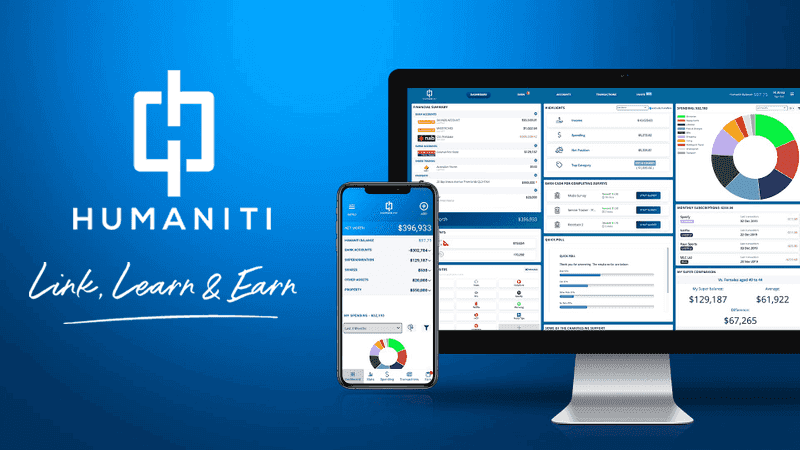

Humaniti is a next-generation technology platform connecting consumers and businesses like never before. For members, Humaniti is the first personal finance app where members can not only link key accounts to handy dashboards for help with budgeting but also earn extra cash through surveys. For businesses, Humaniti is a revolutionary data platform providing deeply insightful decision-making tools by providing a 360 degree view of a consumer based on completely de-identified, aggregated data. Humaniti is free to use for consumers, and generates revenue through its ability to provide unparalleled insights to businesses.

Having already passed its minimum funding target of $200,000, Humaniti will close successfully at the end of its campaign. Here are some of the reasons why you should consider an investment in Humaniti.

Innovative Tech Venture

Humaniti has built a next-generation consumer data platform that utilises enterprise-grade technology solutions with best-in-class privacy measures. The proprietary platform has been significantly invested in to-date, and continues to iterate and improve on an ongoing basis. It seamlessly integrates with businesses’ data analytics, while providing consumers with an easy to understand means of managing their finances. This means that it combines the ‘what’ and the ‘why’ of consumer data, marrying a range of industries that together represent a market opportunity of over $80 billion worldwide. This market continues to expand as businesses, both small and large, realise the importance of insightful data to help inform key decision making.

Four Examples of Humaniti Can Change the Data Game

Humaniti provides a large range of potential applications for its business clients that have previously been highly inaccessible. By leveraging its proprietary technology, the company is able to make a genuine difference for its clients in improving their decision making by combining the ‘what’ with the ‘why’. In a recent webinar (which you can view here), CEO Ben Dixon explained some of the unique ways Humaniti can be used:

- More accurate reporting: In a recent survey it was found that people under-report what they spend on groceries by 29% and over-report their spend on fast food by 37%. If you were to therefore rely on qualitative data alone, marketers would be acting on inaccurate information which is why it's so beneficial that Humaniti actually taps into transactional data.

- Measuring above-the-line marketing: Humaniti can help marketers understand the effects of initiatives such as sponsorships which in the past have been hard to measure. For instance, KFC sponsored the Big Bash and Humaniti identified through surveys and transactional data that the group who watched the Big Bash had a 35% uplift in spend on KFC during that time period. This demonstrated to KFC that their marketing was effective, particularly when they could also compare it to the spend on their competitors.

- Targeting trigger behaviours. If someone switches from UberEats to Deliveroo, Humaniti can trigger a survey within 48 hours to understand why the consumer might have shifted, resulting in more accurate insights.

- Understanding category shifts: Humaniti gives insight into how much market share a company has compared to competitors and can trace what happens to that category over time, such as what happened during COVID.

Linked To Over 240 Institutions

The Humaniti platform links to over 240 financial institutions including banks, superannuation funds, share trading platforms and more. This means that members can easily link their key accounts, securely, to the Humaniti platform, allowing them to sort and track transactions to provide insights into spending patterns.

Rapid Membership Growth

Humaniti already has over 10,000 happy customers, with this number growing every day, supported by Australia’s largest media partners. With the proceeds of this equity crowdfunding campaign, the company plans to ramp up its marketing efforts to quickly scale its user levels.

Transactions Categorised At Scale

At the start of its campaign, the platform had already captured and organised over 16 million transactions ($5.6 billion) across more than 2,000 merchants. That number continues to grow every day, supported by Humaniti’s media partners and high level of service and functionality.

Raised $4.981m Over 3 Years

The company has successfully raised a substantial level of capital in recent years, with investors including Founders, VC Firms, Media Agencies, HNWs, CEOs and Business Owners. This investment opportunity is on the same terms as existing shareholders. Humaniti is now going down the path of equity crowdfunding to ramp up its marketing efforts and build wider exposure and awareness for the platform. In addition to the above, the company has successfully raised over $300,000 so far in its campaign with Equitise.

Major Media Partners

Significant equity investment by ScaleUp Media Fund (News Corp, Network Ten, Nova, Foxtel, REA Group) will drive Humaniti's brand awareness and member acquisition over the next 2 years. The company will be able to access unique media opportunities through its investment partners to boost its awareness and rapid customer acquisition intentions.

Community Impact

Humaniti gets its name because it benefits its members, clients and the wider community. It provides its users with access to optional surveys for real monetary rewards, rather than credit or tokens. The company also purifies 4 litres of water through UNICEF every time a Humanitirian responds to a poll. It also adds a further 10% to everything its members earn from surveys and donates that to charity. Humaniti is a member of Pledge 1%, and also gives members the option to donate some or all of the money they earn from surveys to a charity of their choice.

If you want to know more, download the offer document or watch our webinar with CEO Ben Dixon.

These are just a few of the reasons why our fundraising team selected Humaniti for the Equitise platform. When investing, be sure to consider the information provided in the deal room and offer document, as well as the risk warning. If you have questions, you can ask the company directly through the Q&A functionality. Remember to invest early so you don’t miss out! You can view the offer here.