Credi is the world’s leading relationship lending platform, managing millions of dollars of loans between friends and family at interest rates that are often a fraction of those offered by traditional lenders. It formalises and automates loans and repayments through a simple platform that removes the friction of peer-to-peer lending.

Recently, financial institutions have been the subject of scrutiny amidst unethical and predatory lending practices. Many Australian’s are forced to take out loans from traditional lenders at interest rates of up to 20% p.a. Wanting to help more Aussies get out of debt quicker but aware that there was no affordable and easy way to formalise an informal loan, Tim Dean came up with the concept of Credi. It’s a much-needed solution to a massive market. It's estimated that the ‘Bank of Mum and Dad’ alone is worth $65 billion in Australia. The average interest rate on Credi is only 3% p.a., helping money to stay in the family.

In less than 2 years, Credi gained over 5,250 users and has over $100 million loans on the platform across 26 countries.

In the first half of 2019, Equitise partnered with Credi to undertake a retail equity crowdfund. We loved the concept and given the disruptive nature of the business, saw great alignment with the company raising capital through a disruptive form of investment. It also made sense to give everyday investors the opportunity to join the Credi journey given the platform aimed to help everyday Australians get out of debt quicker.

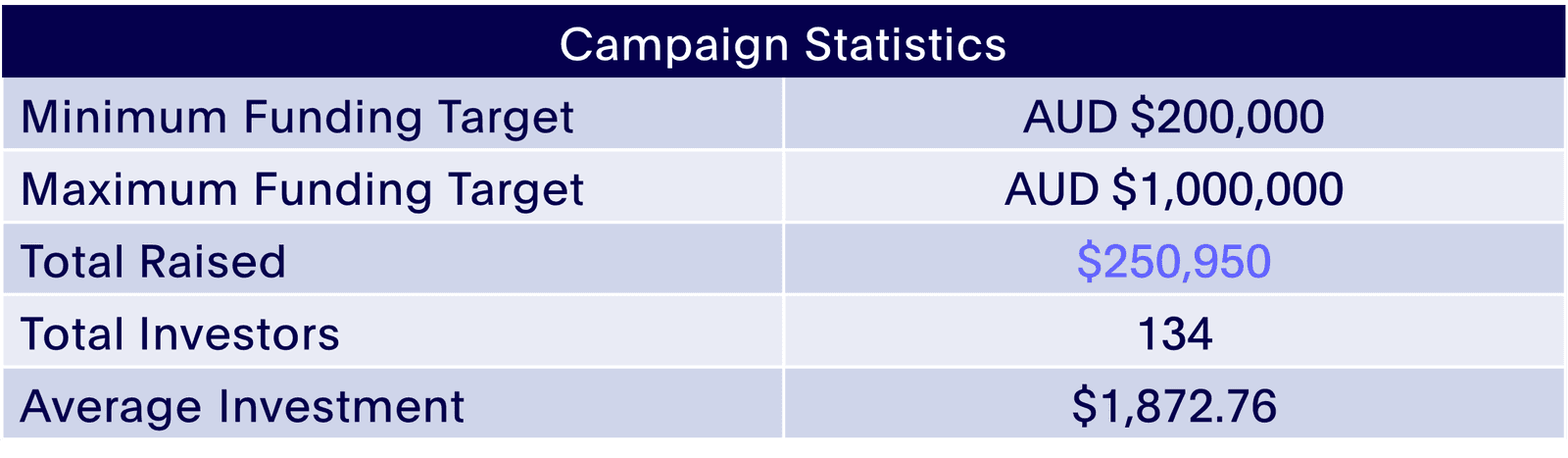

Credi successfully raised $250,950, surpassing its minimum target. The funds from the crowdfund will be used for marketing to increase brand awareness and adoption.

Credi was featured in numerous press articles throughout the campaign including StockHead, Australian Broker and Mortgage Business.

You can read the Credi press release here.