Plastiq is a revolutionary consumer cashback provider that leverages the monetary value of transactional data to reward consumers. Members automatically receive cashback to their Plastiq account on their online and in-store purchases at participating merchants, without the need for merchant integration, loyalty cards or receipts. With a world-class team, including Shark Tank’s Andrew Banks, Plastiq’s proprietary technology platform has streamlined the cashback experience for businesses and consumers, facilitating a mutually beneficial relationship for all involved.

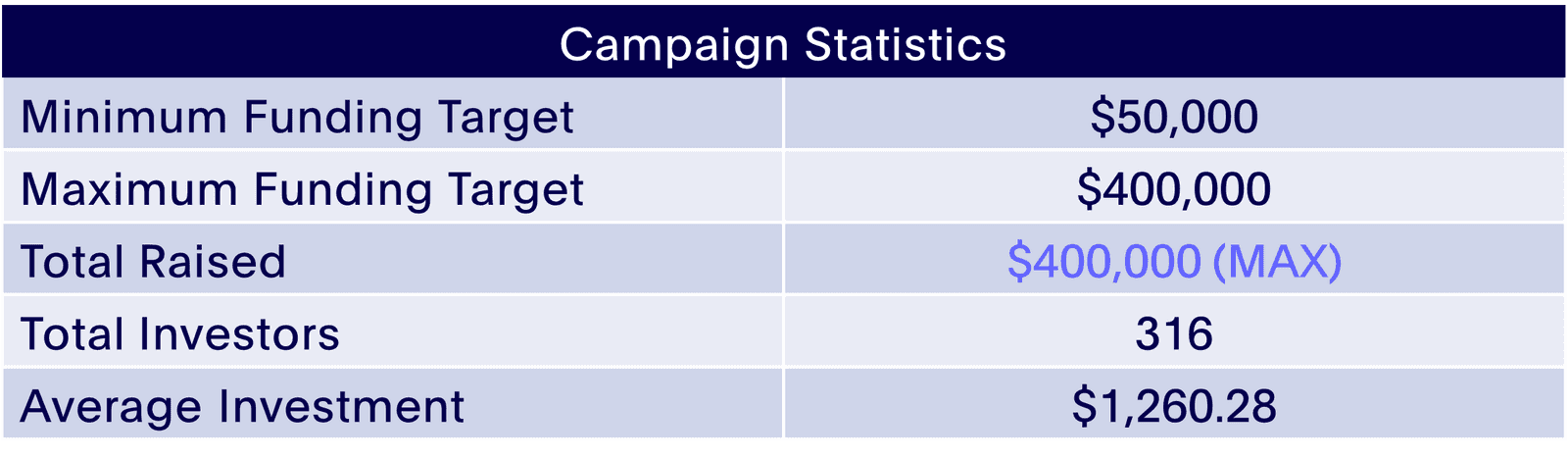

Minimum Funding Target: $50,000

Maximum Funding Target: $400,000

Public Launch: 29 January – 19 February

Total Raised: $400,000

Average Investment: $1,260.28

Total Investors: 316

The transactional and behavioural data generated from customer interactions enables merchants to integrate superior targeting methods, increase visits and best allocated engagement across all customer types. Offline transactional data has been largely unavailable to businesses up to now, having been collected and analysed inefficiently and expensively. Now merchants can take the guesswork out of measuring attribution and maximise returns on marketing spend.

With the cashback, gift cards, loyalty rewards programs and transactional data markets having a combined global opportunity of $1 trillion, Plastiq is perfectly poised to quickly take advantage of the $275 billion local opportunity, paving the way for a quick global expansion.

Plastiq’s Early Traction

Plastiq has experienced significant early-stage traction with 500 onboarded retailers and having formed numerous key channel partnerships including Manly Warringah Sea Eagles (NRL), Raiz Invest and Class Cover with the end of the campaign seeing the addition of Bing Lee to this group.

The company officially launched the loyalty program in November 2019, quickly gaining 900 members before kicking off the equity crowdfund in mid December. Within weeks of the crowdfund going public, Plastiq had over 6,700 members – a 640% increase. In this same time, it captured as additional $97.25 million in transactional data – up from $1.75 million before launch. These results demonstrate the traction and excitement behind the company, as well as the effectiveness of the marketing campaign and press that accompanied the equity crowdfund.

The Equity Crowdfund

Equitise had over 1,200 people subscribe interest in the offer who invested $80,000 at soon at it opened, smashing the minimum funding target of $50,000. After less than two days of the offer being public, it had hit $200,000 from approximately 160 investors.

Plastiq successfully closed the offer when it hit the maximum funding target $400,000, from 316 savvy investors. The deal reached a staggering 800% of its minimum target with 25 days to go, becoming our second offer to close early after Rhinohide.

The offer hit the spotlight with a whole lot of media attention throughout the campaign. The company was featured in publications such as Anthill, The Australian, News.com.au, Smart Company and The Sydney Morning Herald.

There Something in the Water... Sharks

Plastiq is our 4th raise that we have done with businesses that have been backed by at least one of the 'Sharks' from channel 10s Shark Tank including SOFI Spitz, Rhinohide and Car Next Door. Like the other raises, investors were keen to get in the water with a Shark.... although this time the tables had turned, with the investors being the Sharks and Andrew Banks being the Founder.