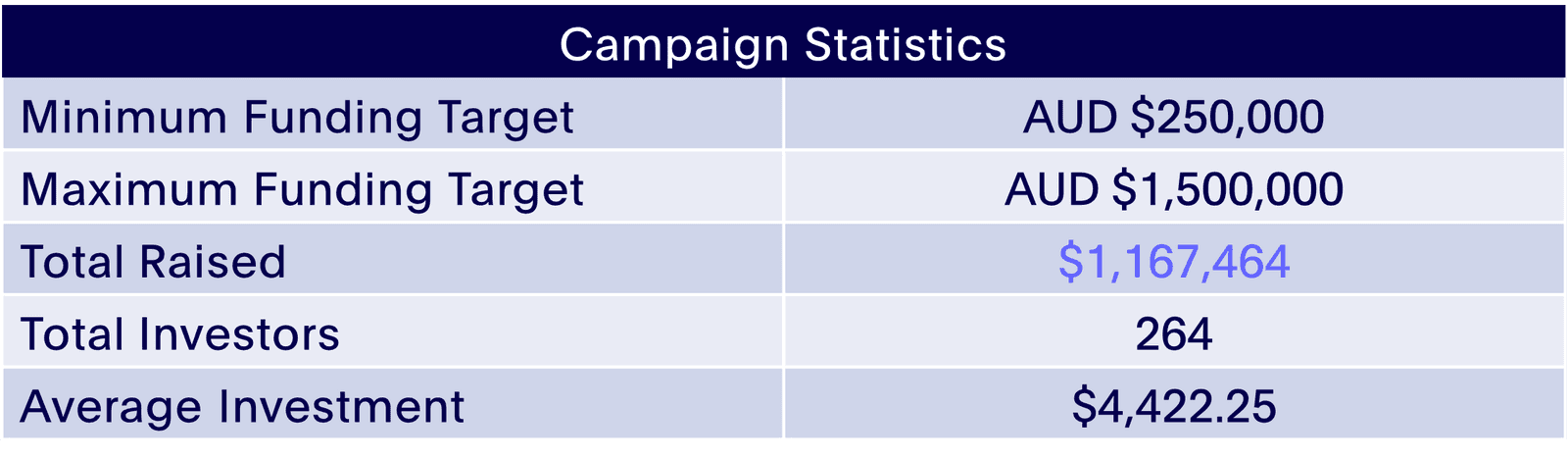

In our last equity crowdfund of 2020, Lumiant finished the year in a strong fashion, raising A$1,167,474 in just over one month. 264 investors joined Lumiant in its mission to transform the financial advice industry, investing an average of $4,422.25 - more than 3x the overall average investment. With over 4x the minimum target raised, Lumiant is well-positioned to execute its go-to-market strategy and scale.

Keys to Success

As a B2B company that was just launching its product, Lumiant didn’t have the database to draw on for initial marketing. The team worked hard to first create brand awareness on personal and company social media accounts before educating the target market about the upcoming equity crowdfund. They also had lots of great contacts within the industry, harnessing potential clients who understand the need for disruption, and previous investors.

Together with Equitise, the company also achieved great press including the AFR which looked at how Lumiant can help improve the current state of the financial advice industry, as well as Australian Fintech and industry press.

Our database was also really drawn to the offer owing to its tech nature. The strong pipeline of potential clients that Lumiant had already secured acted as validation for the solution. Investors could understand the clear opportunity that Lumiant was targeting and readily backed the disruptor on its mission to improve financial outcomes.

What is Lumiant?

Lumiant is a holistic and interactive client experience SaaS solution, transforming the traditional financial advice process and driving better outcomes for advisers and their clients.

The Lumiant platform is being developed to fill this gap; to enable a novel and unique combination of psychographic data and granular financial data to perform multi-goal, multi-scenario analyses and to drive the optimisation and accurate calculation of data-driven financial advice.

Lumiant’s ‘Life Centred Advice’ process and sophisticated software-as-a-service (SaaS) platform combine to exceed the regulatory standards, drive consumer loyalty and advocacy and increase profitability, whilst delivering a meaningful, personalised experience to the end client - one they will truly value.

Why We Liked the Company

An industry disruptor

Lumiant’s business model really aligned with why Equitise was founded; to disrupt outdated industries. Without much technological advancement in the last few decades, Lumiant’s technology helps the Financial Advice industry serve more clients and serve them better by putting their goals and financial wellbeing at the forefront of decision making. Recent changes to legislation have made this sort of technology even more important. This has huge growth potential in an industry worth $4.6 billion in Australia alone.

Significant client traction

Despite being in a pre-launch phase, Lumiant had already secured and validated significant interest in the platform. Of a total market size of 22,893 Australian financial advisors, Lumiant had already signed letters of intent with groups representing 1,500 advisors, or 6.5% of the market. The founding team and core shareholders are also aligned with 4,250 licensed financial planners, underpinning a rapid and effective pathway to market.

Highly scalable technology

The Lumiant SAAS/Cloud-based platform allows for global expansion and a high degree of scalability. Further growth potential can be realised through integration into Salesforce Enterprise Solutions through related partner businesses. As a result, we were able to see the growth potential of the platform, providing easy access to global markets and creating a more attractive target for acquisition from larger, foreign players.

Experienced and relevant team

The Lumiant Board and Executive team have a proven track record of commercial success across the wealth industry, and in the design and delivery of digital products and services for both local and global brands. The team have separately built proven disruption models over their careers. Their direct connections to a large network of financial advisors further increase the suitability of the team to the venture and present potential business opportunities from day one.

With its raise complete, Lumiant is ready to hit the ground running and begin improving outcomes in the financial advice industry. We’re excited to see where 2021 takes them!