This is a complete guide to equity crowdfunding. Learn about what it is, the benefits, how to invest and more. Equitise is the leading equity crowdfunding platform giving you the opportunity to invest in Australian startups and early-stage businesses.

You’ve heard of Kickstarter? Equity crowdfunding is similar, but when you fund projects on Equitise, you get a stake in the business. It's a great way to throw your support behind amazing startups. And the best bit? You own a piece of it. This means like when you invest in listed companies on a stock exchange, you share in the company's success as a shareholder.

Equitise’s investment platform gives you the chance to become a co-owner in your favourite startups and early-stage companies - a space that was traditionally accessible only to wealthy individuals, venture capitalists and angel investors.

Acknowledging the opportunities equity crowdfunding brings to investors, companies and the economy, the Crowd-Sourced Funding (CSF) Act was passed by the Australian federal parliament in May 2017 following the lead of countries such as the UK and NZ.

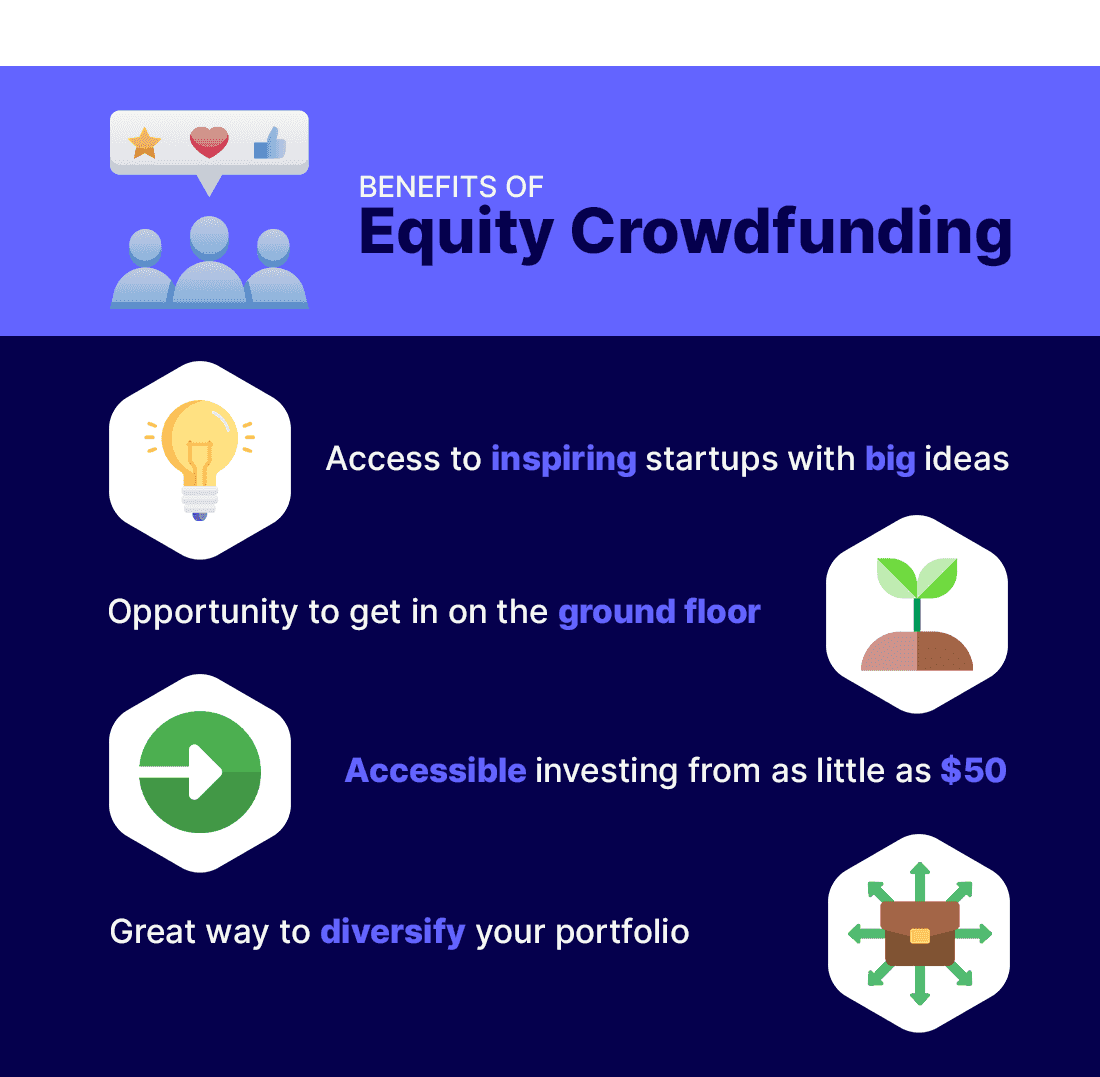

Equity crowdfunding is democratising traditional investing, making an investment in startups and early-stage businesses accessible to all, while simultaneously offering an alternative route to raising capital for these businesses looking to scale and grow. Here are some of its top benefits.

For Investors

Get behind exciting, brave and innovative start-ups

Equity crowdfunding gives you the ability to invest in exciting companies that are often challenging the status quo and bringing innovation to the industry. Investors can back companies they believe in, and as shareholders stand to profit if the company pays dividends or an exit event occurs such as listing on the ASX or NZX.

Minimal barriers to entry

Part of democratising investment is not only the access to these innovative early-stage businesses but also the low entry price. Each offer sets its own minimum investment amount however it usually starts from around $250-$500. This means, unlike other investment routes, it’s highly accessible to everyone. Without hefty transaction fees (we charge nothing to invest) or high minimum investment thresholds, equity crowdfunding provides an opportunity to start your investment journey or diversify your portfolio.

Anyone can invest

Previously reserved only for the wealthy and the highly connected, regulation changes mean that any Australian resident over 18 years can now get involved.

Diversify your portfolio

Diversification means investing in different assets in order to spread the risk. With a low minimum investment, no hidden fees or limit to the number of companies you can invest in, equity crowdfunding offers investors an easy way to diversify their holdings across industries, stages and risks. Shares in an unlisted company are often less correlated than other shares with the ups and downs of the market and whilst riskier given you’re investing in an early-stage business, you get in on the ground floor so have the potential to yield higher returns.

Due diligence

As an intermediary, there are certain due diligence checks we are legally required to undertake for each equity crowdfund. On top of that, Equitise has its own additional due diligence process which involves spending weeks to months looking at a company’s financials, team, business model, industry and future plans. Only around 5% of companies we analyse each year end up conducting campaigns on the platform as we only want to select companies we think have the brightest of futures.

Potential for high returns & maybe rewards

Like venture capital, investing in private companies through equity crowdfunding can carry greater risk, but it can also bring greater returns if it is successful and provides an exit opportunity. Getting in early means investors can potentially experience significant gains as the company grows For more information on returns, click here. In addition, many companies also offer investor rewards.

For Businesses

Access to capital

A third of startups fail due to a lack of capital with traditional options such as venture capital and bank loans often not viable. The sad truth is that many fundraisers hinge on founders being well-connected. Equity crowdfunding provides a much-needed alternative to raising capital, where the crowd, as opposed to just a few key individuals, decides to invest. This access to capital hopefully means more early-stage companies succeed, helping to improve the industry for customers through its innovation.

The creation of loyal brand advocates

When you raise capital through the crowd, you create an audience that is literally invested in the success of your business. These individuals will often spread the word, purchase your products and be a great source of feedback. With retail and wholesale investors you might also walk away with some key strategic partners. For businesses with already established customer bases, it’s a great way to reward your loyal customers as who better to invest and stand to profit from your success than those who backed you from the start.

Mass brand awareness

Equity crowdfunding is not just about raising capital, it’s also a marketing campaign helping to increase brand awareness and possibly customers through the likes of press coverage, emails and social media.

Industry and stage agnostic

At Equitise we consider ourselves industry and stage agnostic. That means we are open to all types of companies, from fintechs to gold mines, from pre-revenue to profitable. Each company is assessed on its merits, and our variety of capital-raising instruments allows us to utilise the most appropriate method for a given company.

Fair capital raising structure

Our fee structure is transparent and clear, with no hidden fees along the way. We don’t demand a slice of equity for an unreasonable price and value each company fairly and as accurately as possible.

Retail Investors

A retail investor is any Australian who is 18 years or older. You can invest as little as you want, or as much (up to the value of $10,000 per company per year in Australia).

Wholesale/Sophisticated Investors

Anyone around the world who meets their country's accredited investor requirements. For instance, to invest over $10,000 in an Australian Equity Crowdfund, you must:

- Be a professional investor with an AFSL, Investing > $500,000 or Fund Manager; OR

- Be anyone who has earned over $250,000 for the past two years or has more than $2.5 million in net assets.

These investors are able to access a wider range of opportunities with no investment limits. For more information, you can read this guide.

So how do I make money from a private company investment? Aside from the other benefits of investing in startups and early-stage businesses, we understand that visibility on how you make a return is still key.

There is uncertainty when it comes to making money from any investment in a company but even more so with ones not yet listed on the stock exchange.

This is because equity crowdfunding investments are relatively ‘illiquid’ (meaning you can't easily sell your shares in the short term) so a return can’t be made until what we call an ‘exit event’ occurs whereby you can sell your shares. However, High School economics teaches us that with greater risk comes the potential for greater returns.

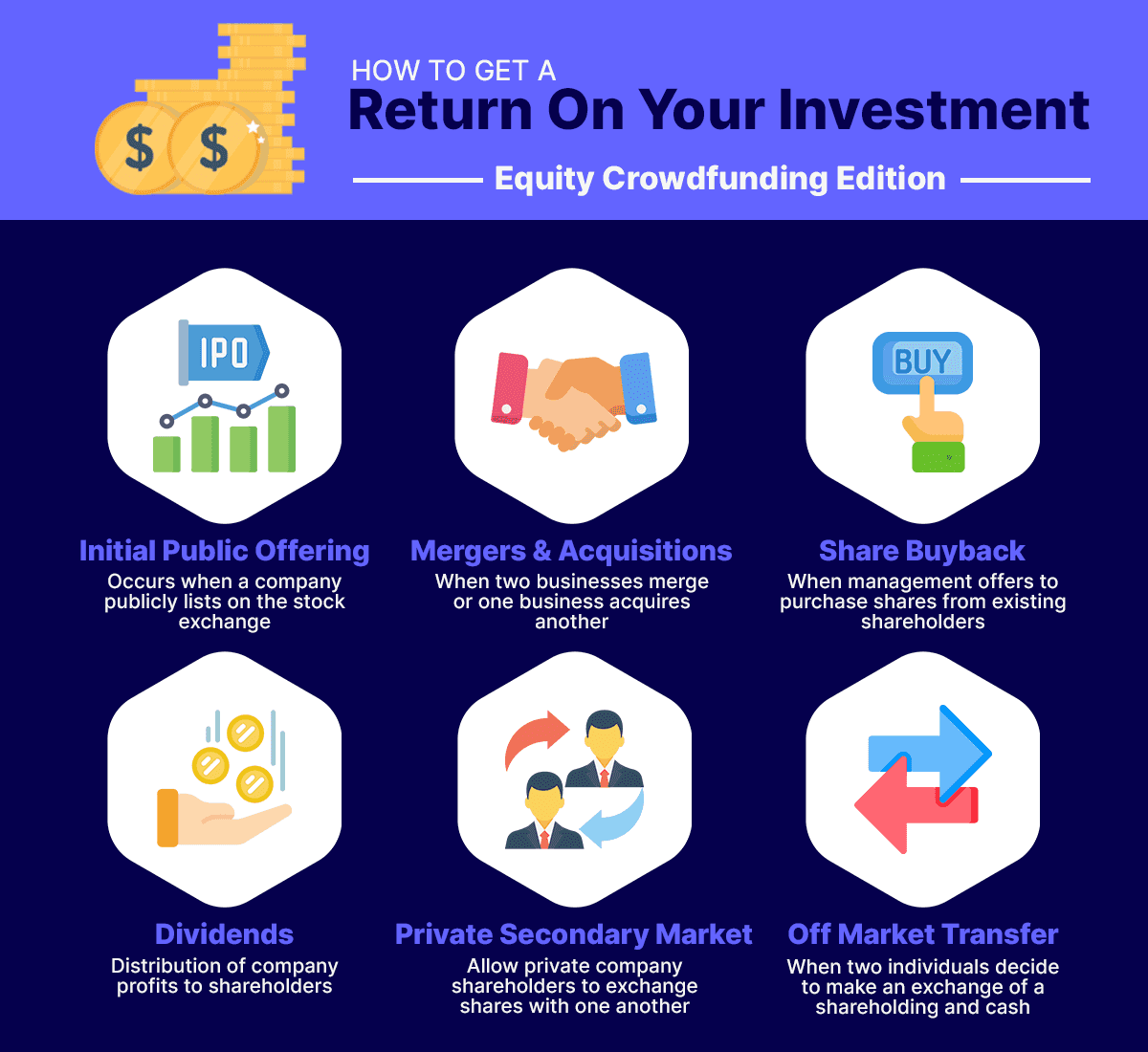

IPO

An initial public offering, or float, is one of the more common and better-known exit opportunities. Generally, once a company reaches a certain size, they may wish to raise a larger amount of capital, and provide their shareholders with a way to exit their investment. In Australia, this usually takes place through the ASX. The company offers a new set of shares to investors, and in doing so also becomes a publicly listed company on the stock exchange. This means that existing shareholders and interested parties can buy and sell their shares relatively easily, for a market-determined share price. But not all private companies want to go public, so what are the other options?

M&A

We’re sure you’ve seen this combo of letters before but what does it actually mean for you and your bank account? M&A stands for mergers and acquisitions, representing the range of business transactions that can occur between business entities, both private and public. A merger is where two businesses combine into a single entity, often so they can benefit from greater scale and work together. An acquisition is where another entity purchases a majority stake in the company and takes control. When this occurs, the impact on you can vary slightly depending on your shareholder agreement, but generally, you will have an option to sell your shares in the transaction, and usually, this is a good thing, as the company making the acquisition will have to pay a premium on the share price to complete its transaction.

Share Buyback

A company might back itself to such an extent that it wants a greater degree of exposure to its own growth. In this scenario, management would facilitate an offer to purchase shares from existing shareholders at a determined price level. This provides investors that choose to take the deal an opportunity to exit their investment.

Dividends

Distributions of company profits aren’t only limited to publicly listed companies. If a private company is profitable it may elect to return a proportion of these profits to its shareholders on a regular basis. Shareholders still maintain their holding of the company and receive dividend payments reflecting their share of company profit. Generally, this happens later in a company’s lifecycle when it no longer needs to reinvest all profits into growth.

Private Secondary Market

The ASX or NZX are examples of public secondary markets where existing shares can be traded between buyers and sellers. Private secondary markets allow private company shareholders to exchange shares with one another should they elect to exit their investment, or desire to increase their holding. Whilst this option is not available right now, we anticipate it will be soon.

Off-Market Transfer

Similar to a private secondary market but in a more manual sense, if two individuals decided to make an exchange of a shareholding and cash, they can do this privately in accordance with their relevant shareholder agreement.

The industry is heavily regulated by key government authorities to protect investors as much as possible and investing through our online platform is highly secure.

We have also put processes in place to try to create a flow of high-quality and highly-vetted companies. In saying that with early-stage businesses there is a higher degree of uncertainty and therefore risk. However, with greater risk, there’s the potential for greater return as you’re getting in on the ground floor when the share price is low. We can't always pick winners but we always pick companies we think have the brightest of futures.

Below, we break down the key components that contribute to the safe and well-regulated area of equity crowdfunding:

Regulatory Protection

The good news for investors is that the government has your back in this area. The 2017 Australian act was passed because the government were completely satisfied that the protections would ensure everyday people avoided financial harm. Our own founders, Chris and Jonny, were heavily involved in developing the protections in Australia, having already operated in the New Zealand equity crowdfunding market. These regulations include investing limits, disclosure and mandatory due diligence and require intermediaries such as Equitise to receive a variety of approvals and licences prior to operation. The industry is closely monitored by key regulatory bodies with severe penalties in place for those who flaunt the rules.

Due Diligence Process

Part of the industry’s regulations mandates we perform a number of checks and verifications as part of our due diligence process. This means we confirm the identities of all key company stakeholders such as major shareholders and directors. We check key contracts and intellectual property holdings and assess the health and validity of the business itself. These base level protections are in place to ensure the company doesn’t chuck a runner the moment they receive your money. On top of this, we hold ourselves to a higher standard of due diligence to provide our investors with what we think are the best opportunities. We comb through financials, markets, teams and more. We do all the boring stuff and only proceed with companies we think have the best chance of success. We also urge you to perform your own kind of due diligence, considering the deal room, offer document and risk warning together.

Risk Profile of Investments

Like all investments, your investment carries certain risks. For a variety of reasons, there is the potential that the company might not flourish, or even make it, which would result in the loss of part or all of your investment. Private company investments are also relatively illiquid, meaning it’s harder to exit your investment for cash compared to publicly traded stocks. This generally means a longer investment horizon, you can read more about exit opportunities here.

In short, yes, equity crowdfunding is safe. It’s a highly regulated and public-facing industry, however, there is risk involved. The benefits are that with greater risk comes the potential for greater return as you’re getting in early. It’s also a great way to support the Australian economy and innovation, investing in businesses that you believe in and that have the potential to improve the world around them.

Making your first investment is quick, easy, secure and accessible.

- If you haven’t already, sign up to our newsletter at the bottom of the page to hear of new offers that go live each month

- When you see an offer you like that isn't yet live, register your interest on the company’s landing page on our website so you get first dibs when it does open and to be kept up to date. You can view all our offers here.

- To get ready to invest, create an account with Equitise

- Under your profile section, verify your identity using your choice of identification (read why we need to do this here)

- If you’re a wholesale investor, update your investor status under your profile, download the form, and get your accountant to fill it out

- Once live, we’ll give you an email and you can head to the company’s offer page on Equitise where there’s all the investment information Then simply click invest! There are no transaction fees so it’ll only cost you what you decide to invest.

Equitise is the leading investment platform in Australia which partners with innovative early-stage businesses running equity crowdfunds as well as wholesale offers and IPOs.