Lumiant

- Type: Retail

- Total Round Size (min): AUD$500,000

- Total Round Size (max): AUD$2,000,000

- Price per share: AUD$1.05

Lumiant

Lumiant is now accepting investments.

- Fees paid by Issuer: 6.00% of funds raised

- Cooling-Off Rights: 5 working days

- Minimum Parcel Size: $249.9

Offer Overview

Share Reconciliation

Key Documents

What is Lumiant?

Lumiant is a holistic and interactive client experience SaaS solution, transforming the traditional financial advice process and driving better outcomes for advisers and their clients.

Research has highlighted a sizable gap in the wealth management and retirement planning industry for a personalised yet automated system that combines values, goals, strategies and investment preferences into one client experience.

The Lumiant platform is being developed to fill this gap; to enable a novel and unique combination of psychographic data and granular financial data to perform multi-goal, multi-scenario analyses and to drive the optimisation and accurate calculation of data-driven financial advice.

This will be Lumiant’s second raise with Equitise, after closing an initial Seed round of $1.17M in December last year. The last six months have been non-stop, as Lumiant met the changing demands of the industry ensuring its platform continues to meet its customer’s needs now and into the future.

Since the raise, Lumiant has:

- Onboarded over 200 clients onto its platform

- Initiated partnership opportunities with key industry bodies and complementary businesses to maximise Lumiant’s distribution

- Grown the team from 2 to 9 FTE

We are now coming back to market to fundraise to accelerate the next stage of growth. Bringing on board the talent to capture market share and scale the platform quickly to capitalise on Lumiant’s first mover advantage.

Investment Highlights

- Be a part of the revolution

Lumiant is on a mission to transform financial advice from being product-led to customer-centric. It is the only platform that supports financial Advisers in delivering a world-class life-centred advice customer experience. Through software supported conversations, Advisers can best align advice with the clients’ core values and goals. It’s a noble revolution, one that will help both current and future generations of clients live their best lives. Living rich lives, rather than dying rich. This is your opportunity to be part of this movement.

“Absolutely visionary. It has given me the shot in the arm I needed.”

Tim Bryce, Financial Advisor

- Capitalising on favourable market conditions

Increased focus on compliance, risk, costs and efficiency will play into Lumiant’s core strengths. Its compliant by design SaaS platform solves many of the problems faced by the industry today and future-proofs financial planning practices by considering where the industry is headed.

Lumiant enables financial Advisers to deliver consistent, compliant and customer-centric advice at scale. Capitalising on the need for Advisers to retain clients for life, optimise sales conversion and improve profitability, while remaining compliant and serving more clients with less staff.

“It is life-changing for clients and advisors.”

James Wortley, Principal Financial Advisor

- Industry leading technology

A fully-configurable, open API enables Lumiant to integrate with client and third party software applications. The modern stack utilises the latest machine learning technologies and smart UX design to drive better outcomes for Advisers and their clients. Instead of building their own client contact, engagement and experience platform, financial Advisers can turn to Lumiant. Over 40 Advisers were onboarded within the first three months of launching and the platform has a strong pipeline of Advisers to onboard over the coming months.

“Training system is brilliant.”

Pete Pennicott, Partner

- Recurring Revenues

The beauty of being a SaaS platform is that Lumiant can generate recurring revenue through a subscription model framed around annual contracts to Advisers. This consistent revenue provides a ready stream of cash flows to support further product development, go-to-market optimisation and business expansion efforts.

- SaaS Scale x Growth

Being SaaS-based means geographies do not constrain us. Built on the Amazon Web Services Cloud, Lumiant can quickly enter new markets almost anywhere in the world. Opportunities don’t end there, as our open APIs allow for further growth potential to be realised through integrations with complementary platforms, such as Salesforce. Furthermore, the platform can be easily “reskinned” to provide services for other industries demanding a values-based customer experience, such as accountancy.

“It is a dream; it is brilliant.”

Andy Marshall, IOOF Alliances

- Defensible Moats

We do not believe there to be a full-stack direct competitor in the Australian market, which provides significant advantages and defensible positions. We expect the Lumiant platform will benefit from network effects, cost advantages and cultural alignments. When you buy Lumiant, you also buy into its philosophy for financial advice, making the platform extremely sticky with customers.

“It is blowing clients' socks off.”

Werner Jansen , Financial Planner

- Experienced management team

The Board and Executive team have a proven track record of commercial success across the wealth industry and in designing and delivering digital products and services for both local and global brands.

The team have separately built proven disruption models over their careers. They have a track record in technology, design, implementation, project management, financial services (including financial planning), start-ups and delivery. The team has experience in founding, managing, scaling and selling award-winning businesses within the digital space.

The Problem

With less than 20% of Australians seeking financial advice, the financial advice industry must rapidly evolve when it comes to the quality, cost and delivery of advice. The industry must also seek to engage clients and advice seekers on a more personalised, individual and meaningful level, so the true value of advice can be recognised.

Significant changes in regulatory requirements, client expectations and an increasing number of alternatives available, mean the industry must transform itself if it wants to continue, grow and be perceived as relevant by future generations of clients.

This difficult operating environment presents an opportunity for progressive advisers to forge fully compliant client-centric, technology-enabled practices which will realise sustainable profits and help them scale.

The specific challenges are:

The financial advice industry faces several challenges in its current form

The industry has been people, pen and paper dependent, with limited scale. Software has not supported the advice process and if anything has detracted from it

Regulatory friction has been a constant as the industry has delivered predominantly product-based financial advice.

Most of the industry technology focuses on procedural and legal based compliance, together with standardised product projections, which have driven poor decision making and created friction in the adviser and client relationship.

Adviser profit margins have been traditionally low as compliance costs have escalated, as have all other practice related costs due to a lack of targeted technologies. This has placed significant limitations on the number of people an adviser can serve.

How to appeal to a new generation of millennial investors who prioritise values-based investing, with a preference for a more digital interaction and service provision.

The Solution

Lumiant has created extraordinary, compliant by design, client and Adviser experiences. Its platform applies a systematic approach to integrating regulatory requirements into the discovery and fact-finding process.

Lumiant is a life-centred cloud-based advice platform that empowers advisers to deliver extraordinary advice that aligns with what clients truly value in their life. Through software supported conversations, advisers will uncover what really matters to their clients, understand their risk capacity, reveal their wealth and provide the goals, strategies and tasks to achieve their best life. The platform then incorporates this into a high fidelity record of advice, that can be exported or shared digitally at the click of a button.

For the first time, it enables advisers to deliver on the promise of advice by shifting the outcome from best product to best life. Modelling strategies that shape and sustain extraordinary lives through Lumiant’s unique optimisation engine, which will be underpinned by new financial logics and rules that can analyse psychological and financial data inputs in a structured and quantitative manner.

This centres the value of financial advice in meaningful long-term goals and values, rather than just numbers and decimal points, creating an opportunity for advisers to retain clients for life. Keeping clients engaged through its Lifebook, which measures, tracks and nudges clients to achieve their financial goals and live their best life.

Furthermore, to help Advisers navigate the increasingly complex regulatory landscape, Lumiant’s processes are compliant by design. Each module has been carefully mapped against the FASEA code of ethics, as well as ensuring Advisers can easily adhere to Know Your Customer and Best Interest Duty requirements by letting the client scope their own advice.

Simply put, Lumiant is a seamless, holistic client experience management solution, driving better outcomes for both advice firms and their clients.

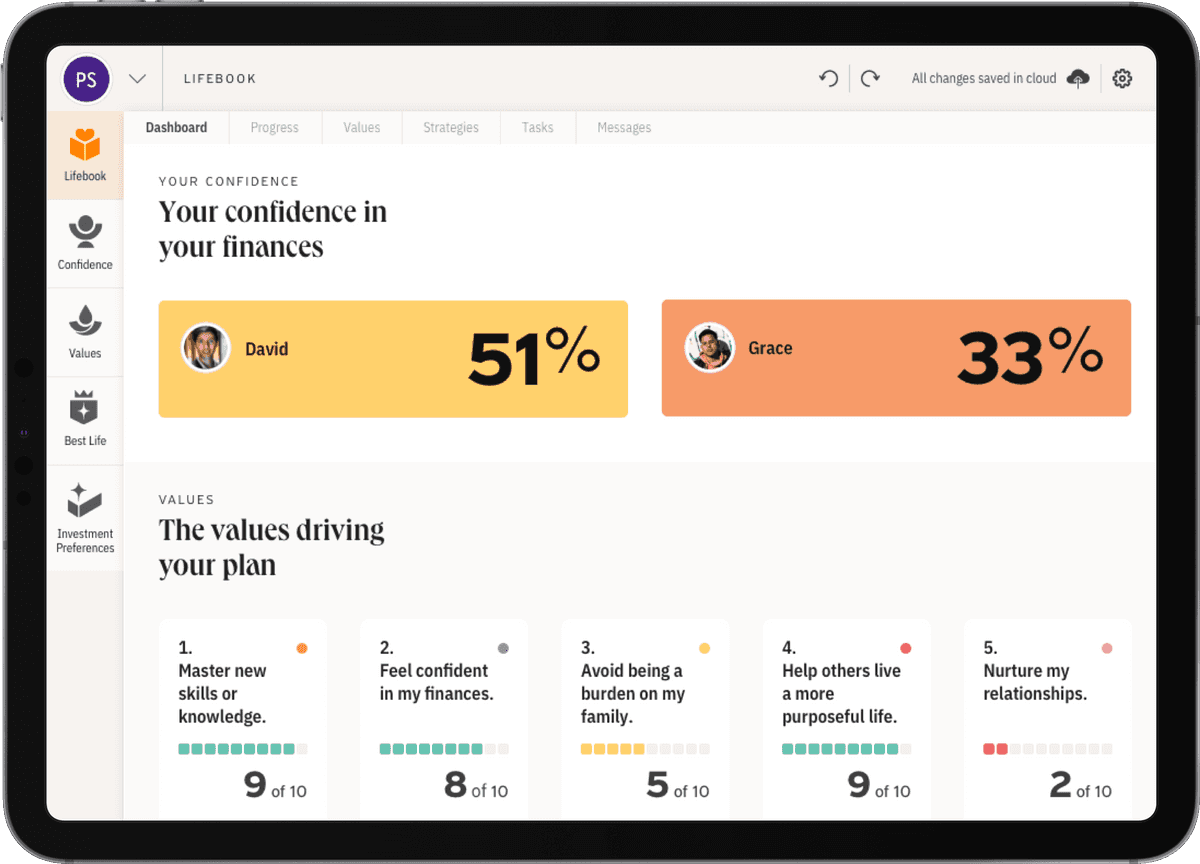

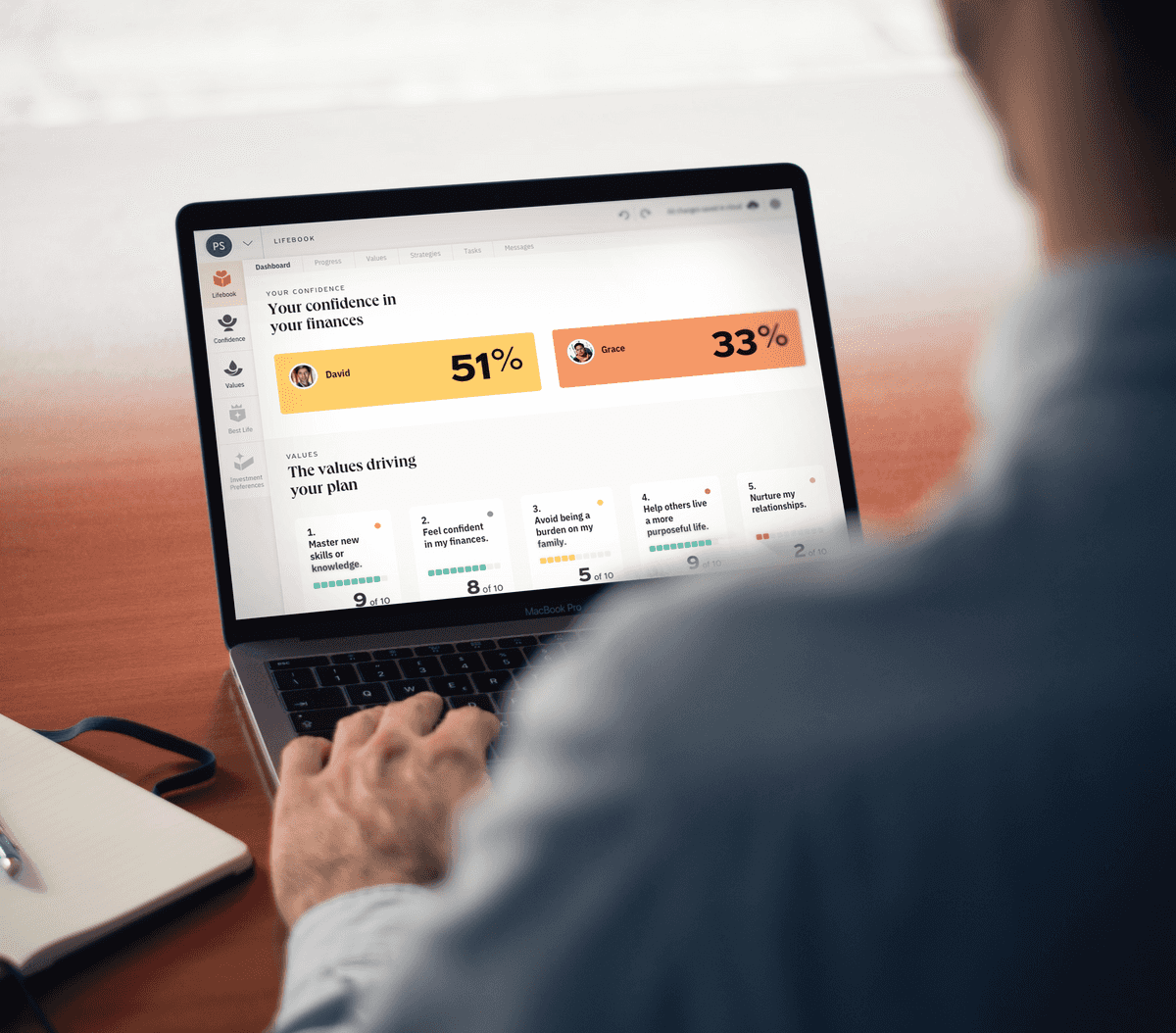

Product Overview

The Lumiant platform has been built from real experience and feedback, combined with the recent regulatory shifts. Its key features exist to provide advisers and their clients with the best possible experience and long-term outcomes.

Lumiant is the product of state-of-the-art software engineering and a robust human-centred design process which places people's needs at the centre of the product design process.

As well as consolidating inputs from a range of disparate technologies currently in play across the wealth management industry, it is compliant by design - reducing compliance and reputational risks of the traditional model.

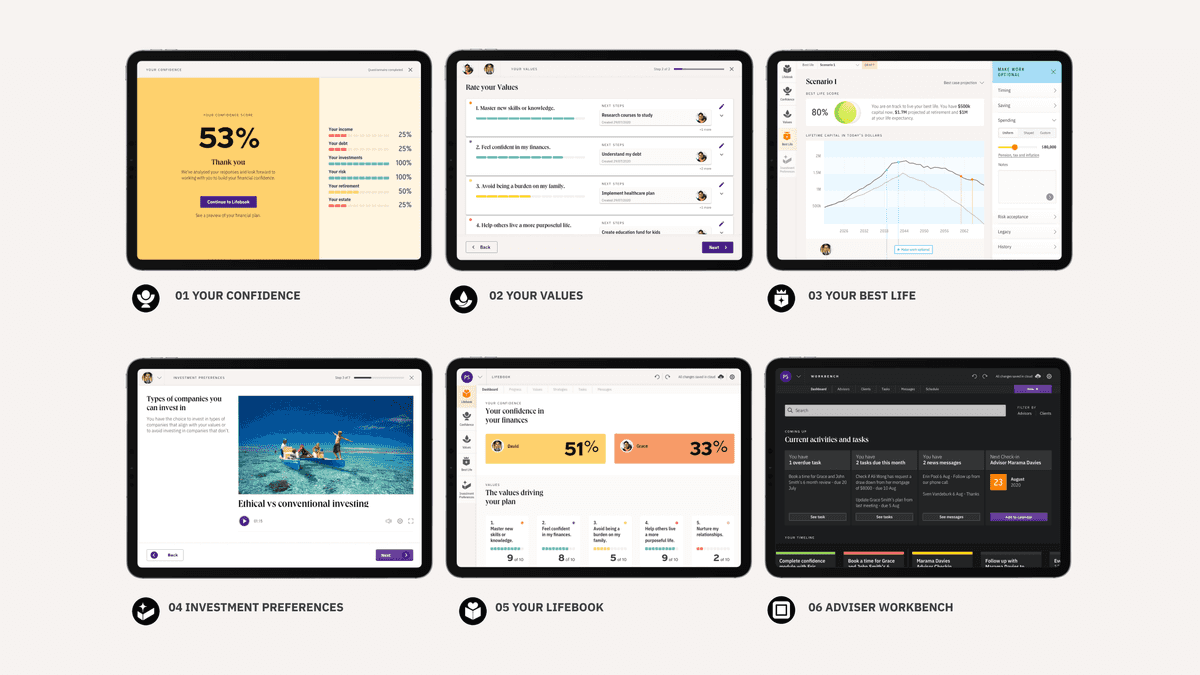

Key Features

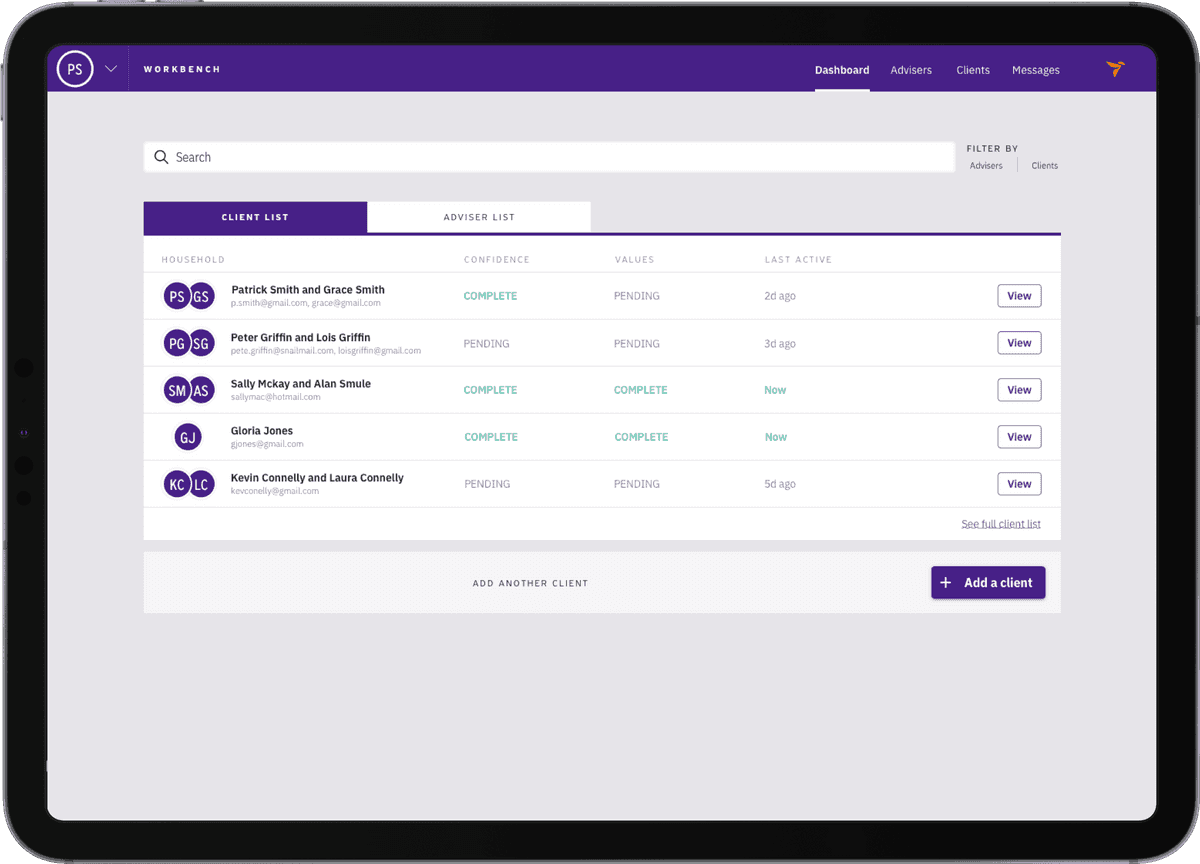

Workbench is Lumiant’s Adviser portal. It provides an administration interface that offers a dashboard view where Advisers can manage client accounts, launch client presentations and collaborative activities. From the Workbench, Practice Managers can manage clients and advisers, as well as review where each client is in the advice process.

Your Confidence is a survey to understand how clients feel about their finances. It has been designed to use System 1, “fast-brain” thinking to help Advisers measure and track a clients financial confidence. By getting clients to self-assess on key areas of their financial life, advisers can qualify and prepare prospects and clients for further advice scoping activities and establish benchmarks for improvement.

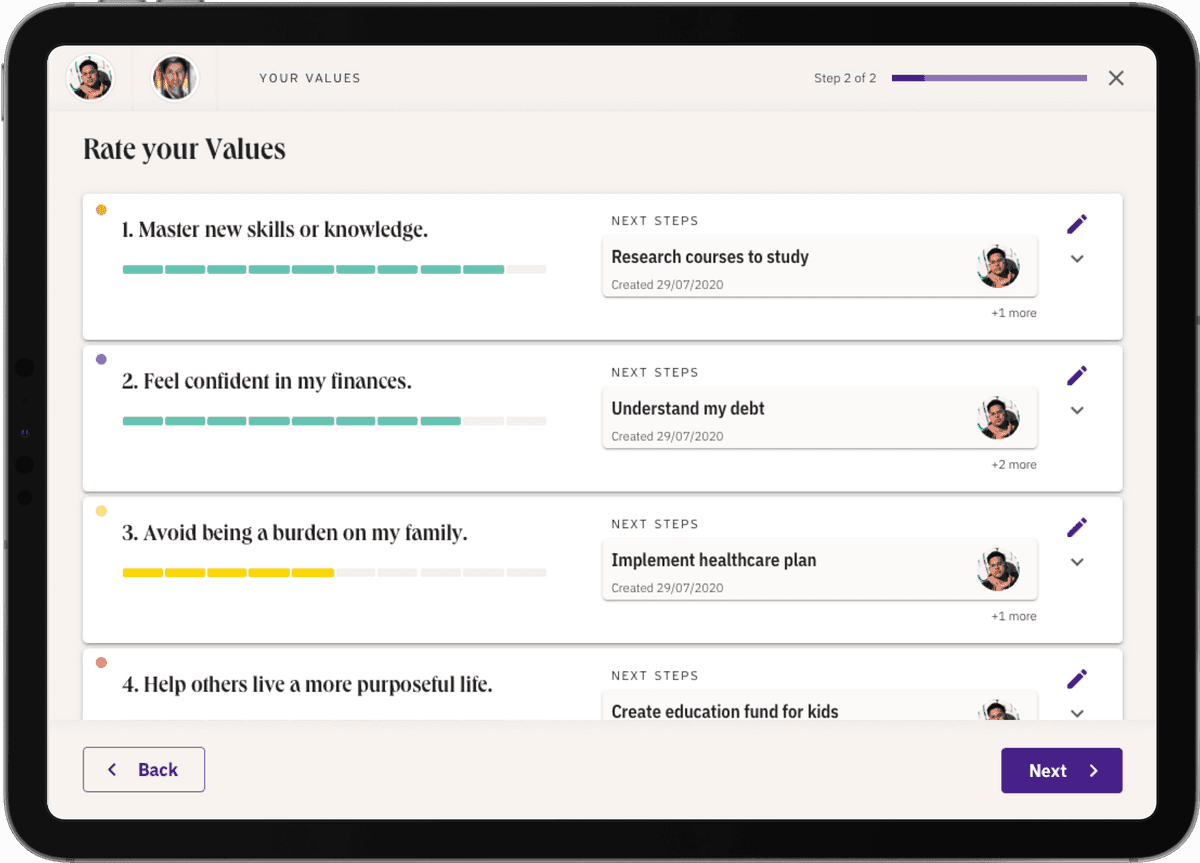

Through software-supported, values-based conversations, Your Values enables Advisers, and their clients, to identify and understand what really matters to them. Based on the 8-Dimensions of Wellbeing and delivered through an engaging card-based process, the proprietary approach helps structure a values conversation that uncovers what clients truly value in life.

Advisers can then align their clients values to design household values when necessary. These values for the foundation for advice planning, where financial advisers can map financial strategies and goals against them to help their clients shape and sustain extraordinary lives.

Your Goals provides a facility for Advisers to capture and track Specific, Measurable, Achievable, Relevant and Timebound (SMART) goals for clients and connect them to higher level Values and Confidence outputs. Providing Advisers with an easy way to track a client's progress towards living their best life.

Goals can be captured in context during the Values conversation or at anytime before or after, using a Quick Goal capture function. Key data includes a description of success, estimated time, cost and confidence around execution.

Your Strategies provides Advisers with an easy way to quickly capture and associate proposed financial strategies with client goals. Advisers can either tag one of Lumiant’s pre-populated strategies to Goals or write in their own, allowing Advisers to begin a conversation around execution and demonstrate competency to the client.

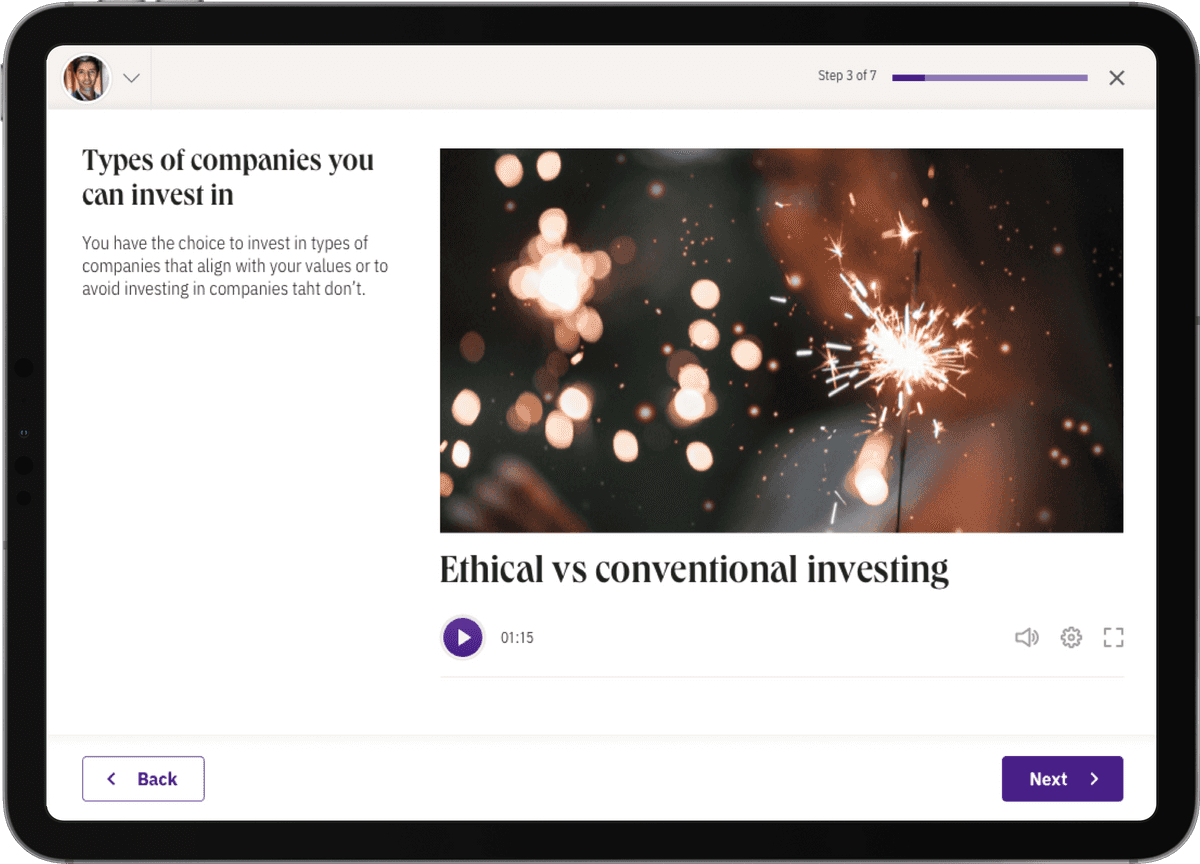

Your Investment Preferences captures client preferences on how their money is invested and the values driving their decisions. An informative survey supported with 7 snack sized videos based on ASICs definitions of investment concepts, such as risk and asset allocation. Our reporting tool allows financial advisers to assess client responses and make recommendations in context.

Your Tasks is a task management module built into the platform. It allows advisers to capture, set and attribute tasks for completion.

Email notifications and reminders keep everyone on top of task action items, helping advisers and their clients to tactically act on the strategic advice and move toward their best life outcomes. Reporting on completed Tasks helps you show the value of advice and guidance retrospectively.

Four 'out of the box' adapters that integrate with complementary software platforms, enabling two-way synchronisation, eliminating double entry and improving practice efficiency. Lumiant integrates with:

- Salesforce

- Salesforce Financial Services Cloud (FSC)

- WealthConnect

- XPlan

All relevant household information will be available in Lumiant automatically from these applications, and data created within Lumiant will flow back into the applications including the creation of new custom fields; and generated Lifebooks.

Your Money allows clients to optionally connect their Australian bank accounts securely to Lumiant for up to date insights on their income, spending and net worth.

Advisers can benefit from a report on the household's transactional activity over the previous year, including categorisation of income and expenses, in order to formulate advice plans.

Your Wealth: Your Investments provides a live connection to your client's investment portfolio, providing a foundation for trade off and modelling conversations.

The Lumiant platform gives financial advisers a snapshot of the current portfolio amount and actual asset allocation as provided from key investment platforms.

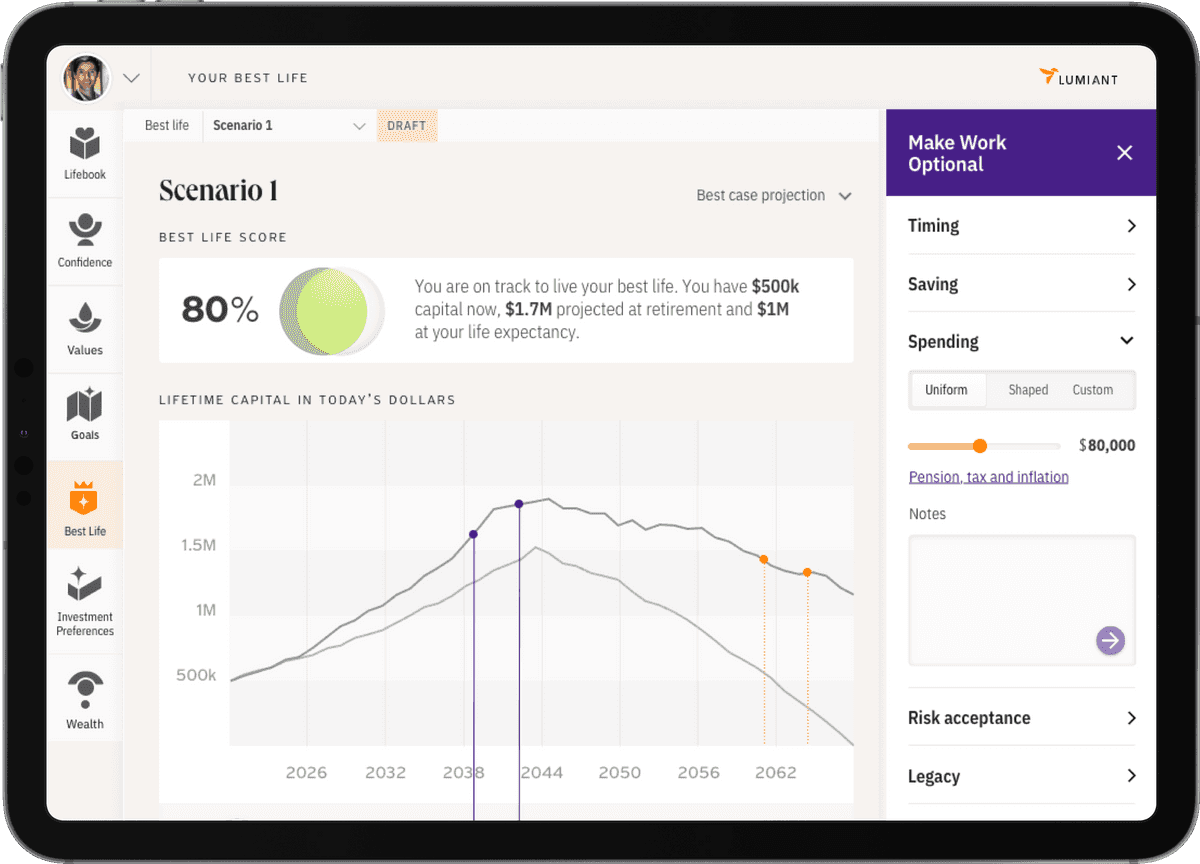

Your Best Life simplifies the complexity of varying scenarios and builds an understanding of required trade offs in context. Helping clients to see how they can live a life aligned with their values as quickly as possible.

Your Best Life includes a proprietary modelling tool that compares single or multi goal inputs against variables such as available capital, timing, risk, saving and spending. Helping financial advisers forecast when a client will be able to live their best life.

Growth Strategy

Lumiant will primarily focus on executing its current pipeline and those indicating existing interest from the centres of influence based LOIs. These early initiatives will underpin the economic model through the initial strategic planning cycle of FY21-23, providing a platform to launch into an accelerated growth plan during the second strategic planning cycle of FY24-26.

A key component for customer success is the delivery of additional professional services which fill the void left by retreating banking businesses and dealer groups. By becoming an ‘unofficial dealer group’ for advisers and delivering the value-added-services they have become accustomed to, Lumiant will become incredibly sticky and increase switching costs for Advisers. Creating a defensible moat to protect its market leading position.

To enhance its distribution channels, Lumiant has also taken an agnostic approach to partnerships. The development of its Open API enables Lumiant to be easily integrated with complementary software, such as CRM tools like Salesforce or wealth platforms like BASIQ. Lumiant will continue to drive further integrations across the financial advice value chain to add greater value to customers and become the core platform that guides, tracks and measures clients’ financial progression towards living their best life.

The accelerated plan for user acquisition will be to pivot into the institutional space and industry super fund markets. These markets have struggled to engage their investors and it is expected that the Lumiant process will be highly sought after by this segment. Equally, these groups are currently experiencing substantial change due to significant regulatory reform and remediation efforts. Accordingly, it is expected that their appetite for technological change will be heightened toward the end of FY21-23.

Lumiant will explore additional channel growth opportunities to leverage the platform alongside other SaaS vendors who have indicated an interest in collaboration. Further adjacent opportunities exist in other parts of the wealth sector including, but not limited to, the accounting profession and the mortgage broking sector.

Dependent upon Lumiant’s success through the FY21-23 strategic cycle, different growth scenarios may arise, including acquisitions, and entering offshore markets such as New Zealand, US, and Canada. However, these will not be leveraged until the local market has been successfully exploited.

Key Team Members

40 year industry veteran and commercial leader. Executive leadership roles across wealth and advice industry with Challenger, AMP and ANZ. Executive Chairman of IPL, NED of Creativemass (owner of WealthConnect).

22 years in the Financial Planning industry as a practitioner and executive. Co-founder and Head of Corporate Development at IPL which to date raised circa $1.7 billion FUM from advisers.

Senior IT executive, business technology leader and enterprise architect with over 20 years experience across Investment Banking, Financial Markets, Wealth Management, Retail Banking and Insurance

Product and design lead with 20 years experience launching and iterating digital products and services for the finance, insurance and wellbeing sectors.

Ash has over ten years of experience in communications and marketing across the UK and Australian markets and has worked with brands including Ascender, Dell and AMP. Ash is a specialist in translating complex topics into impactful campaigns that drive growth, with significant business, finance, and technology experience.

Allirah has over a decade of experience in financial services. As well as being a Financial Adviser, Allirah has actively worked alongside them and supported them in delivering advice. Allirah will be responsible for driving customer success, ensuring the Lumiant technology stack delivers on its promise of improving advisers’ lives.

Historical Financials

Use of Funds

Key Risks Facing the Business

Lumiant is intending to provide a software solution to those who operate in a highly regulated environment and is therefore exposed to regulatory risk. Regulatory risk primarily arises for Lumiant in that it may not adequately deliver regulatory compliance to Best Interest Duty for financial planning businesses, making it liable to any legal alterations that may occur. Given that laws may also change in the future, this can impact Lumiant’s ability to meet its value proposition to industry.

Lumiant is in the process of raising funds (money) to achieve its strategic business objectives. Specifically, it is raising funds to build its technology and for marketing purposes. Without adequate funding, Lumiant may not achieve its strategic business objectives.

Lumiant has several key people that are important to the success of the business. If these people are to leave, the stated industry reach may not be realised. This will impact any future revenues and the overall success of the business. If these key people are to leave, they would need to generally be replaced in order to achieve the business objective.

Lumiant is intending to launch in the highly competitive enterprise SaaS solution market. Competition risk occurs whenever there are other players trying to win market share. The early nature of the business, alongside its pre-launch state, means that competitors can enter the market and gain a first-mover advantage.

Lumiant serves an end market which is currently undergoing a significant transition and at risk of substitution by Robo Advisers. There is a risk that automation of the Financial Planning industry will reduce the number of financial advisers and clients available to be served by Lumiant.

Upon launch, Lumiant may not prove as popular in the Australian market as it was during the testing phase. This could impact customer acquisition, impacting Lumiant’s ability to achieve its strategic business objectives.

Why Equity Crowdfunding?

Lumiant intends to radically transform and excite the financial advice industry. Crowd Funding allows us to access like-minded investors and Financial Advisers who want to be part of something truly transformational.

Lumiant’s core mission is to empower Australians to live their best financial life. We have partnered with Equitise to deliver an Equity Crowdfunding Campaign, which we see as a natural fit in allowing the community of Australian advisers and investors to join us on our journey to elevate the financial well-being of many Australians.

With Lumiant’s core technology in the final stages of development, and poised for rapid growth, we are raising capital to strengthen our team to capitalise