Brunswick Aces 2

- Type: Retail

- Total Round Size (min): AUD$1

- Total Round Size (max): AUD$500,000

- Price per share: AUD$1

Brunswick Aces 2

Brunswick Aces raised $502k via Equitise in December 2022. Since then, Equitise has had some investors reach out who missed our or wanted to invest more. As a result, we are opening up a very short second tranche. Invest now at the link above.

- Fees Paid by Issuer: 6% of funds raised

- Cooling-Off Rights: 5 working days

- Minimum Parcel Size: $250

Terms of Offer

Key Documents

Investor Rewards

For investments between: $250 - $399

- Ongoing 20% discount on Brunswick Aces products

- Exclusive access to events

For investments between: $400 - $1,199

- 30% off first order

- Tasting Pack (3x100ml bottles of choice)

- Ongoing 20% discount on Brunswick Aces products

- Exclusive access to events

For investments between: $1,200 - $3,499

- 40% off first order

- Twin Pack (2x700ml bottles of choice)

- Ongoing 20% discount on Brunswick Aces products

- Exclusive access to events

For investments between: $3,500 - $7,499

- 45% off first order

- Full House (6x700ml bottles of choice)

- Ongoing 20% discount on Brunswick Aces products

- Exclusive access to events

For investments above: $7,500

- 50% off first order

- Royal Flush (6x700ml bottles of choice)

- A night in the bar, on the Brunswick Aces team, for you and 5 friends

- Ongoing 20% discount on Brunswick Aces products

- Exclusive access to events

Top Investor Naming Rights

- The Highest Investor will be granted naming rights to a new space in the bar that is shortly due to open

- The 2nd Highest Investor will be granted naming rights to the bottling and labelling line

- The 3rd Highest Investor will be granted naming rights to the canning machine

Company Overview

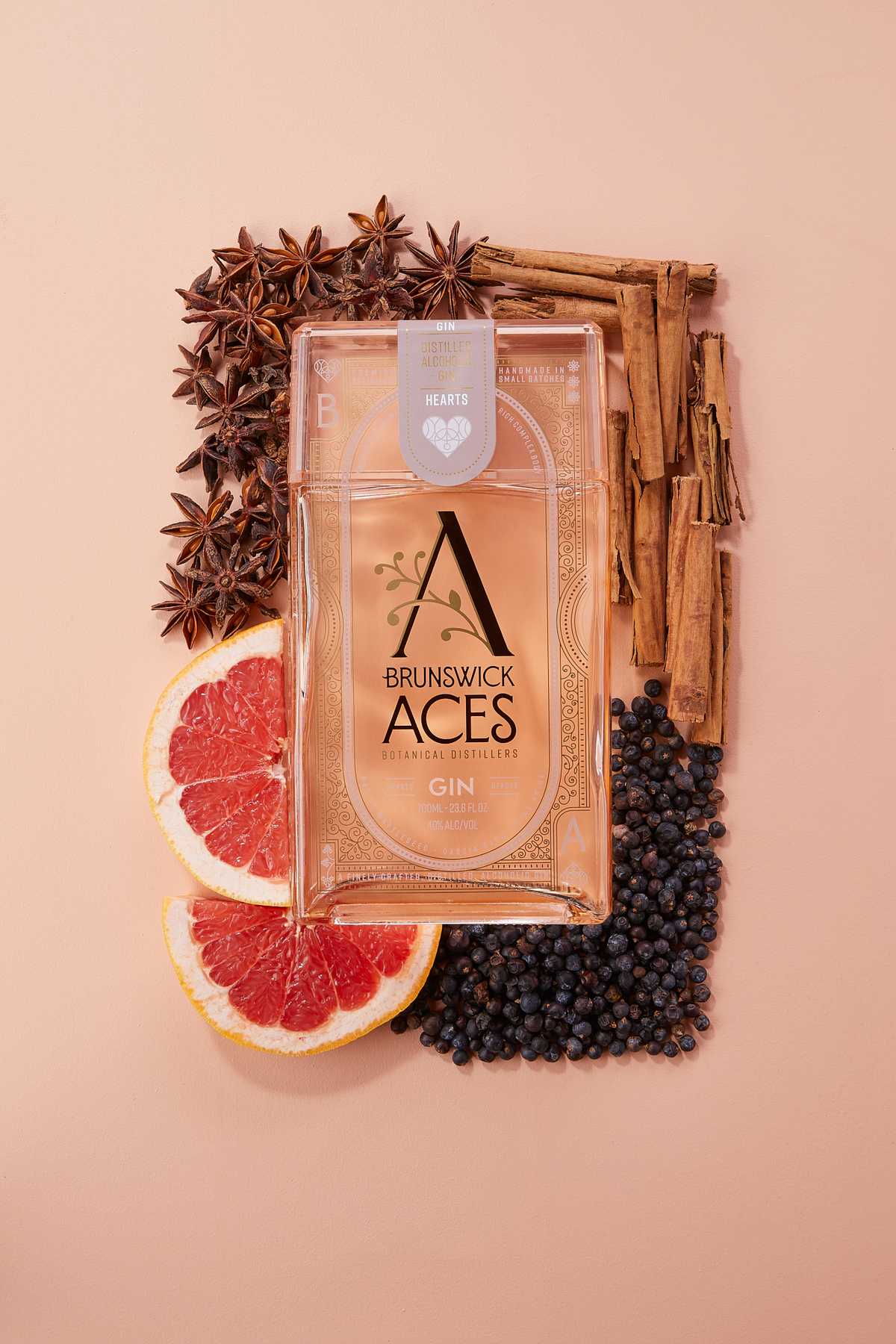

Brunswick Aces Distillery produces an award-winning range of alcoholic and non-alcoholic gins, with a dedicated distillery, and Australia’s first non-alcoholic bar in Brunswick, Melbourne, they are at the forefront of the moderation movement.

In 2017, Brunswick Aces launched as Australia’s first non-alcoholic distillery, before adding botanically paired alcoholic gins a year later, with products now available worldwide, revolutionising how people drink while socialising.

It all started when six neighbours found themselves looking for a solution for what to drink together, after some of the group went sober and they could no longer share their Friday G&T. Shortly after, Brunswick Aces, now a leading Australian producer of both alcoholic and non-alcoholic gin, was born.

Brunswick Aces was one of the world’s first non-alcoholic spirit producers, leading the way as the moderation movement began picking up momentum. With both alcoholic and non-alcoholic gin, made using native Australian botanicals, they are uniquely positioned in the Australian market with their extensive knowledge and experience.

Sapiir, Brunswick Aces’ proprietary range of non-alcoholic gins, is the jewel in the crown and one of the cornerstones of the business. The brand philosophy is to make everyone feel welcome at all social situations, which is why all three botanical blends are available in 0% and 40%, so the same drinks can be enjoyed by everyone.

Not content with only making products to be drunk at home, the Brunswick Aces team opened the doors to Australia’s first non-alcoholic distillery, bar, and bottle shop in early 2021, changing the drinking landscape in Australia forever.

Now, Brunswick Aces is raising capital to execute the second phase of its growth plan - fueling marketing and sales growth in existing markets, solidifying entry into three new key territories, and focusing on product range expansion. For this next phase, Brunswick Aces is forecasting incredibly strong year-on-year growth over the short term.

Investment Highlights

- Leaders of the Conscious Drinking Movement in Australia

Having introduced Australia’s first non-alcoholic gin distillery, bar, and bottle shop, Brunswick Aces has cemented its positioning amongst the leaders of the Australian non-alcoholic beverage industry.

- Accelerating Growth

Thanks to the bar opening, distillery expansion, and online store launch, Brunswick Aces more than tripled revenue in FY22, and the growth of the core business is forecast to remain strong over the medium term.

- Vertically-Integrated Model Boosting Profitability

Brunswick Aces’ customised in-house stills, bottling and labelling lines allow us to control our process, reduce our costs and increase production. This is a meaningful differentiator relative to similar sized businesses that rely on contract distillers.

- National Distribution Agreement In Place

Brunswick Aces has signed a national ranging deal with Dan Murphy’s in September 2022, which has seen Spades Sapiir ranged in 240+ locations nationwide. Lines are also stocked in select BWS, Liqourland, IGA, Vintage Cellars, David Jones, and independent retailers.

- International Expansion Already Underway

Outside of Australia, the brand is present internationally in New Zealand, Japan, Singapore, UK, Europe, Middle East, and Canada, with expansion plans set for the U.S, Asia, and MENA markets through 2022.

- Premium, Award-Winning Brand

On top of producing Sapiir, Australia’s first non-alcoholic gin, Brunswick Aces also distills premium alcoholic gin - their Spades and Diamonds gins took home silver and bronze respectively at the 2022 Australian Gin Awards and Royal Australian Spirit Awards. Additionally, in 2021, their non-alcoholic bar was named one of Concrete Playground’s best new Melbourne spaces, after achieving the biggest hospitality launch covered by the media in over a decade.

Business Model

Brunswick Aces Pty Ltd is a vertically integrated non-alcoholic drinks manufacturer and leader in the Australian non-alcoholic drinks industry. Unlike other non-alcoholic drinks manufacturers, Brunswick Aces are the owners of Australia’s first alcohol-free bar; two e-commerce sites, Brunswickaces.com and Killjoydrinks.com, both offering a plethora of non-alcoholic drinks to the Australian market; a wholesale non-alcoholic drinks distribution business; an alcohol-free distillery and exclusive import rights to some of the world’s best alcohol-free options.

The four key elements of Brunswick Aces’ business model are as follows:

Launching Australia’s first alcohol-free bar secured Brunswick Aces as leader in the Australian alcohol-free drinks category. The amount of press garnered in this single endeavor brought Brunswick Aces national recognition, making them a household name and building significant brand equity.

As more bars and restaurants came to Brunswick Aces to learn about alcohol-free options, they also asked to purchase those options directly from them. The sharing of resources, including staffing, stock, and software across the bar, two e-commerce sites and the wholesale business, ultimately reduce costs.

While the bar, two e-commerce sites and the wholesale business drive a superior margin profile versus non-integrated businesses, the brands represented are not exclusive to Brunswick Aces. As part of the acquisition of Killjoydrinks.com, the business inherited a non-exclusive right to import global products. In addition, Brunswick Aces separately secured the exclusive import rights of three other brands, bringing the exclusive import portfolio to five brands. These imports further boost margins and add to the quality of the portfolio.

In 2021, Brunswick Aces acquired Killjoydrinks.com, one of the first alcohol-free eCommerce sites in Australia, which also advanced the launch of BrunswickAces.com. Having both the bar and two e-commerce sites increased buying power and they were able to reduce their cost base by combining the three.

Growth Strategy

- Existing Market Penetration

Brunswick Aces’ existing national presence is a key focus. Wider brand recognition is already being achieved thanks to national press, as well as national distribution deals in chains such as Dan Murphy’s.

Brunswick Aces will seek to leverage this momentum, as well as that which was gained from the bar launch and newly designed bottles. Funds from this raise will be invested in marketing, as well as building out the domestic sales team.

- New Product Development

Brunswick Aces are shortly due to release their 4th Botanical blend, “Clubs”. Additionally, the product range is soon to include Ready-To-Drink versions of each blend, 100mL bottle sizes, gift packs and bookend packs.

- Expansion Into New Markets

The third key element of the growth strategy involves the continued push into offshore markets. Brunswick Aces’ export relationships, which they have gone to great lengths to initiate and foster during the COVID period, are a meaningful differentiator versus their peer set - many brands talk about moving overseas, but Brunswick Aces are already operating in international markets, with distributor contracts signed or in final negotiations, as well as wholesale partnerships having been achieved in the US and Europe.

Capital raised from this process will allow Brunswick Aces to further build out their international sales team, and to pursue export opportunities in New Zealand, Singapore, Japan, Canada and India.

Why Equity Crowdfunding?

Since inception, Brunswick Aces has empowered consumers to choose how they drink, not if they drink. The founders’ mission, to make everyone feel welcome in all social situations, is community-centric by nature - which is why they have opted to bring their community along for the ride as they embark on their next stage of growth.

By investing in Brunswick Aces, you are becoming a part owner in a pioneering Australian distillery at a pivotal point in its growth. Investors will also get access to an exclusive and exciting range of rewards.

Key Team Members

Stephen Lawrence

Stephen has a background in engineering start-ups, having been employee number #1 at Circa Group, now a publicly listed company. The company developed the Furacell process to manufacture industrial chemicals from renewable feedstocks.

Diana Abelardo

Diana has a background in management and international trade. She has a strong financial focus, having worked as a management accountant while business partnering for many Melbourne based startups and established businesses.

Dr Cameron Hunt

Cameron has a background in analytical chemistry, with a PhD in Stem-cell Neurobiology and conducts research projects developing cures for neural degenerative diseases like Alzheimers. Cameron also has over 15 years experience in the hospitality industry across both front and back of house.

Eric Gambardella

An innovator since he launched his first start-up as an undergraduate, Eric has always been passionate about identifying opportunities in consumer markets. Eric has been able to pivot within his previous two companies leading to successful exits.

Stuart Henshall

Stuart comes from a marketing & events background. With 12 years of experience working in agencies on global brands in London and Sydney prior to Brunswick Aces. He has led award-winning brand campaigns across the health and lifestyle industries, as well as led international spirits brand campaigns across the vodka, gin, and whiskey categories.

James Gibson

Our Head of UNE in the U.K and Europe, James is an ex-town planner, turned property developer, perfectly placed to help us expand globally. His passion for building solid structures means that our global network is off to a strong start.

Use of Funds

For further detail please see Page 29 of the Offer Document.

Financial Information

For further detail please see Page 24 of the Offer Document.

Key Risks

For further detail please see Page 28 of the Offer Document.

The craft spirits and nolo alcohol spaces are competitive. The Company is a first mover and operates a differentiated model, but could lose market share if more players in the market took the approach.

The Company will maintain their focus on the premium gin and Sapiir markets in which they have made their name. The Company’s customer base is likely to be sticky if the company maintains its quality and range.

The Company has a number of key team members integral to the running and growth of the business. If one or more of these individuals were to leave the business, failure to replace them adequately may harm company objectives.

The Company incentivises key individuals with equity and options in the business to ensure they are fully aligned with the success of the Company.

The Company has created a strong brand reputation in its several years of operation. With expansion comes the risk that core brand values are diluted and lost with scale, which may impact the underlying value of the business.

The Company’s intended approach to expansion involves reaching out to independent distributors to allow the Company to maintain its craft distillery feel and avoid losing quality or authenticity with scale.

The Company is particularly exposed to any COVID-19 related risks or fluctuations. While the business was able to effectively see out the pandemic, future lockdowns or outbreaks may harm business performance, particularly the Company’s on-premise channels.

Increasing production capacity should allow the Company to enter another potential lockdown with improved inventory levels. This will allow the business to operate on a direct-to-consumer basis if on-premise sales channels are impacted.

The Company is raising capital to fund its growth plans. Should insufficient capital be raised, or if costs are higher than anticipated, the Company might need to raise additional capital or risk not meeting its business objectives.

The Company will intend to redistribute the allocation of funds raised to areas most needed for business improvement. The Company may also opt to carry out an additional funding round.