Allied Beverages

- Type: Retail

- Total Round Size (min): AUD$170,800

- Total Round Size (max): AUD$660,000

- Price per share: AUD$0.66

Allied Beverages T/A BLVD

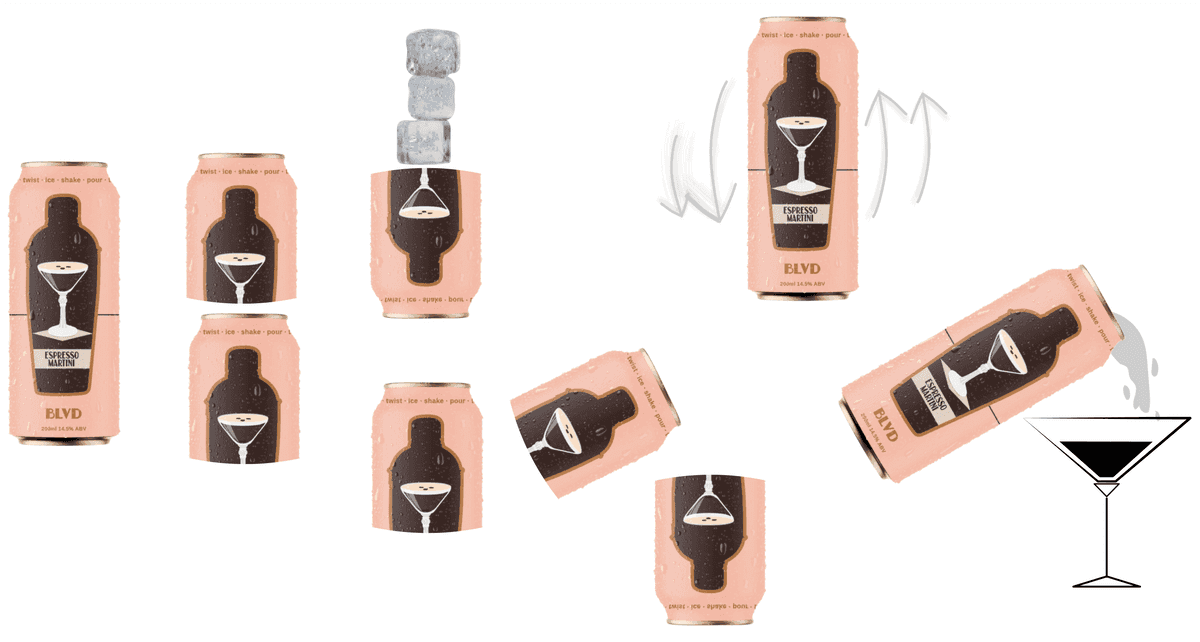

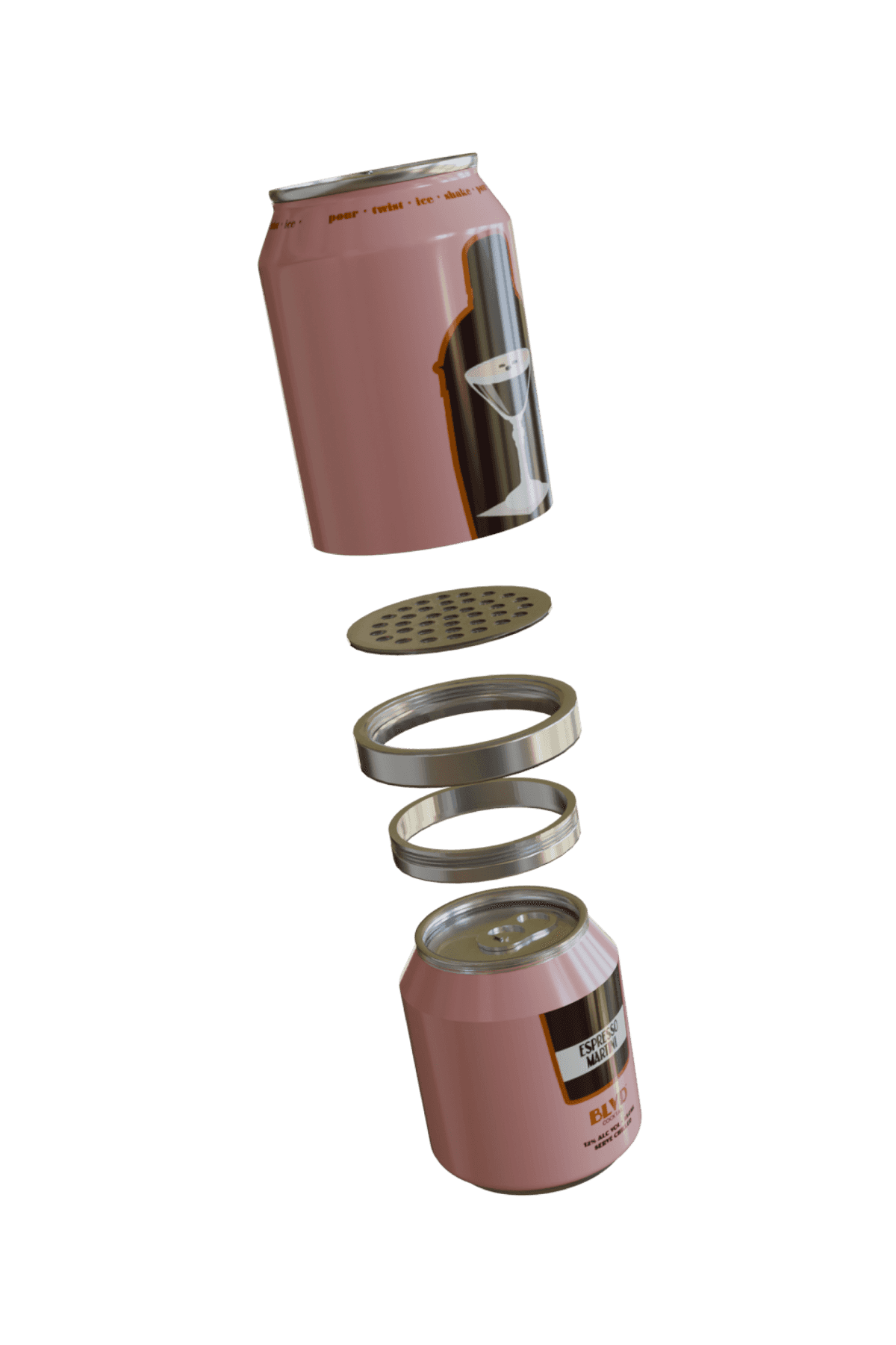

Allied Beverages Pty Ltd is the parent company of BLVD™, and the owner of The Sydney Shaker™, an all in one cocktail shaker in a can.

The Sydney Shaker™ is a patent-pending invention. Its unique design features a built-in strainer and screw-top lid, which allows consumers to shake the drink with ice before they pour, achieving authentic bar-quality flavour and texture.

The company plans to strategically launch BLVD™ as the proprietary brand using the technology, and also license The Sydney Shaker™ technology to other drinks manufacturers.

Allied Beverages meets the Early Stage Innovation Company (ESIC) requirements, meaning investors are expected to be eligible for a 20% tax rebate as well as a Capital Gains Tax exemption for up to 10 years on their investment.

- Fees Paid by Issuer: 6% of funds raised

- Cooling-Off Rights: 5 working days

- Minimum Parcel Size: 250.8

Terms of Offer

For more information see 2.11 in the offer document

Key Documents

Company Overview

Allied Beverage's the holding company of BLVD, mission is to license, manufacture and distribute their all in one shaker in a can - The Sydney Shaker.

They saw an opportunity to develop technology to ensure RTD pre-batched cocktails are served in a vessel that enables liquid to be agitated with ice and strained within the vessel, achieving a bar quality cocktail.

Research revealed that this sub-segment of the RTD market has seen minimal innovation by the way of packaging. Different format sizes, pack material and styles have entered the market, but nothing that enables ice to be added, which is a key component in achieving the perfect serve.

Investment Highlights

- An all in one solution

BLVD has created an all in one shaker in a can. Unlike other RTD cocktails that fail to replicate the bar quality product, BLVD creates an authentic cocktail thanks to The Sydney Shaker technology.

- Growing Industry

Ready-to-drink cocktails are the fastest-growing category in the US, growing 26.8% YoY. Closer to home, RTD’s took off during the pandemic's peak, since then consumption has only increased, with 21% of Australians now consuming RTD’s, and with 30% of Australians drinking cocktails, the combined RTD cocktail sub-segment is poised for explosive growth.

- Multiple Revenue Opportunities

To limit risk and take full advantage our patent pending technology we have 2 key revenue streams in our business:

1. We will generate revenue by launching our own brand (BLVD) through the funds raised.

2. We will earn fees by licensing our device to existing beverage producers.

- Experienced Team

Allied Beverages and BLVD’s™ team consists of highly experienced and skilled team members across marketing, development, and finance who all boast an impressive background in the liquor industry.

Growth Strategy

To enable BLVD to meet rapid scalability there will be a focus on licensing and manufacturing, as we see consumers are more likely to purchase The Sydney Shaker over other brands given that it adds premium quality to a ready-to-drink product no matter what the brand.

BLVD are in a unique situation where they will work with our competitors to grow the category in a rapidly growing market.

Both of the major national retail chains in Australia have an appetite for innovation, particularly in the spirits category and both have expressed interest in distribution of BLVD.

Team

For more information see 2.9 in the offer document

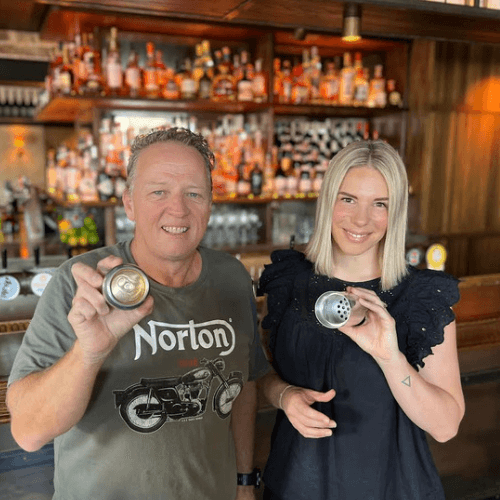

Mark Dorrell

Mark, an industry veteran, is motivative by analysis and relationships. With experience in lead corporate and founder-owned brands such as Moet & Chandon, Belvedere, Hennessy, Mr Black and many more. Mark has overseen the establishment of global distribution networks and managed key accounts like Sainsburys (UK) and Qantas.

Samm Creasey

Samm is proficient in elevating brands, collaborating with founders in leadership positions within marketing and consulting. She has demonstrated success in both local and global markets and oversaw key activations with brands such as Mr Black that has allowed skilful management of brand assets to enhance consumer and industry recognition.

Financials

For further detail please see section 2.13 of the Offer Document.

Use of Funds

For further detail please see section 3.2 of the Offer Document.

Key Risks

For further detail please see section 2.14.1 of the Offer Document.

The beverage industry is highly competitive, with many established brands and new entrants competing for market share. While we have a Patent Pending for our design, there may be imitations where we will be required to defend our design which would require unbudgeted funding.

As an early-stage business, the Company is susceptible to the loss of key team members as they are considered critical to the continued success of the Company. If a key team member was lost, due to illness for example, this could significantly affect the Company’s ability to continue its operations or achieve its business objectives.

The alcoholic beverage industry is highly regulated, with strict requirements for licensing, labelling, production, and distribution. Producers must comply with federal, state, and local laws and regulations, including taxes and licensing fees. Failure to comply with regulations can result in fines, legal action, and reputational damage.