Starting with the bold assumption that most readers wear clothes, Sam Wood (Equitise Investment Associate) breaks down the key drivers of growth in the apparel industry, and what investors should look for in 2023 and beyond.

Market Overview

The global apparel industry is estimated to be as large as USD $1.7 trillion, forecast to grow at a 2.8% CAGR out to 2027. Apparel manufacturing (not even taking into account distribution, retailing, resale) is the 5th largest industry in the world by volume of people employed.

These are staggering numbers, but the logic checks out. Depending on your personal situation, you might shop at Kmart or you might shop at Gucci, but we’d be willing to bet that you do, in fact, wear clothes.

As tends to be the case, the US comprises the bulk (USD $344 billion) of the market. In Australia, we make up “only” USD $20 billion by comparison.

The largest apparel companies in the world by market cap are LVMH, Nike and Dior. It’s hardly surprising that first names that come to mind when we think of clothing are right at the top of the list - these companies have had huge success in leveraging their brand equity to generate shareholder value. But the market is huge, and there is space for challenger brands to take share.

In Food & Beverage (F&B), larger conglomerates can’t innovate and iterate as quickly as smaller, nimbler brands who are closer to their target audience. So, they leave it to the boutiques to operate at the cutting edge, and then acquire them when the time is right. Eagle-eyed investors will have noticed the explosion of craft breweries being acquired in the past couple of years, including Stone & Wood/Fermentum group (Equitise alumnus) and Camden Town Brewing (Crowdcube alumnus).

While this trend hasn’t been quite as pronounced in Apparel to date, there are parallels. Smaller brands can be nimbler and more targeted in their product development and marketing. And, as with F&B, larger companies, like JD Sports and Kathmandu, have shown a willingness to make strategic acquisitions.

In December of last year, at Equitise we wrapped up a raise for Bushbuck, a Kiwi outdoor clothing and equipment brand. Bushbuck are an example of the sort of niche business that could be a prime strategic acquisition target down the track. Via equity crowdfunding, they were able to leverage this their diehard, rusted-on customer base (45k loyalty club members and a 51% returning customer rate!) to access NZD $1m of retail capital and turbocharge their push across the ditch into Australia.

As well as strategic investors, Private Equity (PE) groups are keeping an eye on the outdoor wear sector - in May 22, Five V Capital acquired a majority stake in global adventure brand, Sea to Summit.

Investor Capital

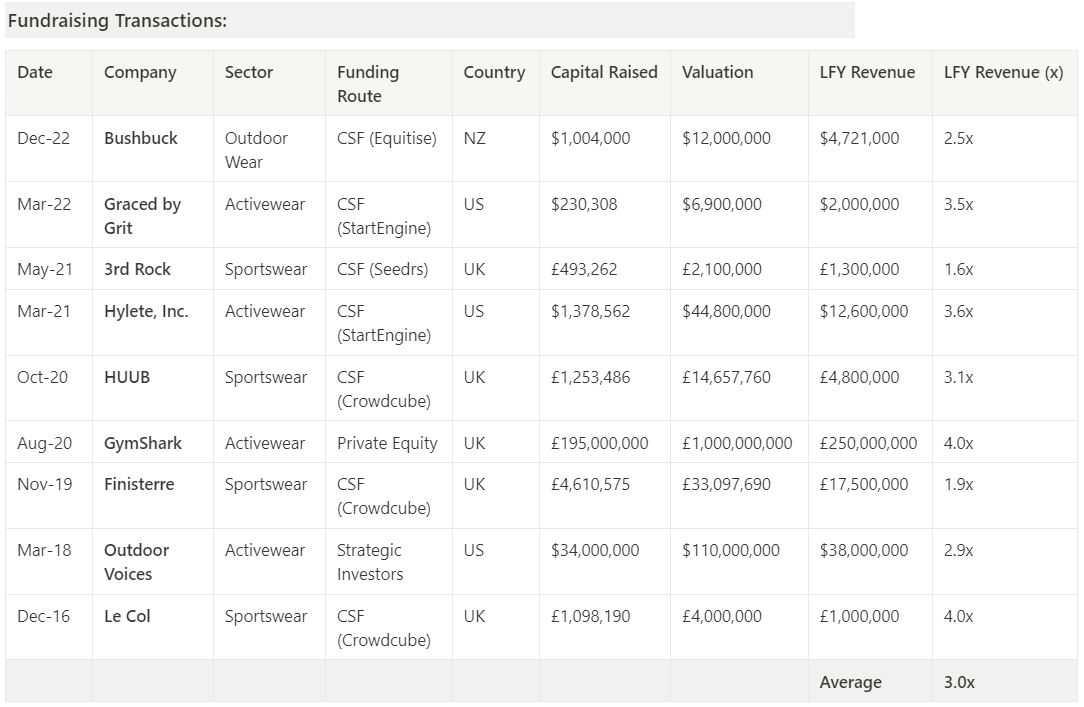

Equitise’s data, collected from publicly available information, shows that it's not just institutional investors who are keeping an eye on opportunities in the sector.

At the lower end of the market, smaller activewear and outdoor wear brands have had success accessing both retail and institutional sources of capital.

While some brands, like Gymshark in the table and example above, have secured PE or strategic investments, many choose to raise via Equity Crowdfunding, which is a strong fit for the category:

- For investors, the business models are easy to understand. They can touch and feel the product, and make their own assessment as to its quality. They may even be regular users already.

- For businesses, there is clear strategic value in a combined marketing and fundraising exercise. Not only are brands left with growth capital to execute on their vision, but in doing so they unleash an incentivised team of brand ambassadors into the community.

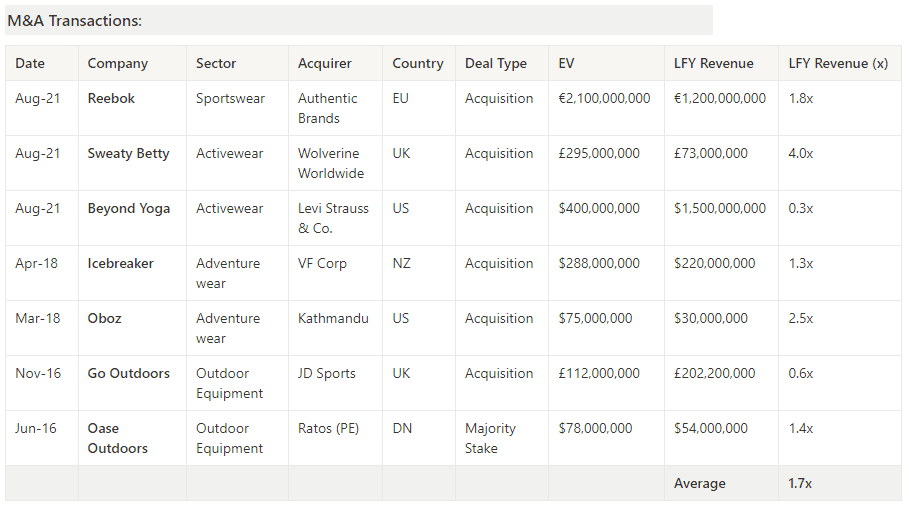

At the top end of town, strategic investors have been active in the M&A market - examples include the aforementioned acquisitions of Oboz by Kathmandu, and Go Outdoors by JD Sports.

Readers will note that valuations achieved upon exit tend to be smaller from a multiple perspective than early stage fundraises. This is because the companies being acquired are more established, and there is likely less proportional growth to be achieved - it’s easier to grow $1m by 10x than it is to grow $100m by 10x!

As always, investors should be mindful of valuation at entry. Growing consumer goods businesses is difficult, and while the barriers to entry can range from low to prohibitive depending on the category, competition is fierce and customer acquisition can be expensive. As such, investors should be conscious of the sort of growth that is being priced into a brand’s valuation.

There are so many factors at play, but a super oversimplified, back of the envelope calculation might look like this:

💡 Say Company X raises at a $5m valuation using the average revenue multiple of 3.0x from the fundraising table. This implies that they are doing about $1.7m in revenue at that point. We will assume that the multiple of revenue achieved at exit via an acquisition is the average (1.7x) figure quoted in the M&A table above. Ignoring any dividends, reinvestments, subsequent rounds, or the like, for an investor to achieve a 5x return on their money, the company needs to be sold at a $25m valuation. Our 1.7x revenue multiple implies that they are doing about $14.7m in revenue at that point. This means that in order for investors to achieve 5x their money, the business must grow revenues 9x.

Where investors can get caught out is if they aren’t careful about the valuation at which they invest.

💡 Take Company Y, for example, who is generating the same ($1.7m) revenue as Company X, but raises capital at a $10m valuation (5.9x revenue). Using the same simple metrics, for investors to achieve a 5x return, the business must be sold for $50m, implying $29.4m of revenue at a 1.7x exit multiple. In this scenario, Company Y must grow revenues by nearly 18x for customers to achieve the same return!

Being mindful of the sort of valuations at which these companies are being acquired will help investors to remain disciplined with respect to their entry point, which will help protect from downside risk and boost upside potential.

Case Studies

Apparel brands are a great example of businesses that are well suited to investments from retail investors as well as institutional.

Retail investors, as mentioned, will act as brand ambassadors. They might not be providing strategic guidance on your board, but they’re out there in the market selling your product and contributing to customer acquisition. The cost of the equity that founders are giving away is repaid, just in a different way to an institutional investor.

Institutional investors will likely take a board seat, and yes, a bigger slice of the pie. In return, however, and depending on the makeup of their team, you could get access to a high quality ex-operator in your category and their invaluable strategic advice.

In more established Equity Crowdfunding markets, there have been many examples of businesses that have had success mixing retail and institutional capital.

Finisterre, a sustainable outdoor clothing startup, mixed growth equity with repeat crowdfunds:

- Founder-led B Corp and pioneer in sustainability

- Reputation for product quality & innovation

- Raised £3.9m in 2019 via crowdfund from ~2k investors (and new customers)

- Tripled revenue, added over 200k customers, and become profitable

- Returned to Crowdcube in 2022 to raise another £4.5m, led by Active Partners (investors in Rapha, LEON, Soho House)

Le Col, an innovative cycling apparel brand, worn by cycling enthusiasts the world over, did the same:

- Completed equity crowdfund in 2016 to build community and for marketing impact, securing commitments of £1.1m from 344 investors (and new customers)

- Received a £2.35m investment from Puma Private Equity in 2018

- Received another £2.5m investment from PPE in 2019

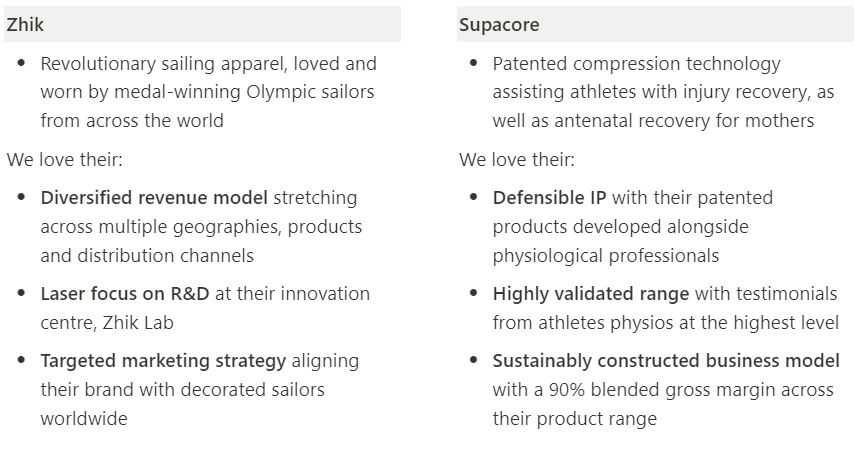

Closer to home, we’re seeing a similar trend emerge, with institutional investors increasingly comfortable investing alongside Equity Crowdfunds. In fact, Zhik, one of Equitise's live deals, is part owned by local PE shop, Nightingale Partners. The fact that professional investors like Nightingale see the strategic value that an equity crowdfund can bring to their portfolio companies is a positive sign for the industry, and should give CSF investors confidence that their interests are aligned.

2023 and Beyond

So, what do we think retail and institutional investors alike should keep an eye on? We deal with consumer brands on a daily basis at Equitise, and have noticed some consistent themes popping up. Here’s what we think you should look for:

1. Omni Channel Takes Centre Stage

The diminishing pool of companies that can make a 100% online D2C model work has been well documented. Examples do exist - businesses with a cult-like following, operating in specific niches with a highly engaged audience, can leverage their community to maintain a sustainable LTV/CAC.

On the whole, however, the tailwinds that supported a pure online D2C model (such as COVID-enforced online shopping) have eased off. Amongst other things:

- Customer acquisition (via channels like Google) has become more expensive and less effective

- Logistics have become more difficult

- The market has become saturated with homogenous products.

That’s not to say online D2C doesn’t have merit as a channel - there are clear benefits of the approach that hold true. These include:

- Fresher and more accurate customer analytics

- Faster, iterative product development

- More control over customer relationship with your brand

The solution, as always, lies somewhere in the middle. While D2C will remain a key strategy, Equitise is on the lookout for companies with an omnichannel distribution model: i.e. customers are not limited to one means by which they can access the product.

Nike is one of the world’s premier omnichannel retailers. If I decide I want a pair of Kayano 29s, I can decide whether I’d prefer to purchase them online directly from Nike, from a retailer like Rebel Sport, or in a physical store. They’ve also built the Nike app into the experience, which, amongst other things, allows customers to find and reserve items in store, but through their mobile.

Omnichannel distribution fosters a seamless, holistic relationship between a brand and its customers. Equitise is excited by businesses that understand that their distribution channels are where their customers are looking, and not the other way round.

2. Technology Driving Product Differentiation

Technology has impacted the apparel industry in a lot of the same ways as it has impacted all consumer products. While COVID may have accelerated and exaggerated the shift, the proportion of consumer expenditure occurring online was already growing, and prospective eCommerce retailers were benefiting from tech that simplified things like UX development, procurement and logistics.

For apparel, brands are leveraging improvements in manufacturing capabilities and R&D efficiencies in order to drive product innovation.

We know the fashion sector is built on creativity and artistic expression - consumers in that world are willing to pay good money for new, edgy and exciting products. In activewear and outdoor apparel there exists a similar dynamic. At the top end, professional athletes are constantly searching for an edge. At the amateur end of the market, while performance is still important, consumers are also focused on image, comfort, and the impact that what they’re wearing is having on the environment.

Monoliths like Kathmandu and Patagonia can rely upon their brand as a moat, because the love for the brand that they have grown over time transcends the functional benefit of the products. For challenger companies, it has never been more key to stay nimble and innovative, in order to differentiate their products through their IP.

3. Growth of the Athlete Ownership Model

NBA star Kobe Bryant said he hoped to be remembered more for his investment career than his basketball career. While, sadly, his career post-basketball was short, he did leave a lasting legacy in the investment world.

Kobe’s investment approach was simple but effective. He asked himself:

- Do I understand the business?

- Is it a business I can help?

- What are the barriers to entry?

- Do they have a positive, sustainable culture?

In this instance, it is #2 we’re focused on. Kobe sought only to invest in businesses where he was able to positively influence their outcome. Often, this revolved around products with an athletic aspect to their brand, for which he was able to use his platform to promote and boost sales. A notable example is the sports drink, BodyArmor (where there was a pretty successful outcome).

Influencer partnerships are nothing new, particularly in the Health & Beauty sector. However, there has been an increase in the number of athletes using their platform to access investment opportunities, and to align their personal brands with the product to add value from a promotional standpoint.

Some brands engage athlete ambassadors on a one-off basis, while others structure such arrangements on a contract basis. At Equitise, a model we are seeing more and more of is athletes having equity in the business. Athletic Ventures, led by ex-AFL player Matt deBoer, are an example of a local syndicate of athletes using their platforms to gain access to high quality deals, particularly in sectors like consumer where they can have a positive influence on the investment outcome.

By getting involved this way, not only are athlete owners incentivised to engage in a sustainable, long term promotional partnership, they are also incentivised to have input on initiatives such as New Product Development, allowing companies to experiment effectively, and bring quality innovations to market more quickly.

How Can You Participate?

So how can you get involved and put your capital to work in an extremely exciting space?

We’re so glad you asked.

Equitise has a number of exciting opportunities in the pipeline for 2023, with innovative companies that tick a lot of the boxes that we discussed above.

In early 2023, Equitise is partnering with:

The Zhik EOI campaign has just launched, and we’ll be launching the Supacore EOI campaign in the coming weeks. For those with significant interest, please feel free to reach out directly at [email protected]

We’re extremely excited about what 2023 holds and we hope you are too. Thanks for reading!