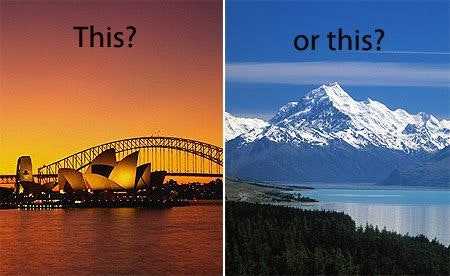

New Zealand is a hidden gem when it comes to the relative opportunity for early stage businesses to receive investment when compared to the much larger (and one would assume much more efficient...?) Australian angel and early stage venture capital (VC) market.

In 2013 the New Zealand Angel Network invested $53.2 million into locally based "young companies", which was a record high for the industry and an 80% increase on the $29.9 million invested in 2012 (this is compared to a circa 20% increase in the Australian market). The Chair of the Angel Association of New Zealand Marcel van den Assum recently stated "The Substantial increase in investment last year shows the enthusiasm angels have for supporting entrepreneurial endeavour and the economic value it generates".

What gets interesting is when you compare this to the Australian early stage VC market which had circa $150.0 million invested over the same period. This may seem like a vast difference (and to be fair it is pretty material), however when compared to the local GDP figures, it becomes obvious that New Zealand is leading the way with early stage investment, which bagged approximately 3 times more investment than Australia for every dollar of relative GDP in 2013.

Some interesting statistics on early stage angel investing in the New Zealand market:

- A whopping 55% occurred in Auckland and just 10% in Wellington

- 32% of investment was in “software and related services”, with “pharmaceuticals, biotechnology and life sciences” coming in second at 19%

- The average deal size was $497,486 in 2013, up from $298,968 in 2012

- Of the $53.2 million invested in 2013, 80% ($42.8 million) was follow-on investment and 20% ($10.5 million) was new investments

- 51% of shares issued were ordinary shares, 22% were preference shares and 26% were convertible notes

Equitise is excited to be working with some of New Zealand's leading Angel groups, accelerators and early stage VC business to collaborate and contribute to further improving the local investment landscape for early stage businesses.

We are grateful for the use of the insightful statistics provided by the New Zealand Venture Investment Fund and The Angel Association New Zealand.