mathematics.

Mark is the Head of Trading at Maqro and is primarily responsible for the companies trading decisions, active investors and trading departments recommendations. He has 25 years experience in financial markets, starting his career on the SFE trading floor as a broker before spending the last 16 years as a professional trader. Mark previously was the owner of proprietary trading firms, Genesis and Aliom trading. He also served as the founding president of the Australian Securities Trader Association (ASTA) for 10 years.

Joel is an experienced in-house lawyer and company secretary. He is highly sought after by clients due to his extensive experience involving complex financial transactions and disputes. He has a strong background acting for public companies, banks and regulators in various jurisdictions, both in Australia and overseas.

Gregory acts as an Advisor to the Board and is a Cornerstone investor of Maqro Investment Group. Gregory is an active investor, providing key insights on Strategy, Research and also Product Development from a client-facing perspective.

Greg has significant holdings in several companies, one of which is an ASX listed entity, whereby he is a Top 20 Shareholder.

Hue Frame Co-Founded Maqro and acts as Advisor to the Board, utilising his past experience as CEO of a Sydney based Stockbroking Firm. Currently, Hue is Managing Director and Portfolio Manager at Frame Funds, which acts as Investment Manager to two Managed Investment Vehicles.