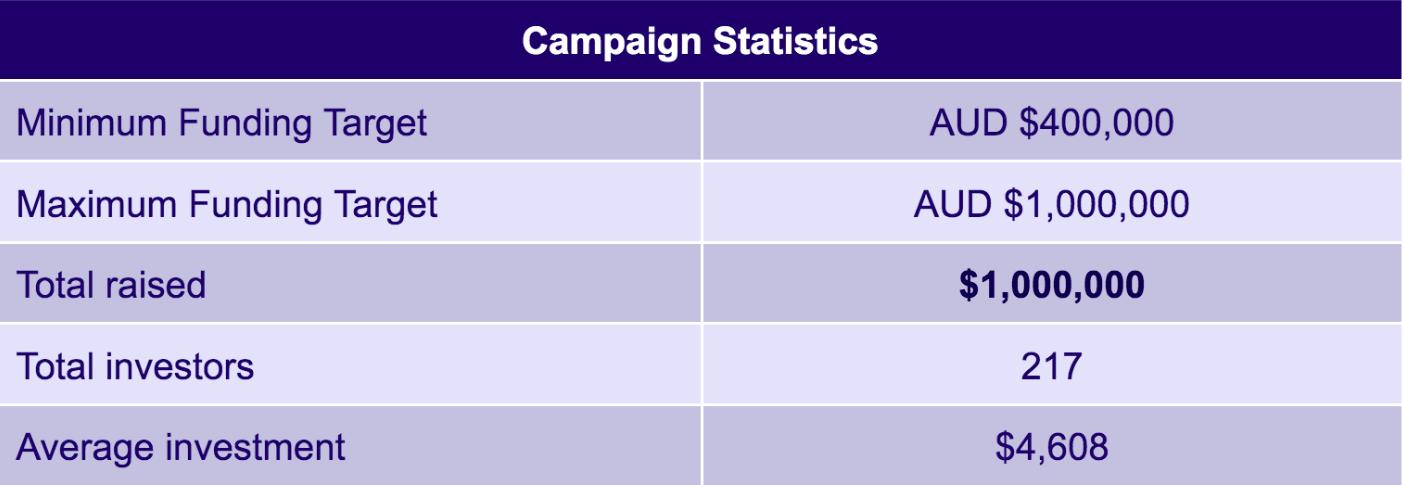

The Australian online marketplace Bundlfresh partnered with Equitise to successfully raise $1,000,000 from 217 investors. Bundlfresh aims to use the funds to expand its services across Greater Sydney, and continue on its mission to ‘make shopping local a big advantage’.

What is Bundlfresh?

As large grocery chains invested heavily into online shopping and convenience, many smaller independent, local retailers have been unable to participate meaningfully in this digital channel.

Founded in 2019, Bundlfresh is an Australian online marketplace allowing consumers to bundle produce from their favourite local stores, butchers, bakers, greengrocers, delis and more, into a single order and delivery. Currently, Bundlfresh serves 47 suburbs across the Northern Beaches of Sydney, and has plans to expand across Greater Sydney Area, and other major Australian cities over the coming years.

Why we liked the company

Unique Value Proposition

Bundlfresh has a unique value proposition for both customers and vendors: enabling local vendors to compete with big grocery chains through online sales; and allowing customers to flexibly bundle any item in a single order and delivery, saving time and money.

A Massive Underserved Market

Fresh Produce is a $50Bn market and Independent (non-supermarket retailers) have ~30% share ($15Bn). In such a massively underserved market, Bundlfresh is capitalising on the rise of online shopping, and riding off the megatrend of buying local to focus on a $2Bn market opportunity.

Strong traction and growth potential

In the past two years, Bundlfresh has grown at an annual growth rate (CAGR) of more than 300%, and is now serving 47 suburbs. Since May 2019, more than 120,000 vendor orders have been delivered to nearly 3,000 customers.

Sustainable business model

Unlike other last-mile delivery services such as Milkrun and Send, Bundlfresh has carved out its own niche with local vendors, and is able to have a clear road to profitability without suffering the intense price competition present in the industry. With strong customer satisfaction, high retention and ‘word of mouth’ referrals, Bundlfresh’s Customer Lifetime Value (CLV) currently sits at $2,825 and its online conversion rate is 18% compared to the industry average of only 3%.

Looking Ahead

In addition to launching into new regions across Sydney in the coming months, Bundlfresh is has been approached by a Tier 1 Independent Grocer seeking to be onboarded onto the platform. This will see the addition of 10,000 grocery lines allowing customers a ‘full service’ offer beyond fresh produce. With a commitment to supporting local communities and suppliers across Australia, the vendor has expressed an intention to price match Coles and Woolworths on more than 1,200 products.

Key Takeaways from this Raise

More sophisticated investors in CSF

In recent raises, and particularly in this one, we are seeing higher participation from sophisticated investors who are driving up the investment average. With Bundlfresh, we observed a very high average investment of $4.6k vs our avg across most deals of $2.8k. In 2021, 11% of investors are wholesale investors, an increase from just 7% in 2018. This is a continuous trend that we expect to keep seeing as the crowdfunding space matures in Australia.

Engagement over size

A key contributor to Bundlfresh’s successful raise is its highly engaged audience - both customers and vendors. With hardly any marketing spend to date, the company's growth to over $3m in annualised revenue has come nearly entirely from word-of-mouth referrals. With 500 of its 3,000 customers having ordered more than 15 times, the company has built a platform with sticky and passionate customers with many jumping at the opportunity to invest. Whilst many other companies we have come across have had much larger databases to which they could market the offer, Bundlfresh's was unique in its 'stickyness'. This is a key thing for companies to consider when they are considering a CSF, and drives the likelihood of converting customers into investors.