In the near future Dropbox and Evernote might go toe to toe especially with Dropbox currently developing Composer. Composer allows users to share and edit files simultaneously. It can also be described as online collaborative note editing tool, pretty similar to Evernote.

The two software companies by no means should be classified as close competitors as the two vary greatly in funding obtained and company size. Dropbox employs around 1200 employees and the number is still growing. On the other hand Evernote, some might estimate, employs around 70 people.

Dropbox to date has accumulated US$1.11 billion of funding since 2007 and generated revenue between $300M-$400M in 2014, nothing short of impressive. Coming from humble beginnings of just $20K seed round in 2007, to $250M raised in 2011 and to $500M line of credit in 2014, Dropbox is surely cannot be classified as a Tech start-up. It is too big to be acquired, especially with the outstanding line of investors backing the firm (take a look below); an IPO is definitely on the to do list in the near future.

There is a big momentum behind Dropbox with no obvious explanation as to why it has such an inflated valuation multiple. In general valuation multiples could be misleading and misrepresenting the true value of a business (a topic for another post) but it could provide a benchmark where one can compare similar companies for investing purposes.

According to CB Insights, Dropbox was valued at $10B in 2013, 50x 2013 revenue of $200M (rumoured)- perhaps a bloated valuation. One of its main competitors, Box, that has similar product is valued at $2.19 billion as of 24/04/2015. (source: Yahoo Finance)

A private company with a higher valuation than a similar public company is something to think about. Box has generated $212 million of revenue in 2014 (CB Insights), and that revenue corresponds to a 10.3x valuation multiple.

As for Evernote, it has raised $203.8M of total raised funds to date (it could be higher due to undisclosed investment amounts) and a valuation of $1 billion in 2012. Also it has an 85 million user base compared to Dropbox of 300 million user base. According to Evernote, 4.5 million users are paying subscribers ($45 per user on an annual basis). However Evernote is creating a new stream of revenue through its Evernote Market which generated $4M in 2014. The total revenue for 2013 is estimated to be $206.5M.

Suffice to say it will be a hard endeavour for Evernote to compete with Dropbox at this stage. It is worth noting that Evernote is more effective in generating revenue per user than Dropbox.

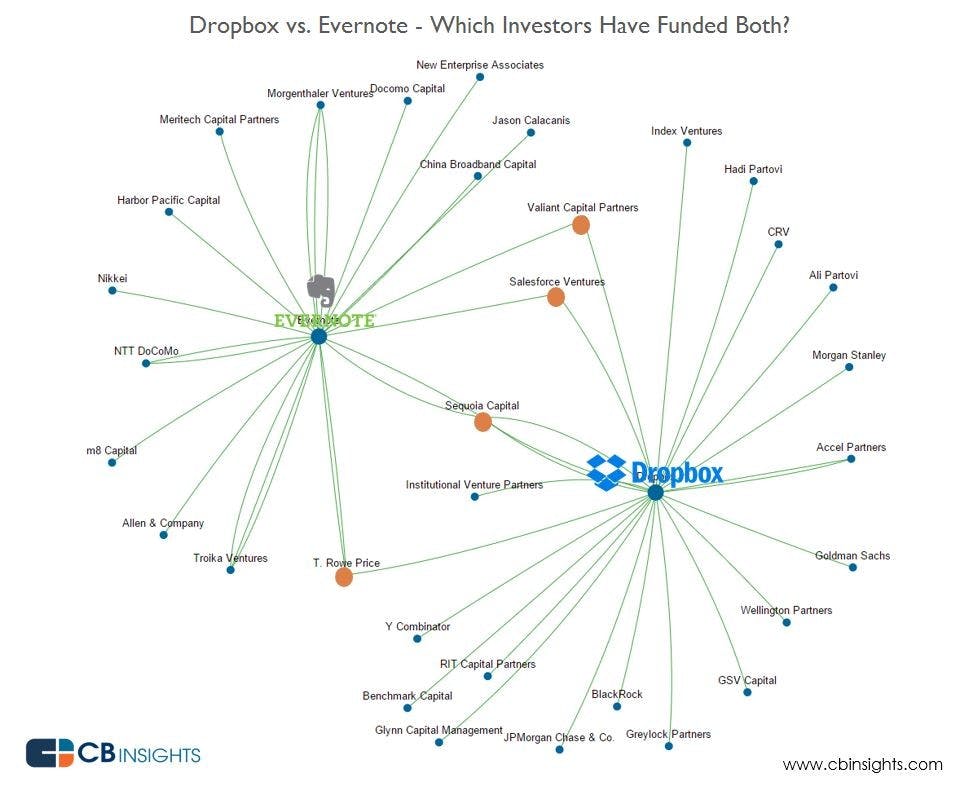

The graphic below shows the different backers that are supporting Evernote and Dropbox.

Both companies have Sequoia Capital, T. Rowe Price, Salesforce Ventures and Valiant Capital Partners as common investors.

Time will reveal what implications of having common investors could have (perhaps a merger) and what the future is storing for both companies.