The Tech media has been going a crazy regarding the high valuation for Tech companies in the private sector. These companies with high valuations are ironically called unicorns.

Unicorns are companies with at least a $1 billion valuation. As unicorns represent mythical creatures, startup companies tagged with such a label are hard to find, as hard as it would be to spot the legendary creature.

The valuation for these companies are however not based on their impressive historical performance. They are labelled and valued purely on expectations. Investor simply decide to believe in their “story”.

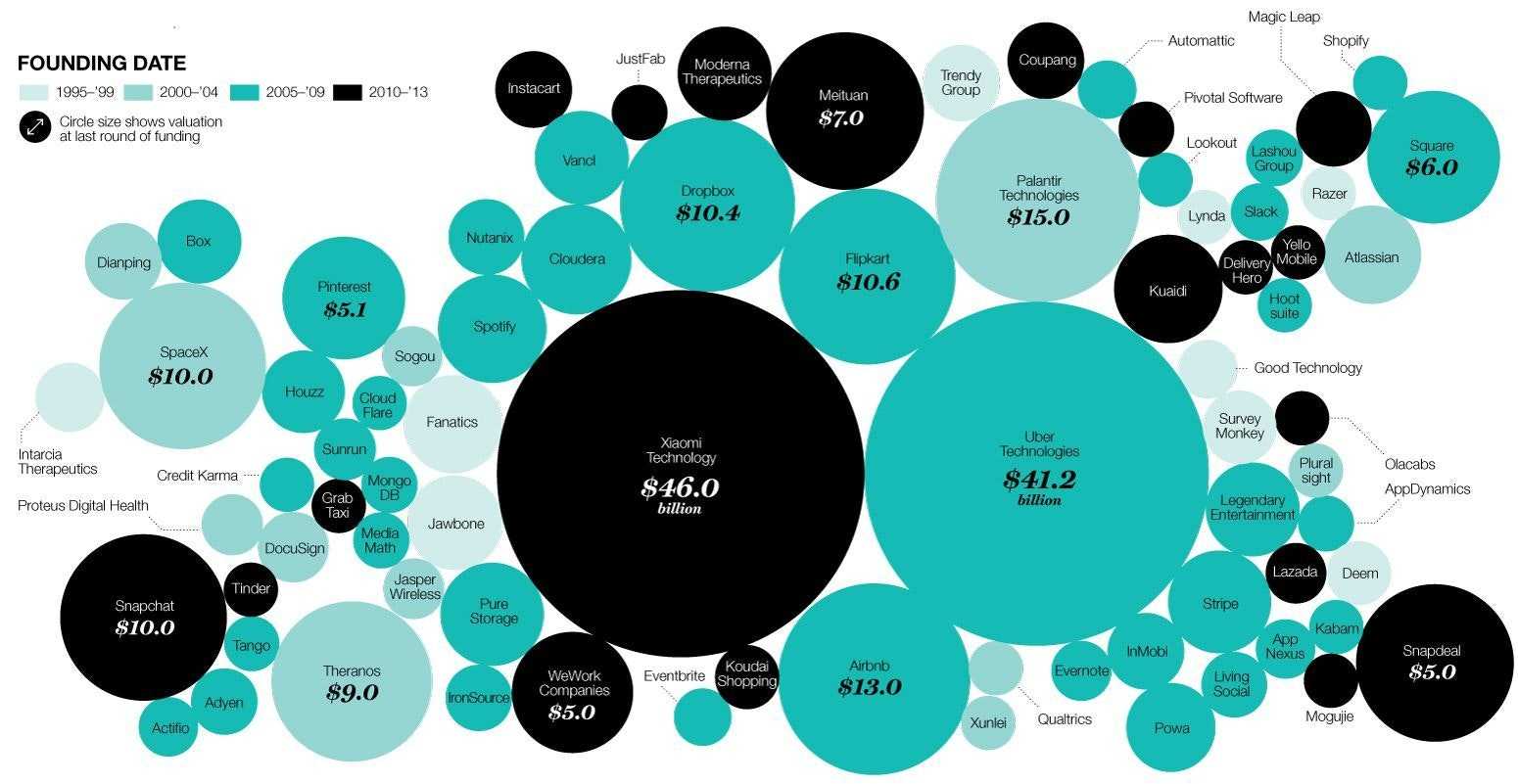

To take it even a further, it has been reported that venture capitalists are on the lookout for startups with as much as a $10 billion valuation labelled as “Decacorns”.

Some examples are Uber ($68 billion), Airbnb ($31 billion), Palantir ($20 billion), WeWork ($18 billion), SpaceX ($12 billion), Pinterest ($11 billion) and Dropbox ($10 billions) or “Super-unicorn” Facebook (£122 billion).

Looking back, it can be deduced that Facebook started the hyper valuation trend. Before Facebook went public, valuations were conservative, however when the share sale opened it was valued at $104 billion. Since then, venture capital firms and investors are on the hunt for the next Facebook.

The Features Of A Unicorn

If we take the time to think about the common characteristics that these amazing companies have in common we can easily identify the following three aspects:

1. They function within a potentially huge market: the product has to have the chance of reaching a big audience or it has to be highly valuable for its users.

2. They offer something original: usually the product encloses an innovative feature or a new utility. It adds something new to similar existing products.

3. They provide an advantage: something that differentiate them from their competitors, from a community or technological point of view.

A Global Overview

From an historical point of view, the investment industry loves those unique labels, names or however one might call it, as they spice up the industry.

In 2013, 15 companies joined the unicorn club, 38 in 2014, American tech platform CB Insights has created “The Global Unicorn Club”, which identifies 216 Unicorn companies, most of them tech companies, for a total cumulative valuation of US$751 billion.

The top 5 global unicorn companies are: Uber ($68 billion), Didi Chuxing ($50 billion), Xiaomi ($46 billion), China Internet Plus Holding ($30 billion) and Airbnb ($29.3 billion).

From a survey conducted by GP Bullhound, 47 unicorns have been identified in Europe in 2016, with a combined value of $130 billion, averaging a valuation of $2.8 billion each.

The top 5 European unicorn companies are: Spotify ($8.5 billion), Skype ($8.5 billion), Zalando ($8.1 billion), Markit Group ($6.2 billion) and King Digital ($5.6 billion).

The countries that host the majority of unicorns are the UK, Sweden, Germany and France.

Silicon Valley is no longer the only big epicentre of tech unicorns. Even if American unicorns raise almost twice the amount of capital compared their European counterparts, the average revenue generation for a European unicorn ($355.3m) is almost three times higher than in the US ($128.8m).

Even if the majority of unicorn companies are based in China or in the US, Australia and New Zealand are showing an increasing growth of startups that reach high valuations and are successfully funded. The Aussie and Kiwi tech ecosystems appear to be strong and healthy and companies such as the software company “Atlassian” and the email marketing firm “Campaign monitor” are an example of successfully tech companies, valued at $8 billion and $1 billion respectively.

Risks Of Having A High Valuation

Having a high valuation is dangerous and there can be some consequences.

Usually early stage companies and startups go through several funding rounds. Before starting the second or third round, it’s important that the investors’ expectations have been met during the first round.

What if the startup did not raise what was expected during round A and didn’t performed accordingly to the determined valuation?

This scenario would make raising funds in the subsequent rounds a very hard task.

For example, Fab, the design-focused e-commerce, was expected to generate $250 million in revenue in 2013 with a valuation of almost $1 billion, but in 2014, it generated only $100 million.

Open-source software company Hortonworks was valued at $1 billion, and when it went public, it reached a market cap of $666 million.

It could also cause stress or pressure on the founders or have unnecessary working capital. Stewart Butterfield, co-founder of Slack, admitted that they have spent only 1% of the money raised. He was also quoted saying “If you allow yourself to believe you’re worth $1 billion after two to three years of being in business, you’re going to get yourself caught up in trouble”.

Why Are There So Many Unicorns?

1. The reason why there are so many unicorn companies worth billions is that, compared to the past, companies are taking longer to get to a liquid event, such as going public (IPO). A study conducted by Cowboy Ventures found out that it took seven years on average to go public. In 1994 it took an average of 5 years for a company to IPO, in 2014 the average grew to 8. The more a company stays private and continues to grows, the more the valuation increases.

2. Moreover, a wave of innovation is penetrating different sectors and countries around the world. Previously almost all venture-backed unicorn companies were concentrated in the United States and were connected in the software industry, now the location and the industry in which these companies operate are much more diverse. For example, more than a quarter of the unicorns identified in 2015 were founded outside the U.S. and, even if the software industry is still in first place, many new unicorns operate in different areas such as e-commerce, transportation, lodging and travelling.

Some suspect that we are in a bubble similar to the dot-com bubble in 1997-2000, where there was a surge in the number of funds, number of deals and the total value of funding.

Perhaps the media is exaggerating the number of unicorns that are popping up but, according to a study from the National Bureau of Economic Research, on average, unicorns are approximately 50% overvalued.

The probability of investing in a unicorn is still quite slim - one would have similar chances in having twins - so keep in mind the risk that every investment carries with it and try not to get too excited about a companies’ story and high expectations.