Equity Crowdfunding was created to make investing in private companies accessible for everyday people.

While Equity Crowdfunding is a very inclusive investment method relatively speaking, there are still some restrictions about who can invest in different types of offers and how much each type of investor can commit.

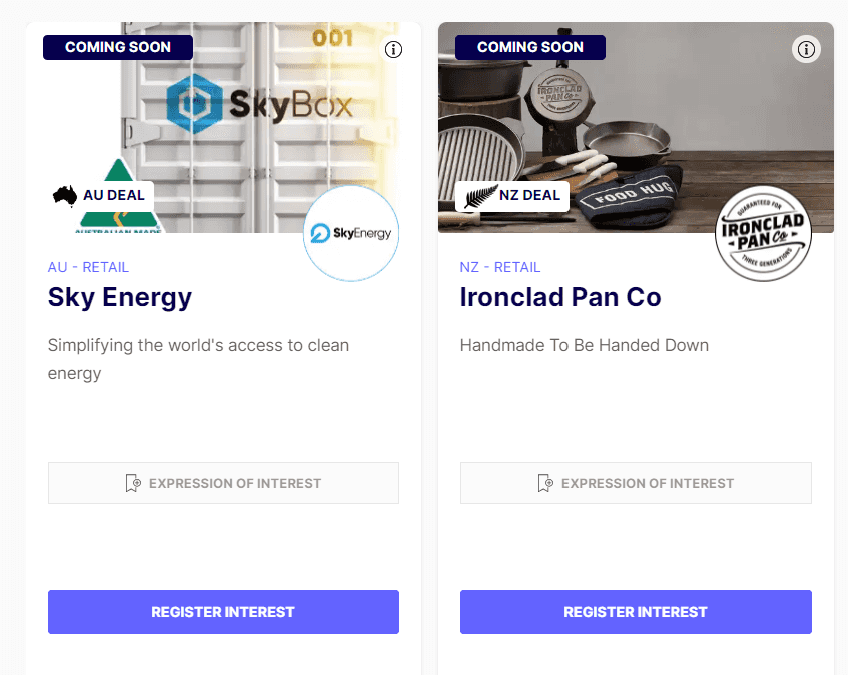

Deals

Australian Offers:

Australian retail equity crowdfunds are open to any Australian resident over the age of 18.

International investors based outside of Australia are also able to invest in an Australian retail offer if they are classified as a wholesale, sophisticated or accredited investor in their jurisdiction.

Australian retail investors can invest a maximum of $10,000 per company, per year. There are no restrictions on how much a wholesale investor can invest.

The minimum parcel size of the deal is the minimum amount that any retail investor from Australia can invest in, the minimum parcel size varies from deal to deal.

For international investors, the minimum investment is usually higher than that of Australian investors, accounting for extra transaction costs to process the payment. If you are an international investor looking to invest in one of our deals, please email [email protected].

Wholesale investors:

You’ll see the terms wholesale, sophisticated, eligible or accredited investor be used interchangeably. For the purpose of equity crowdfunding these all have the same practical implications and can be interchanged with one another. What this means is that you are able to access additional investment opportunities that aren’t available to retail investors.

Qualification criteria will vary depending on what country you are based in. To find out if you meet the criteria to be considered a wholesale investor for our most common countries of investment, please see the definitions below.

To check if we are able to accept investments from your country or for more information about international investing, please email [email protected].

Australian Wholesale:

In Australia, the definition of a Sophisticated or Wholesale investor is someone who has:

- A gross income of $250,000 or more per annum in each of the previous two years; or;

- Net assets of at least $2.5 million.

Sophisticated or wholesale investors are not limited in how much they can invest in any offer. They also aren’t shielded by the same benefits and protections as retail investors.

Sophisticated and wholesale investors must present Equitise with a s708 Sophisticated Investor Certificate issued by a qualified accountant confirming the above before investing in an offer.

If you qualify as a wholesale or sophisticated investor in Australia you are also able to invest in our New Zealand equity crowdfund offers.

Investors outside Australia:

If you are based outside of Australia and New Zealand but would like to invest in one of our offers you must qualify as an Accredited/Sophisticated Investor in your region.

New Zealand Wholesale:

In New Zealand, a wholesale investor is someone who:

- Is considered an eligible investor because they have sufficient knowledge and experience dealing in financial products that enable them to assess the merits and risks of the transaction. Note, Eligible investors are required to certify they are an eligible investor.

- Net assets, combined with the assets of entities controlled exceeded $5 million for the 2 most recent financial years, or the total turnover of the entities controlled exceeded $5 million for the 2 most recent financial years.

- Own, or at some time during the last 2 years have owned, a portfolio of "financial products" of a value of at least $1 million. Financial products include debt securities, equity securities, managed investment products, and derivatives.

- During the last 2 years, carried out 1 or more transactions to acquire "financial products" where the amount payable under those transactions (in aggregate) is at least $1 million and the other parties to the transactions were not associated with the investor

- Principal business is investing in financial products or principal business is providing a financial adviser service in relation to financial products or in the business of trading in financial products on behalf of other people.

- Within the last 10 years been employed in an investment business and, for at least 2 years during that 10 year period, participated in the investment decisions made by that investment business.

- Is a financial adviser in New Zealand and holds, or operates under, a Financial Advice Provider (FAP) licence.

- Is investing $750,000 or more into the company.

United Kingdom:

Self Certified:

I am a self-certified sophisticated investor because at least one of the following applies:

- I am a member of a network or syndicate of business angels and have been so for at least the last six months prior to today's date;

- I have made more than one investment in an unlisted company, in the two years prior to today's date;

- I am working, or have worked in the two years prior to today's date, in a professional capacity in the private equity sector, or in the provision of finance for small and medium enterprises;

- I am currently, or have been in the two years prior to today's date, a director of a company with an annual turnover of at least £1 million.

OR

High Net Worth Investors:

I had, throughout the financial year immediately preceding today's date, an annual income to the value of £100,000 or more;

- I held, throughout the financial year immediately preceding today's date, net assets to the value of £250,000 or more.

Net assets for these purposes do not include:

- The property which is my primary residence or any money raised through a loan secured on that property;

- any rights of mine under a qualifying contract of insurance; or

- any benefits (in the form of pensions or otherwise) which are payable on the termination of my service or on my death or retirement and to which I am (or my dependants are), or may be, entitled.

European Union:

An Experienced Investor is a person or body who, at the time of the investment, falls into one of the following categories:

- A person or partnership whose ordinary business or professional activity includes, or is reasonably expected to include, acquiring, underwriting, managing, holding or disposing of investments, whether as principal or agent, or the giving of advice concerning investments; or

- A body corporate which has net assets in excess of €1,000,000 or which is part of a group which has net assets in excess of €1,000,000; or

- An unincorporated association which has net assets in excess of €1,000,000; or

- The trustee of a trust where the aggregate value of the cash and investments which form part of the trust’s assets in excess of €1,000,000; or

- An individual whose net worth, or joint net worth with that person’s spouse, is greater than €1,000,000, excluding that person’s principal place of residence; or

- A participant who has a current aggregate of €100,000 invested in one or more experienced investor funds; or

- A participant who invests a minimum of €50,000 in an experienced investor fund and who has been advised by a professional adviser to invest in the fund and the fund’s administrator has received confirmation of such advice; or

- A participant who is a professional client.

The minimum investment for an Experienced Investor who does not fall within these points above is €100,000 or its foreign currency equivalent.

Singapore:

You are defined as an accredited investor, if one of the three statements below applies to you:

- Your net personal assets exceed S$2,000,000 in value, or

- Your net financial assets exceed S$1,000,000 in value, or

- Your income in the preceding 12 months is not less than S$300,000

Hong Kong:

To be considered an accredited investor in Hong Kong, a person must meet at least one of the following criteria:

- Have a portfolio of securities with a market value of at least HKD 8 million (or its equivalent in a foreign currency).

- Have a gross income of at least HKD 2 million per annum for the past two consecutive years.

- Be a corporation with a portfolio of securities with a market value of at least HKD 40 million (or its equivalent in a foreign currency).

United States:

To be considered an accredited investor in the US, a person must meet one of the following criteria:

- Have an individual annual income of at least $200,000 in each of the two most recent years, or a joint income of at least $300,000 with their spouse, with a reasonable expectation of reaching the same income level in the current year.

- Have a net worth of at least $1 million, excluding the value of their primary residence.

- Investment professionals in good standing holding the general securities representative license (Series 7), the investment adviser representative license (Series 65), or the private securities offerings representative license (Series 82).

- Directors, executive officers, or general partners (GP) of the company selling the securities (or of a GP of that company).

- Any “family client” of a “family office” that qualifies as an accredited investor.

- For investments in a private fund, “knowledgeable employees” of the fund.

Canada:

To be considered an accredited investor in Canada, a person must meet one of the following criteria:

- An individual who has a before-tax income of over $200,000 for at least two years in a row ($300,000 if combining income with a spouse) and expects to exceed that income the current calendar year.

- An individual, alone or with a spouse, who has net assets of more than $5 million

- An individual who, either alone or with a spouse, beneficially owns aggregate financial assets of more than $1,000,000, before taxes but net of any related liabilities.

- A person registered in Canada, under securities legislation, as a dealer or an adviser.