This is the second post in our blog series on the new tax incentives for investment in Australian Early Stage Innovation Companies (ESICs). In our first post we gave a general overview of the key features and objectives of the tax changes. In this post, we'll take a deep dive into startups, exploring the implications of the new legislation for founders.

The Problem

Founders face a high-risk period between initial funding and initial revenue in which it is difficult to attract investors or obtain finance to develop their concept to commercialisation. When startups fail, it typically happens in this period. And typically it happens simply because the startup does not have the capital to support ongoing operations.

The Solution

The new rules attempt to encourage investors to provide capital to startups in this crucial stage by putting in place tax incentives for investment in early stage startups. But these startups also need to be the type of high growth, scalable, innovative businesses for which such an investment conveys an ability to generate substantial economic value.The upshot is startups need to make sure their business is classified as an Early Stage Innovation Company (ESIC) to ensure that new investors can access the new tax changes.

What is an ESIC?

To be an ESIC under the new rules, companies must be classed as both ‘Early Stage’ and ‘Innovative’. It’s much easier to identify whether or not a company as early in its development than it is to determine whether a company is developing innovative products, services or processes. To reflect this distinction, the ‘Early Stage’ test regime is objective whereas the ‘Innovation’ test regime is more flexible, with dual objective and subjective pathways.

A) Early Stage Test

Startups are classified as Early Stage through an objective, four-part testing regime:

1. Incorporation or Registration of the business in the last three years, via either:

- Incorporation in Australia in the last three financial years

- Registration in the Australian Business Register in the last three financial year

- Incorporation in Australia in the last six income years and < $1.0m of total expenses

2. Total Expenses reported by the company:

- Must be < $1.0m for the previous income years

- Included any wholly-owned subsidiaries of the company

- Is calculated per ATO definition

3. Total Income reported by the company:

- Must be < $200k for the previous income years

- Included any wholly-owned subsidiaries of the company

- Is calculated per ATO definition

4. Not listed on any stock exchange in Australia or overseasWhere ‘financial year’ refer to taxable income periods and include the current year.

B) Innovation Test

Startups are classified as Innovative through a dual process whereby either a principle-based (subjective) regime or an activity-based (objective) regime must be satisfied:

Subjective Regime – the following principles must be demonstrated:

- New or significantly improved good, service or process

- An objective and realistic applicable addressable market

- Commercialisation whereby the innovation leads to the generation of economic value

- High growth potential (not SMEs serving a single local market or geographic area)

- Scalability / operating leverage where increases in revenue cost relatively little

- Ability or propensity to adapt to a national, multinational or global scale

- Competitive advantages that drive value for customers, are rare or unable to be imitated

Objective Regime - the following activities count toward a 100-point goal:

- R&D claims granted cover >50% total expenses (75 points)

- R&D claims granted cover 15-50% total expenses (50 points)

- Receiving an Accelerating Commercialisation Grant (75 points)

- Completing an eligible accelerator program (50 points)

- Third party investment of more than $50K (50 points)

- Enforceable standard patent or equivalent offshore (50 points)

- Enforceable innovation/design patent or equivalent offshore (25 points)

- Research or university commercialisation collaboration (25 points)

Eligible accelerator programs have the following characteristics:

- Time-limited support for startups

- Open, independent and competitive application-based entry process

- The accelerator entity has operated for more than six months

- The accelerator entity has graduated at least one cohort

- The accelerator entity can provide value-add support

It’s worth noting that startups need only satisfy one of the above innovation test regimes. If an early stage company can’t meet the Subjective Regime, they are still able to be classified as 'Innovative' by tallying 100 points in the Objective Regime.

Examples

To round out the article, we’ve put together some fictional case studies to illustrate how the new ESIC assessment process will function.

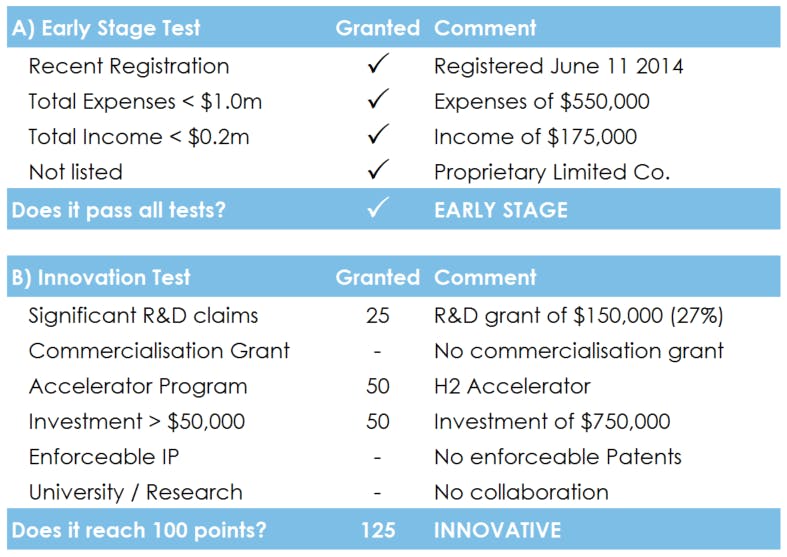

- Example 1: AltFi Online

AltFi Online is an innovative Fintech platform that is just over two years old and went through an eligible accelerator. They received a round of seed investment and have also received an R&D grant for the development of a novel platform to bring lenders and borrowers together.

In this case, AltFi would be likely to qualify as an Early Stage Innovation Company as it passes both tests. Its future investors would be able to reap the benefit from the recent tax changes.

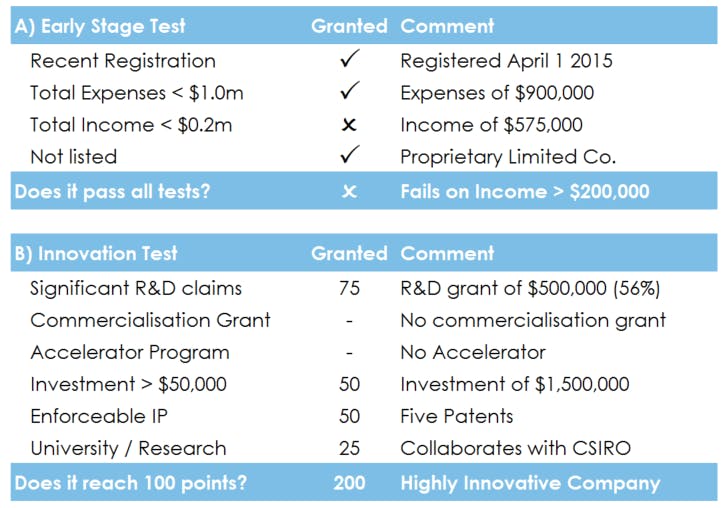

- Example 2: Seranos Biosystems

Seranos Biosystems is a company that is just over a year old who has a new medical diagnostics test with some strong early sales. They have worked on the technology with the CSIRO and have several patents, which has allowed them to attract a substantial investment from a MedTech Fund.

In this case, Seranos would be likely to not qualify as an Early Stage Innovation Company. The reason for this is that although it passes the Objective regime Innovation test, it does not also pass the Early Stage test. The level of taxable income Seranos has generated in the last financial year indicates that it is not in the early stage space targeted by that the recent tax changes.

That’s it from the us on the implications of the new tax rules for startups. In the next blog post we’ll walk through the key impacts and details of the tax changes for investors interested in funding innovate early stage companies.

The above is based upon the views of Equitise and does not represent formal tax advice.