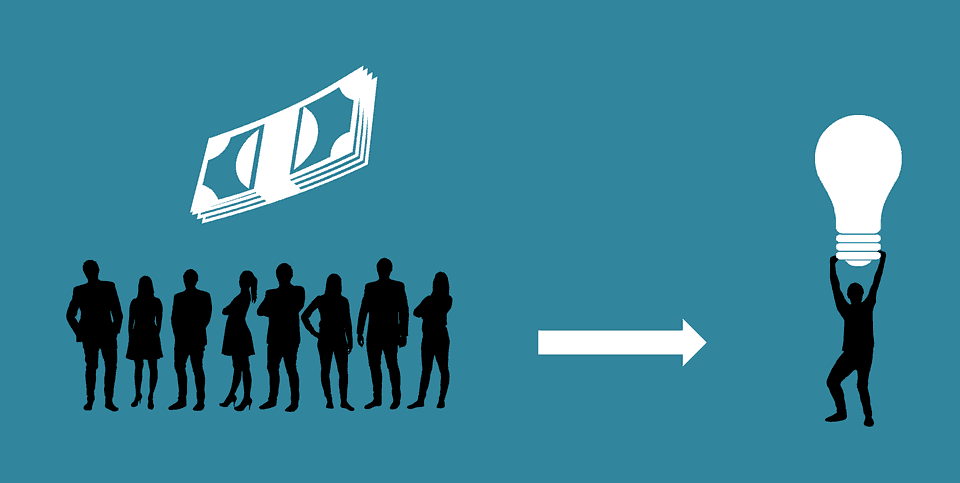

EQUITY CROWDFUNDING IS THE PROCESS WHEREBY PEOPLE, OR 'THE CROWD', CAN FUND START-UP COMPANIES AND SMALL BUSINESSES IN RETURN FOR EQUITY.

Technology has completely changed the world of financial services and equity crowdfunding is changing the way companies raise money. In the past, only high net worth investors could invest in early stage companies, but today, equity crowdfunding allows the everyday Australian to invest. Simply put, equity crowdfunding is an investment platform built for these everyday, or retail, investors.

Equity crowdfunding is a quick, safe and easy way to seek startup funding and it opens the gate to this new pool of strategic investors.

WHAT ARE THE MAIN ADVANTAGES OF EQUITY CROWDFUNDING FOR INVESTORS?

- LOW BARRIERS TO ENTRY

Equity crowdfunding requires only a small amount to be invested as a minimum. For example, a minimum investment on the equity crowdfunding platform Equitise can be as little as $50. This aspect makes equity crowdfunding suitable for new investors who want to start with small investments.

- INVEST IN AS MANY COMPANIES AS YOU WOULD LIKE

There are no limits on the number of companies in which you can invest. In this way, you can create your own diversified portfolio of small investments focusing on startups that you feel are good investment opportunities.

- INVEST IN EXCITING STARTUPS AND IN BRANDS YOU BELIEVE IN

Equity crowdfunding allows investment in early-stage companies that are in line with the investor’s passions and interests. It encourages investments that carry a specific meaning for that investor and consumers can invest in the brands they love and are loyal to. Because of this, investors become brand ambassadors with ownership of the company.

- THE COMPANIES ARE SELECTED BY THE PLATFORM

Before being able to launch an equity crowdfunding campaign, a company has to go through an approval process in order to be accepted by the crowdfunding platform. Equitise assists the companies throughout the whole process. The platforms aim to select companies that have the highest chance of success for the potential investors.

- HIGH RETURNS IF THE INVESTMENT IS SUCCESSFUL

Similar to venture capital, investing in private companies with equity crowdfunding can bring significant risk but it can also bring greater returns if the business is successful, sold or floated on the stock exchange.

- FUNDS RETURNED

Every equity crowdfunding campaign sets a minimum and maximum invested amount. If the minimum amount is not reached, the investors are refunded for their own protection.

- YOU CAN SHARE YOUR INVESTMENT ACTIVITIES WITH YOUR NETWORK

If you have made an investment you are particularly excited about, you can share it with your investors’ network. Equity crowdfunding platforms encourage the sharing of investment opportunities as it helps the startup to reach the needed funds.

- ANYONE CAN INVEST

Equity crowdfunding goes under the idea of enabling “everyday” investors access to great investment opportunities. In the case of Equitise, anyone in NZ and Australia over the age of 18 can invest in the offers of the platform.

If you are looking for a new investment opportunity or for a way to diversify your portfolio, equity crowdfunding is an option you should definitely take into consideration.