Sam Wood (Equitise Investment Associate) breaks down the recent shifts seen in online and in-store grocery, and what investors should look for in 2023 and beyond.

Market Overview

As with many number of things, the last couple of years have brought a permanent change in the way in which we purchase our groceries - the most obvious being the broad-based shift online, which was significantly amplified due to COVID:

- In the US, online grocery sales reached USD $9.3b in March 2021, up 43% compared to March 2020

- The percentage of grocery sales made online was slightly under 4% in December 2019, by the end of 2022 it was in the low teens, and it is anticipated to reach ~25% by 2030

- As of September 2022, nearly 60% of US consumers buying groceries online had started doing so in the last 2 years

At the same time, we’re seeing an increase in the level of focus that consumers are placing on the food they eat. In the US, organic fruit and vegetable sales surpassed USD $21b in 2021, 4.5% higher than in 2020.

This could indicate that there is an opportunity for grocery retailers, who operate at the intersection of these trends, to acquire customers whose purchasing habits are moving that way.

Investor Capital

Fundraising

Given its ubiquity in our daily lives, businesses in the grocery sector have had success raising capital from retail investors (via Equity Crowdfunding) who feel a sense of personal alignment with the brand and vision.

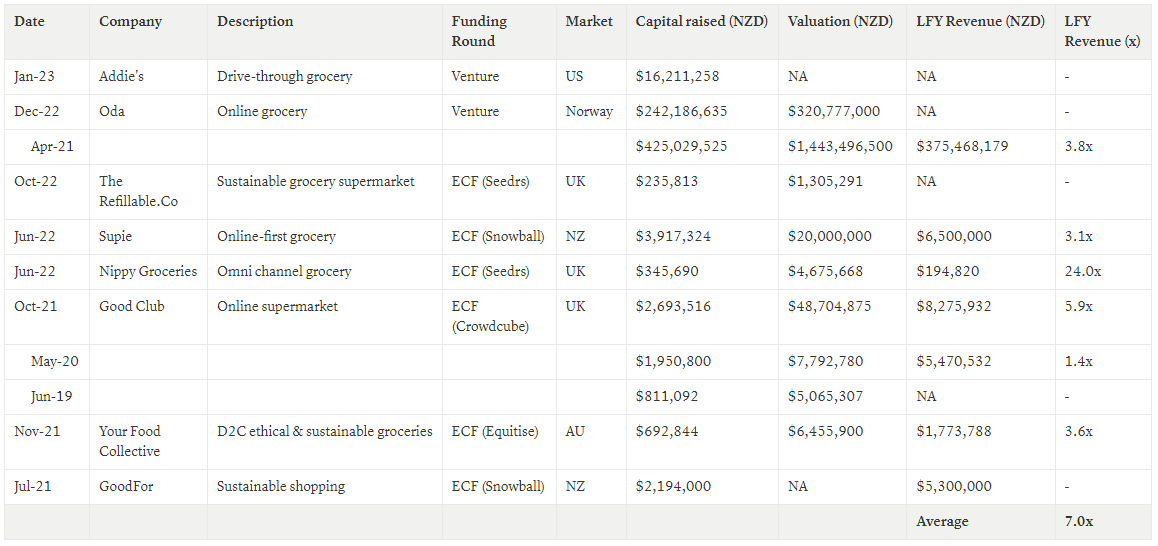

And fundraising activity has not been limited to Equity Crowdfunding. In a vote of confidence in the capacity to achieve an outsized outcome in the space, Venture Capital firms are actively participating in funding rounds, such as with the Addie’s and Oda raises referenced below:

Highlight - Supie

- NZ-based online-first grocer

- Hit $6.5m ARR by FY22

- Raised NZD $3.9m via Equity Crowdfunding platform Snowball Effect

- Topped up retail capital with investments from Icehouse Ventures, Enterprise Angels and Arc Angels

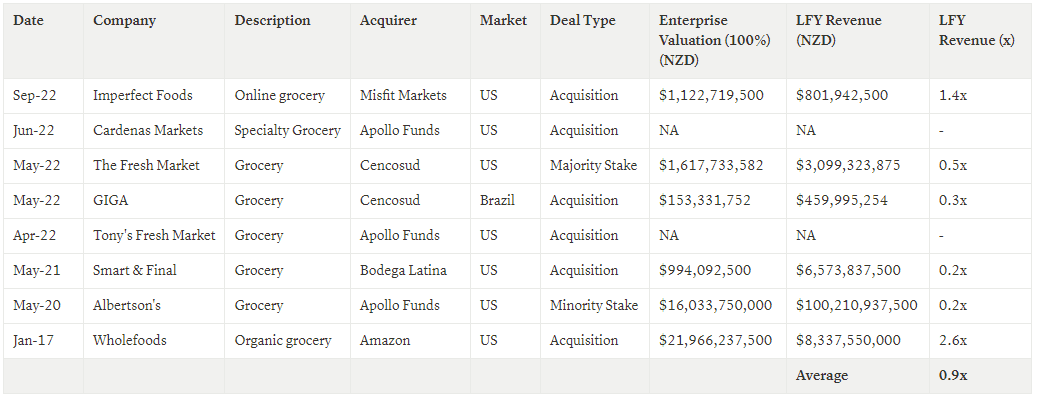

The top end of the market has seen significant and continued M&A activity. Global Private Equity giant, Apollo, has been particularly active in the traditional grocery space, while conglomerates like Amazon and Misfit Markets have acquired specialty grocery providers Wholefoods and Imperfect Foods.

Highlight - Whole Foods

- Acquired by Amazon for USD $13.7b in 2017

- $42/share, all cash transaction

- Amazon’s largest ever acquisition

What Does This Mean for Grocery Looking Forward?

The movement of a global eCommerce giant into the grocery retail space (specifically speciality, organic retail) might retrospectively be considered a harbinger of growing organic/online dynamic. There are some specific elements of both the Whole Foods deal and the broader structural shift in the sector that we think are crucial for new and existing players in the grocery market to be cognisant of:

1. Importance of an Omnichannel Footprint

Amazon’s online platform allows them to leverage their direct relationship with consumers to drive a fast feedback loop and iterative testing. At the same time, there are elements of the brick and mortar experience, like a conversation with a helpful and knowledgeable staff member, that are difficult to replicate online. Amazon’s purchase of Whole Foods gave them immediate access to hundreds of physical stores, allowing them to feed a comprehensive suite of online and offline insights into the overarching omnichannel strategy.

2. Environmental Implications of Grocery Delivery

All things equal, an increase in the amount of food being delivered direct to doorsteps could imply an increase in the number of diesel-guzzling delivery trucks on the road. Combine this with extra waste in the form of single-use plastic packaging, and we’re starting to paint a pretty negative picture from a sustainability perspective.

3. Difficulty Turning a Profit Online

The move online poses a difficult business model problem for retailers. In the US, a typical grocer makes approximately $4 on a traditional $100 grocery basket in-store. By contrast, when the grocer has to manually pick from the store and deliver to the customer, the grocer loses -$13 on that same $100 basket.

4. Keeping Pace with Consumer Technology

In 2022, Amazon began to roll out its cashierless technology across Whole Foods stores, while Woolworths Scan&Go had been introduced even earlier. As technology continues to improve and new initiatives continue to be developed that enhance the consumer retail experience, businesses that lean into these developments are likely to thrive while those who spin their wheels are likely to be left behind.

How Can You Get Involved?

In 2022, Amazon began to roll out its cashierless technology across Whole Foods stores, while Woolworths Scan&Go had been introduced even earlier. As technology continues to improve and new initiatives continue to be developed that enhance the consumer retail experience, businesses that lean into these developments are likely to thrive while those who spin their wheels are likely to be left behind.

Equitise is currently working with Huckleberry, the leading sustainable organic grocer in New Zealand. We are extremely excited by Huckleberry and the approach they’re taking to deal with the issues we noted above:

- They’re winning the Kiwi organic grocery niche with a forward-thinking, omnichannel approach

- They’ve got positive community and environmental impacts baked into their model

- Their business is underpinned by an innovative, sustainable and profitable net-zero circular delivery model

- Their tech-first platform has them set to outpace slow-moving incumbents

We’re really excited about this one, and the interest from our investors has been very strong. With over 800 expressions of interest (and counting), we’re opening this deal up for investment very soon. Register your interest at the link above to be first to hear about it.

If you have any questions, please email [email protected]