Fractel

- Type: Retail

- Total Round Size (min): AUD$200,000

- Total Round Size (max): AUD$750,000

- Price per share: AUD$1

Fractel

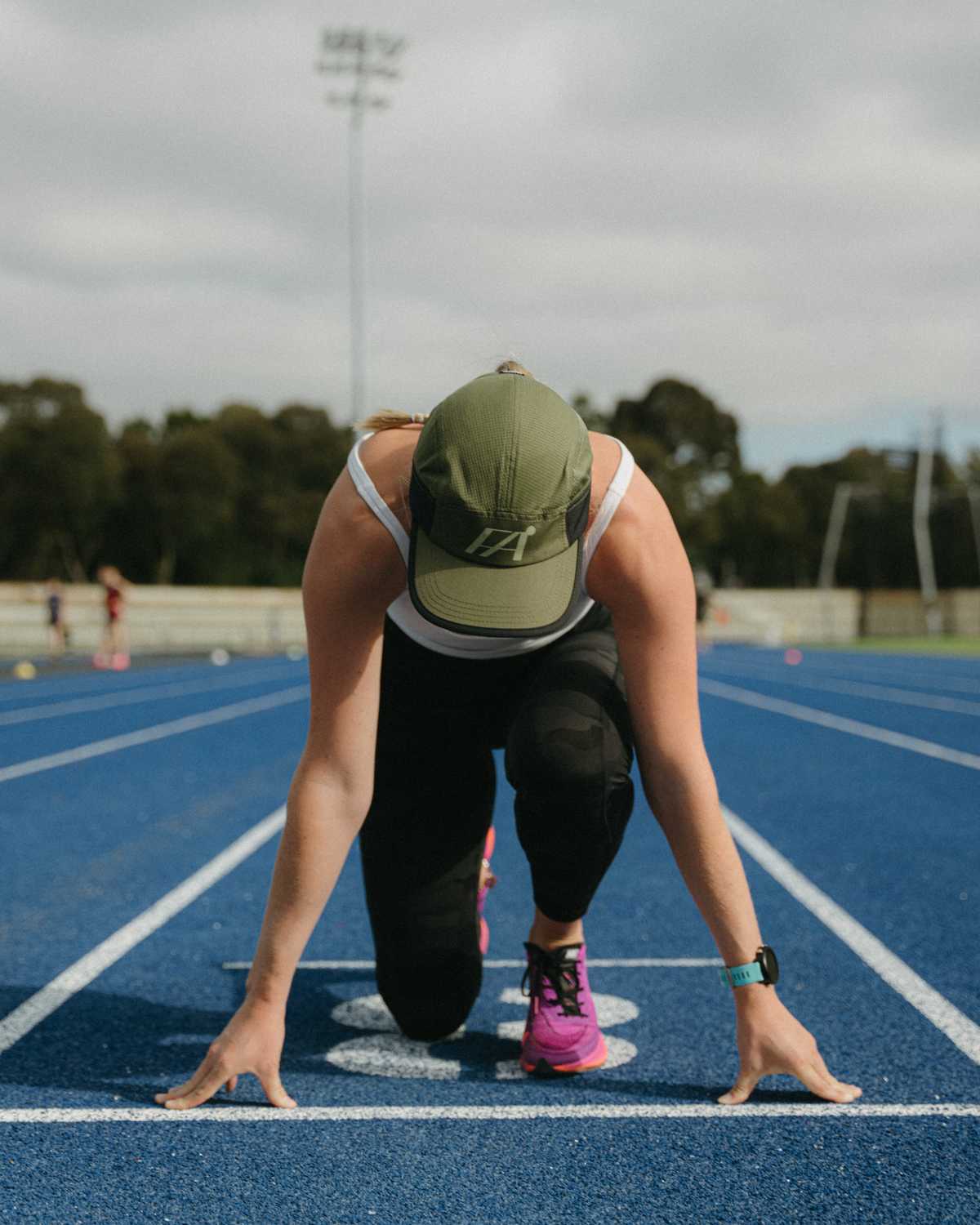

Fractel is a premium sportswear brand, focusing on headwear, innovation and sustainability. Their products, known for their unique blend of style, functionality, and sustainability, have set them apart in the sportswear industry.

Fractel's journey began with a vision to revolutionise the sportswear industry. Consumers are increasingly turning away from traditional offerings that often compromise on environmental impact and authenticity. They are instead gravitating towards purpose-driven brands like Fractel, which prioritise genuinely sustainable and innovative products.

- Fees Paid by Issuer: 6% of funds raised

- Cooling-Off Rights: 5 working days

- Minimum Parcel Size: $250

Terms of Offer

Key Documents

Investor Rewards

For investments between: $500 - $1,999

10% Lifetime Discount*

*Lifetime discount only applies to DTC sales

For investments between: $2,000 - $4,999

15% Lifetime Discount*

Limited Edition Cap

*Lifetime discount only applies to DTC sales

For investments between: $5,000 - $19,999

20% Lifetime Discount*

Limited Edition Cap & Tee

*Lifetime discount only applies to DTC sales

For investments above: $20,000

25% Lifetime Discount*

Limited Edition Cap & Tee

*Lifetime discount only applies to DTC sales

Company Overview

Investment Highlights

- Innovative Design

While traditional sportswear often compromises on either performance or eco-friendliness, Fractel have created a design that doesn’t compromise on either. Large brands can often overlook Headwear and thanks to Fractel’s colourful and fully customisable headwear it sets them apart from other products in the space.

- Rapidly Growing Market

With over 90% of products made from 100% recycled fabrics, Fractel is leading the way in sustainable sportswear, appealing to a growing demographic of environmentally conscious consumers.

- Traction

In the last fiscal year, Fractel achieved over $1 million in revenue, and their year-on-year growth is on track for north of 100% this financial year. This demonstrates their significant market presence and the trust consumers place in the company.

- Partnerships via Custom Program

Through their custom program Fractel has partnered with some big-name brands including Red Bull, Google, and Qantas. In addition, they also work with breweries, retailers, coffee shops, and more highlighting the appeal for customisable, sustainable products.

Growth Strategy

Fractel have ambitious plans to expand their product line into performance apparel, tapping into a broader segment of the sportswear market by leveraging the brand trust they’ve built in the past 5 years. This expansion aligns perfectly with the growing demand for sustainable sportswear and Fractel's ability to deliver excellence in this space.

Fractel's Custom Headwear Program is another exciting avenue for growth. In 2023, they sold over 17,000 units through this program alone, revealing a robust demand for personalised, sustainable products. With their eyes set on dominating this niche, the sky’s the limit for growth potential.

With a newly signed distribution contract throughout Europe and a team on the ground in the USA, Fractel expect substantial growth in these regions, to the point where Australia will no longer be their main revenue driver within the next 12-18 months.

Team

Fractel is led by founder, runner and outdoor enthusiast Matt Niutta. The team brings together a wealth of experience in design, sustainability, and business strategy. The management's past experiences and deep-rooted presence in the community have been instrumental in Fractel's rapid growth and innovation.

Financials

For further detail please see section 2.11 of the Offer Document.

Use of Funds

For further detail please see section 3.3 of the Offer Document.

Key Risks

For further detail please see section 2.13 of the Offer Document.

Fractel relies on packaging suppliers, fabric suppliers, manufacturers and distributors. With current global supply chain and delivery constraints, this may hinder their expansion plans when entering new markets. Likewise, they may not be able to receive stock from the factories in China via sea freight on time. This may result in significant delays or cause certain products to go out of stock, potentially delaying revenue or impacting their ability to grow sales.

The cost of our products are dependent upon many factors including fabric costs, packaging costs and manufacturing costs. Increasing costs of goods may result in significant reductions in margin, or significant increases in prices passed on to consumers which may affect Fractel's ability to compete in the market.

Fractel pride themselves on delivering exceptional products, a strong sustainable ethos and a local appeal that differentiates itself from similar competitors. If competitors begin adopting a similar approach, this could lead to a reduction of market share within Australia and abroad. This will impact revenues and impact growth prospects and customer retention rates.

Fractel's brand is centred around providing sustainably built, performance sportswear for a community that loves to get outdoors. In a case where quality controls are not met, this could harm the reputation and perception of the brand, leading to a fall in sales and potential loss of a loyal customer base.