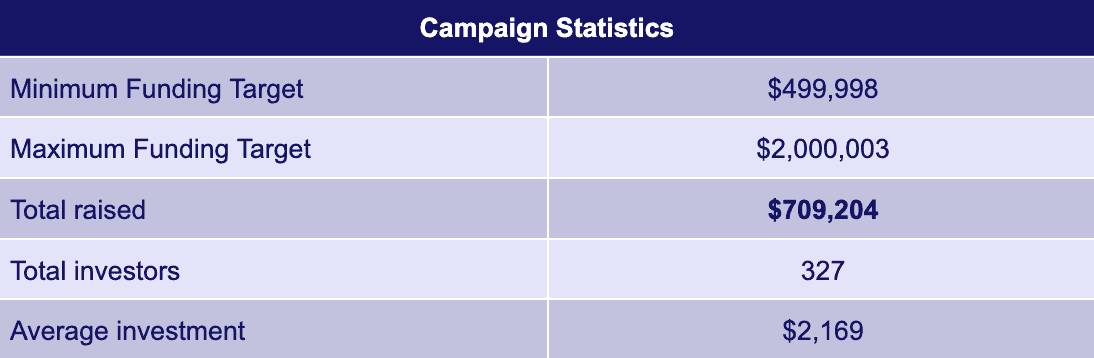

Tint has raised $700,000+ within 2 weeks of launching, to fuel growth plans!

Overview

In December 2021, DIY paint and home decoration company, Tint, successfully closed their equity crowdfunding raise by reaching $700,000+ within 2 weeks of launching to the public. This raise continues Equitise’s strong track record in the D2C, e-commerce space, following successfully after TBH Skincare and Car Next Door.

What is Tint?

Tint is an online paint brand on a mission to create healthier and more colourful spaces. They are focussed on making painting more accessible and sustainable than ever before.

The outdated $2.5b Australian paint and home decoration industry is ripe for disruption, so Tint has taken the opportunity to renovate how we decorate. Tint’s fresh perspective on shopping for paint includes a modern customer experience, premium eco-friendly paints at fair prices, and a commitment to the planet to ensure our only impact is on your walls.

Since launching 18 months ago, over 20,000 Australians have rolled with Tint, with annualised sales approaching $5m and our average review scoring us 4.91-stars. Moreover, 15% of Tint’s sales are from high-volume/high-frequency trade painters, with more joining their company each day.

The company has received $4.6m in backing from reputable investors including Aconex Co-Founders Rob Phillpott and Leigh Jasper; founder of PE firm BGH Capital, Ben Gray; and Bellroy Co-Founder Lina Calabria.

Why we liked the opportunity

1. Disrupting the outdated paints and home decoration industry

The Australian DIY paints and home decoration market has not kept up with the times, and depends on a frustrating offline customer experience. Legacy brands rely on warehouse-style hardware stores where customers can easily be overwhelmed with too many product options, and underwhelmed by the lack of guidance. Tint’s decorator-friendly approach and proprietary technology have created a new way to shop for paint that is online, convenient and easy.

2. Impressive financial performance to date

In just 18 months, Tint was approaching $5.0m in annualised sales and growing at 587% CAGR. Tint had seen a significant uptake from trade painters, with trade making up 15% of sales. This highlighted their potential for rapid scaling and traction, as they achieved up to 65% contribution margins on their products thanks to our in-house paint fulfilment solution.

3. Building a sustainable brand

Tint is motivated to make being colourful as green as possible. Tint’s range of premium paints are water-based, odour-free and vegan. With an eye for sustainability, Tint has aimed to plant a tree for every can of paint they sell, planting enough trees in October 2021 to cover two Sydney Harbour Bridges. They have also committed themselves to run all of Tint’s operations, including fulfilment, on 100% renewable energy.

4. Supported by a revenue-generating proprietary technology arm

Through Tint’s technology arm, Palette, Tint have supplied the global paint industry with their proprietary colour technology since 2013. Palette’s revenue is primarily driven by sales of our colour readers, showing 30,000 active users globally. Prior to COVID, Palette was generating annualised sales of $1.0m at up to 75% gross margins. Hence, Equitise saw how Palette’s proprietary technology and paint industry experience created an unprecedented and defensible technology advantage for Tint.

5. Experienced management team with backing from distinguished investors (some of whom are re-investing in this round)

The founders, DJ Dikic (CEO) and Rocky Liang (CTO), have deep expertise in design and engineering, and have successfully scaled Palette as a global technology business since 2013. Our Chairman, Adam Lewis, is the former McKinsey ANZ MD and former Aconex chairman. The company has received $4.6m in backing from reputable investors including Aconex Co-Founders Rob Phillpott and Leigh Jasper; founder of PE firm BGH Capital, Ben Gray; and Bellroy Co-Founder Lina Calabria.

Key takeaways from the raise

1. Strong community engagement with proven business model

Tint makes painting exciting, simple and rewarding by offering a streamlined product and colour range, delivering high-quality creator content. This has created a profound impact on their customers, inspiring their engaged community of decorators to invest in Tint’s journey and reach their key growth milestones.

Hence, this raise saw the community-oriented benefits of equity crowdfunding, with Tint capitalising on their social media following and impressive traction to date.

2. Attractive to investors with multiple paths to exit

Although Tint’s immediate focus was on scaling the business and consolidating their leadership position in the online home decoration market, Tint demonstrated a number of potential exit options for investors. Currently, no paint brand is listed on the Australian Stock Exchange (ASX), and given the Home D2C market had seen significant success in Australia with brands like Koala and Temple & Webster experiencing further up-rounds and even an ASX listing, investors saw the opportunity exists for the business.

Looking Ahead

In addition to disrupting the $2.5bn Australian paint and home decoration industry, Tint’s core strategy will focus on supercharging marketing efforts to increase average order value (AOV) and customer lifetime value (LTV). With goals to expand their product range to new categories, Tint also aims to rollout across Australia to grow their local market share.

With plans commencing to expand into Sydney, then progressively into Brisbane, Perth and Adelaide, Tint is expected to improve delivery times, lower freight costs, and increase conversion rates over time, particularly for Tint Pro customers.

We are looking forward to continuing to work with the Tint team, and are excited to see their growth and expansion in the future.