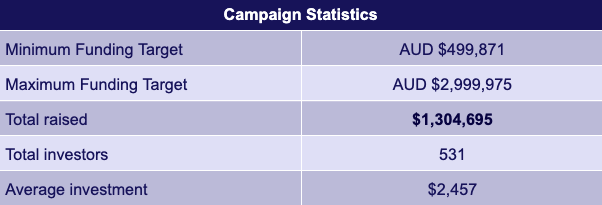

The Australian smart helmet technology company partnered with Equitise to successfully raise $1,304,695 from 531 investors.

Overview

In February 2022, the smart motorcycle helmet creator, Forcite, successfully closed a Series A round of $6m led by Uniseed. The round was supported by existing investors, and a $1.3m CSF raise through Equitise.

This raise continues Equitise’s strong track record in the D2C, e-commerce space following successful raises with TBH Skincare and Tint.

The funds from this equity crowdfund will help Forcite to focus on product development, establishing distribution channels across Europe and scale up manufacturing of their new MK1S helmet to meet a waitlist of over 13,000 customers.

What is Forcite?

Forcite has created a mass-produced smart motorcycle helmet with EU/Australian safety standard certification, patented visual alerting system, integrated camera and audio technology. Born out of the personal experience of founder Alfred Boyadgis, the team are leading the sector globally with game-changing technology delivering greater safety to riders.

Forcite has achieved strong traction having shipped almost 1,380 smart helmets in Australia, and registering interest of over 13,000 individuals. Approximately 50% of these customers are Australian, and over 21% coming from the US, which provides a massive market opportunity as the company expands production capability.

Within the global motorcycle market of USD 278 billion in 2020, consumers are rapidly opting for private mobility mode, with two-wheelers becoming a preferred choice owing to their affordability and convenience during COVID-19. Based on industry analysis, the global market is estimated to exhibit growth of 6.87% in 2022.

Key Investment Highlights

- Rapid traction and market validation

To date, Forcite has sold almost 1,380 helmets across three controlled releases, with their last release selling out in under 35 minutes. Having a unique and innovative design that addresses rider demand for quality, comfort and advanced technical ability, Forcite’s helmets have grown in popularity through word of mouth and private riding groups run by customers, establishing a strong community of loyal customers. - Strategic partnerships driving scalability, distribution and sales

Having partnered up with a leading helmet manufacturer, a Tier 1 motorcycle brand, industry experts and with Government support, Forcite has already built out the production line and quality control framework resulting in achieving a high quality product. - Clear growth roadmap across verticals

As part of the next phase of growth, Forcite is scheduled to release four new styles of helmets and their very own modular on-bike/in-bike computer vision/lidar/radar system that will communicate directly with the helmet. From developing commuter-styled motorbike helmets to racing helmets, Forcite will continue to be a competitive differentiator. - Team, advisors and investors

The Founders have 28 years of combined experience in technical design and commercializing products. They are supported by a dedicated team of software and hardware engineers along with advisors and production experts who have joined the shared vision. But more importantly, throughout the raise we saw the supportive community of motorbike enthusiasts, ready to invest and follow Forcite’s journey from the beginning. - Building a community of fans, not just customers

Forcite has built more than just a smart helmet motorcycle company, they have built a lifestyle brand that speaks to its audience. Through their community events, riding groups, social media groups they have built a core group of customers keen to transition to shareholders and co-owners.

Key Takeaway from this Raise

The raise demonstrates how institutional forms of capital work seamlessly alongside equity crowdfunds. Bringing on capital from VC/Private Equity and raising via an equity crowdfund are not mutually exclusive. In fact, more mature markets such as the UK demonstrate that these forms of capital work alongside each other regularly, serving very different purposes. As the Australian sector matures, we will continue to see more regular examples of this.