An analysis of our five most recent IPO performances.

Overview

Over the past few years, Equitise has helped with five IPOs. This blog examines the performance of the five IPOs, emphasising the role of diversification in mitigating investment risks and enhancing portfolio returns, with an average 426% profit.

IPOS:

- Auric Mining (AWJ)

- LTR Pharma (LTP)

- Native Mineral Resources (NMR)

- Resource Base (RBX)

- Southern Cross Gold (SXG)

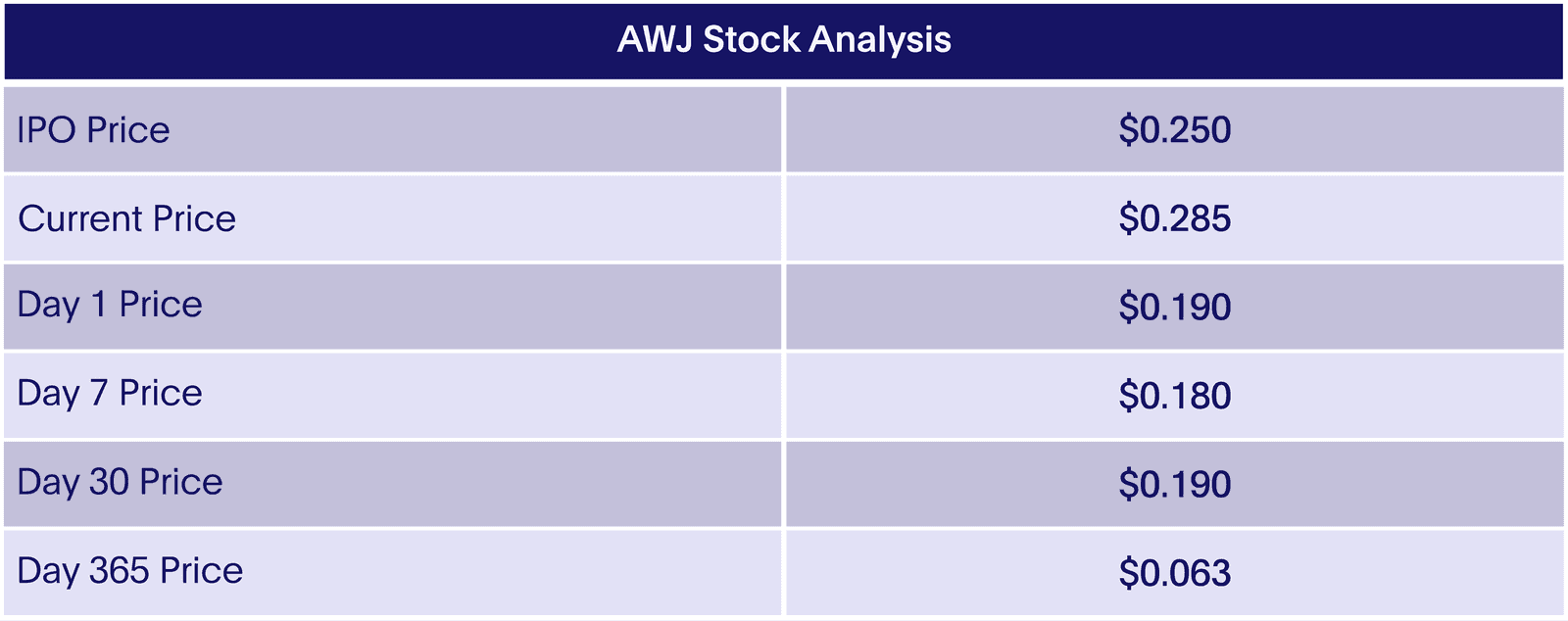

Auric Mining (AWJ)

Auric Mining’s stock initially underperformed, falling from its IPO price to as low as $0.04. Despite this downturn, the stock has recently surged to $0.285, its highest price to date. This rebound underscores the potential for recovery in the long term, but also highlights the volatility and risk inherent in investing in one single IPO, particularly mining stocks.

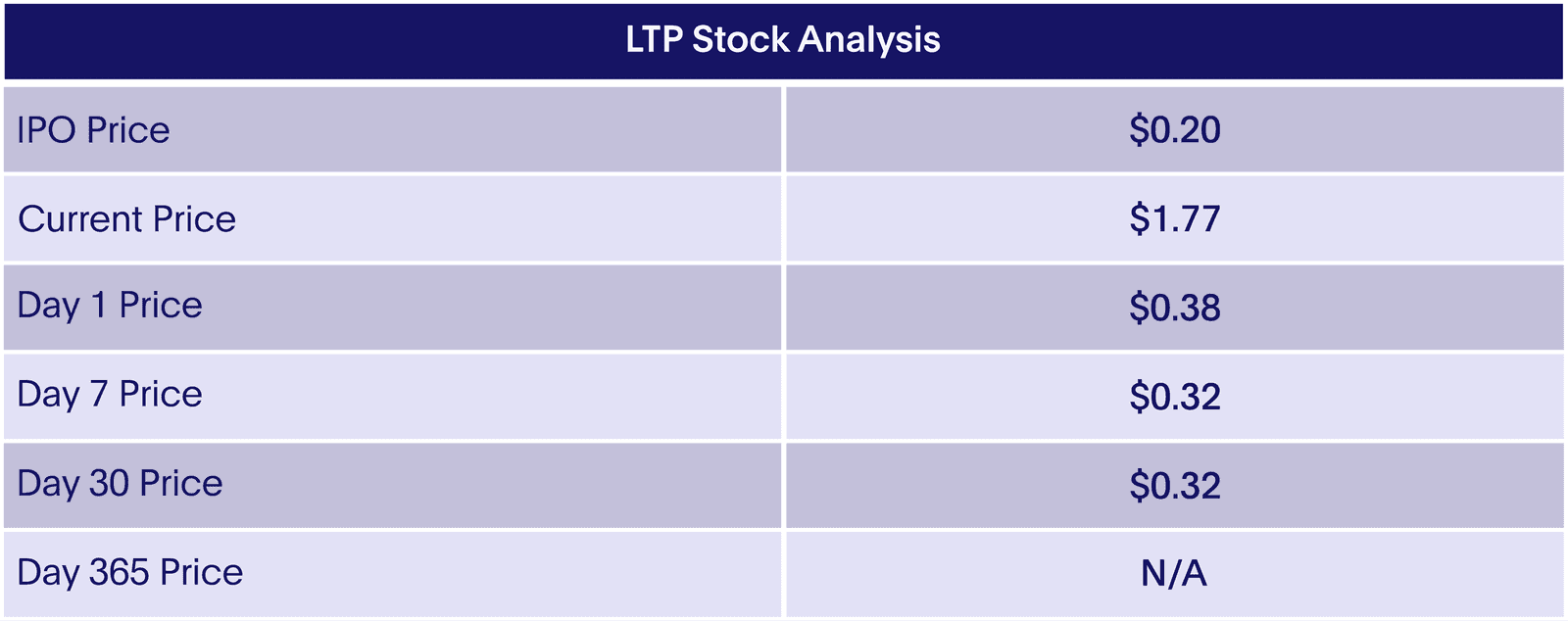

LTR Pharma (LTP)

LTR Pharma has been a standout success, with its stock price increasing dramatically from $0.20 to $1.77 in less than a year. This means that an investment of $2,000 at the IPO would now be worth approximately $15,700. This exceptional performance illustrates the potential rewards of investing in high-performing IPOs but also reminds investors of the unpredictability (and hence risk) brought by individual stocks.

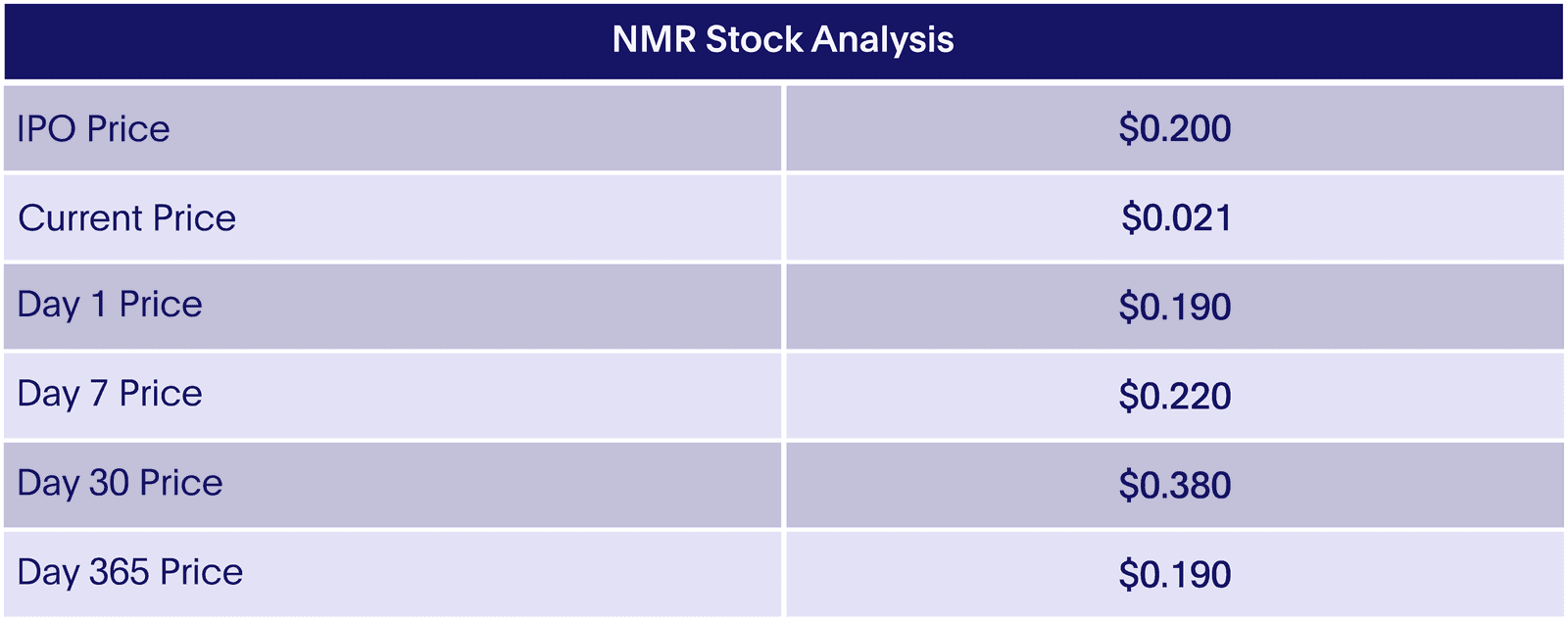

Native Mineral Resources (NMR)

NMR’s stock experienced a brief period of growth but ultimately declined significantly, falling from $0.19 on Day 1 to $0.021 currently. This emphasises the potential for severe loss, especially if you only invested in this one stock.

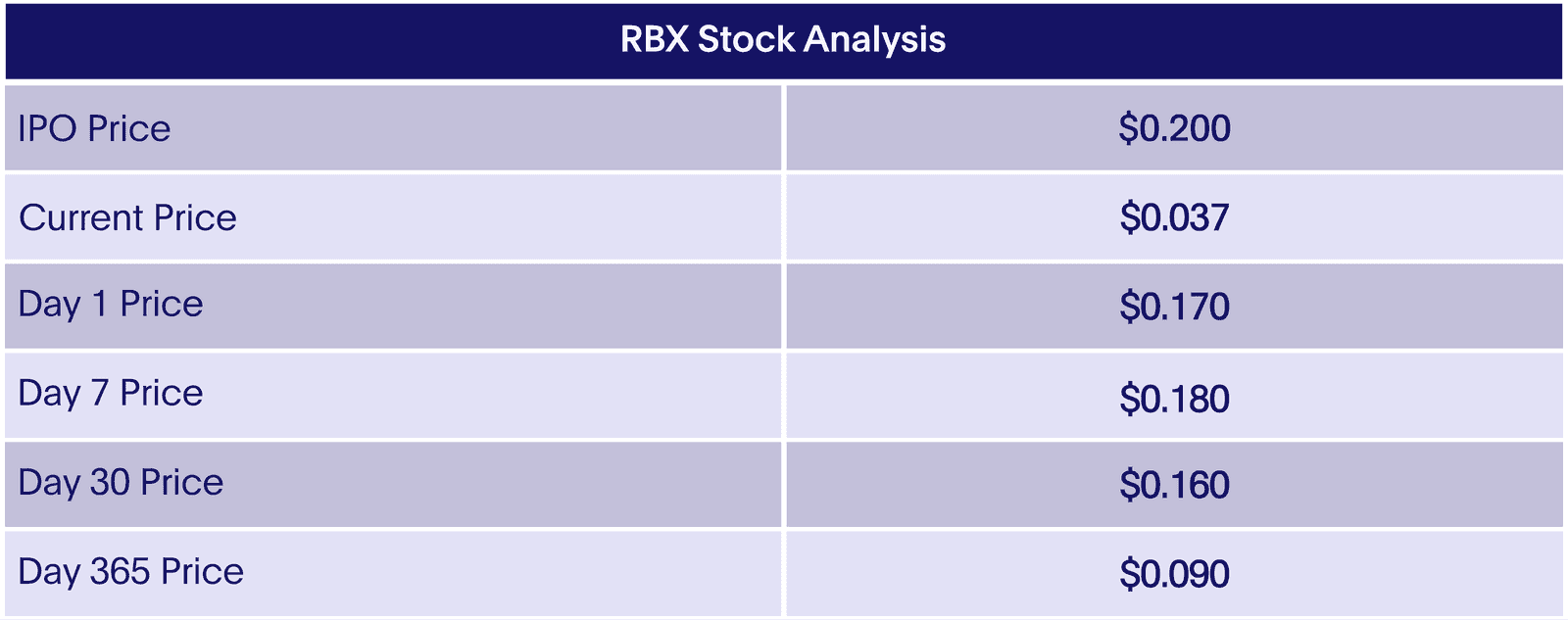

Resource Base (RBX)

RBX’s stock has also declined since its IPO price to $0.037, reflecting ongoing challenges in the mining sector. This underperformance underscores the risks associated with sector-specific investments on the performance of stocks.

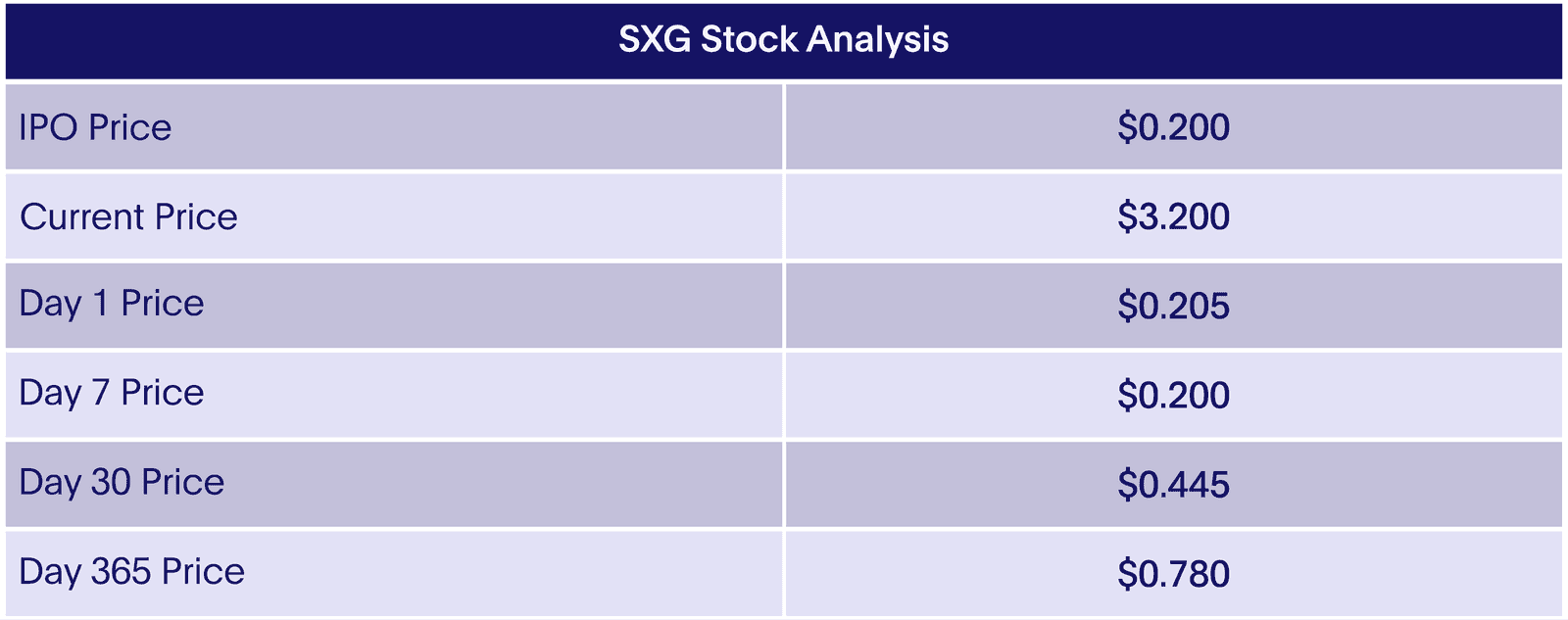

Southern Cross Gold (SXG)

SXG has demonstrated remarkable growth, with its stock price consistently rising from $0.20 to $3.20. This exceptional performance highlights the significant upside of investing in a successful IPO.

The Importance of Diversification

Diversification is an investment strategy aimed at reducing risk by allocating investments across various assets. This strategy is crucial for managing the inherent risks of IPO investment, which can be highly volatile and unpredictable, as seen from above.

By investing in a diverse portfolio of IPOs, investors can mitigate the risk associated with any single stock's underperformance. For instance:

- NMR and RBX have underperformed significantly, with their prices falling well below their IPO levels. $2000 invested in NMR equates to negative $1,790 today.

- LTP and SXG, on the other hand, have shown substantial growth, with SXG increasing by over 1,500% and LTP by 785%.

A diversified portfolio containing both high-performing and underperforming IPOs can reduce the impact of individual stock losses. Here, the gains from LTP and SXG can offset the losses from NMR and RBX, resulting in a more stable overall return.

Overall, a diversified portfolio would have benefitted from the strong performance of LTP and SXG while absorbing the losses from NMR and RBX, leading to a profitable investment outcome. With a $2,000 investment in each equating to a portfolio valued at $42,560.