Xinja is one of Australia's first neobanks, being 100% digital and designed for mobile. As a challenger bank, it's disrupting traditional banking with its customer-first mentality, helping people bank better through AI. The team regularly engaged with the Xinja community, welcoming feedback and ideas, and as result, has already built a loyal customer base of 23,000 subscribers.

As Xinja is building a bank for its customers, the company was drawn to the idea of building it with its customers. After the overwhelming response from their first equity crowdfund in 2018, Xinja came back for a second equity crowdfund. The first kicked off in January 2018 and was the first retail equity crowdfund in Australia after the legislation changed in 2017. The amount raised was $2,409,000 from 1,222 investors - a record which would not be beaten until its 2019 raise.

Before the launch of the second equity crowdfund, Xinja received great news – the Australian Prudential Regulation Authority (APRA) had granted the company a restricted banking license. This was a huge step forward for the neobank which hopes to gain the full banking license later in 2019.

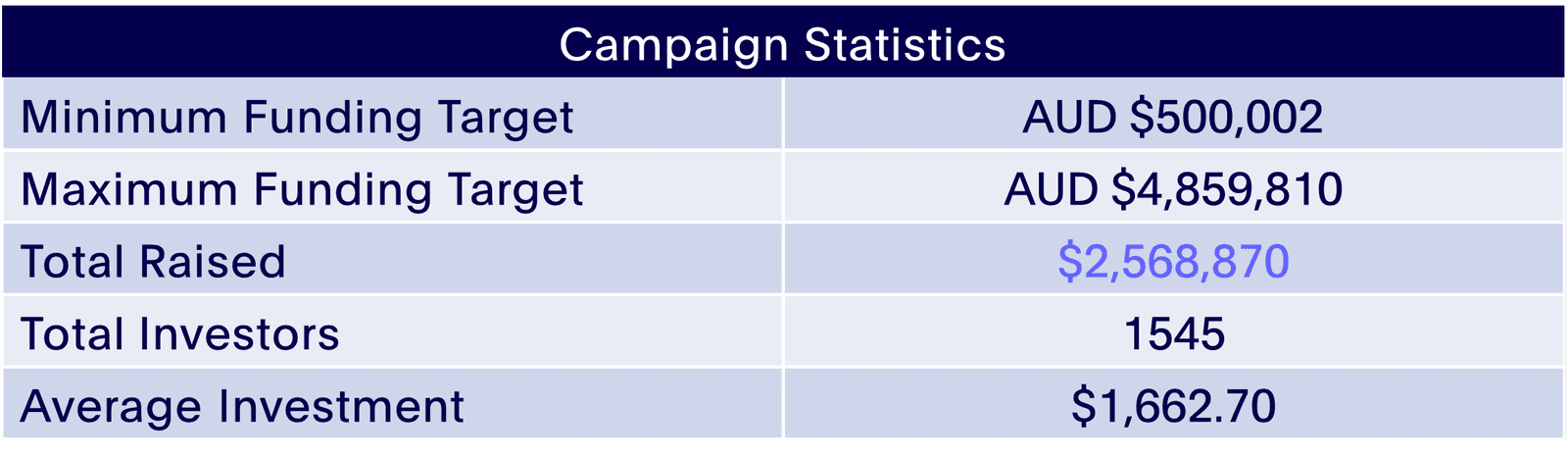

Almost to the day a year later, Xinja and Equitise launched the second equity crowdfund. The minimum investment target ($500,000) was hit in under 9 hours with $1,000,000 being raised within 3 days. Whilst many investments were from first-time investors, 223 investors from the 2018 crowdfund bought additional shares, investing, on average, 72% more than they did in the first round.

Following on the hype from their first equity crowdfund, Xinja was featured in many publications including The Australian, Sydney Morning Herald and Smart Company. Over 300 people attended the Xinja webinar with CEO Eric Wilson who covered a presentation on the business model followed by a Q&A.

The offer successfully closed after a 40-day campaign, raising a total of $2,568,870 from 1545 investors - a new Australian record. We were overwhelmed once again by the support from the 'crowd' to back something they care about. Xinja is a perfect example of a company which is disrupting the status quo, building a bank for the people, with the people, and equity crowdfunding allows investors to be a part of that journey!