Making feeling good an everyday thing.

Overview

Vitable’s personalised vitamin subscription service has gained thousands of loyal customers throughout since its inception. Thanks to Vitable’s large database and well-executed digital marketing strategy, the team effectively promoted the campaign to their huge audience, which resulted in over 2,000 people expressing interest in the deal.

Who is Vitable?

Vitable is a HealthTech company that simplifies their customer's health and well-being needs. Thanks to their innovative technology, Vitable easily and quickly tailors a health plan to each individual through their health quiz. This results in a personalised vitamin subscription delivered straight to customers' doors in daily compostable packets.

Why we liked Vitable

High quality, Australia-Made Products

Vitable’s direct-to-consumer (D2C) business model allows them to offer their customers premium products without the high price tag and hassle of buying multiple bottles of branded vitamins. All of Vitable’s products are manufactured in Australia and their formulations are all research-backed.

Personalised and Accessible

The personalisation of Vitable’s business model, as well as the convenience for their customers in their subscription model sets them apart from their competitors in the industry.

Key Takeaways

Strong Communications Plan

Vitable’s marketing and communications expertise no doubt contributed to the campaign being executed with precision, hitting each phase and milestone exactly as planned.

Tough Market Conditions

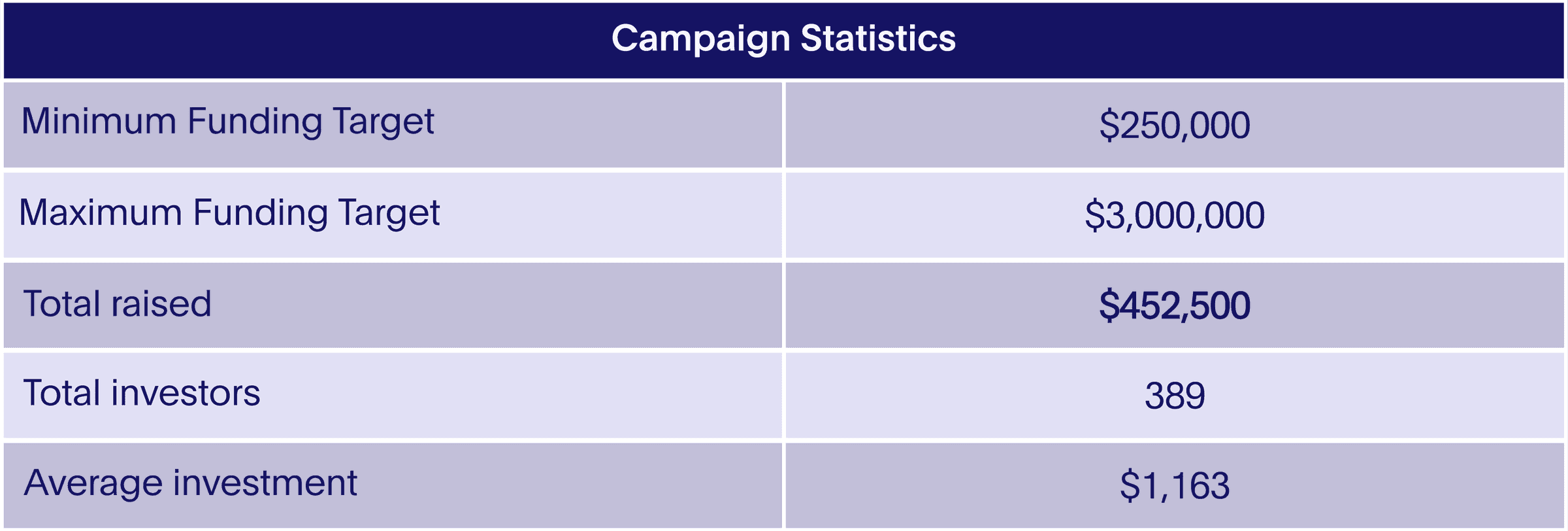

The interest in the Vitable offer was high, with over 2,000 people expressing their interest. However, while the funds raised were still sufficient for their needs, in past years we have seen a correlation between a high expression of interest to a high amount raised. Vitable’s end result of just under $500,000 showed that while people were interested in the offer, tough economic conditions resulted in a lower conversion of investors with smaller amounts invested too.