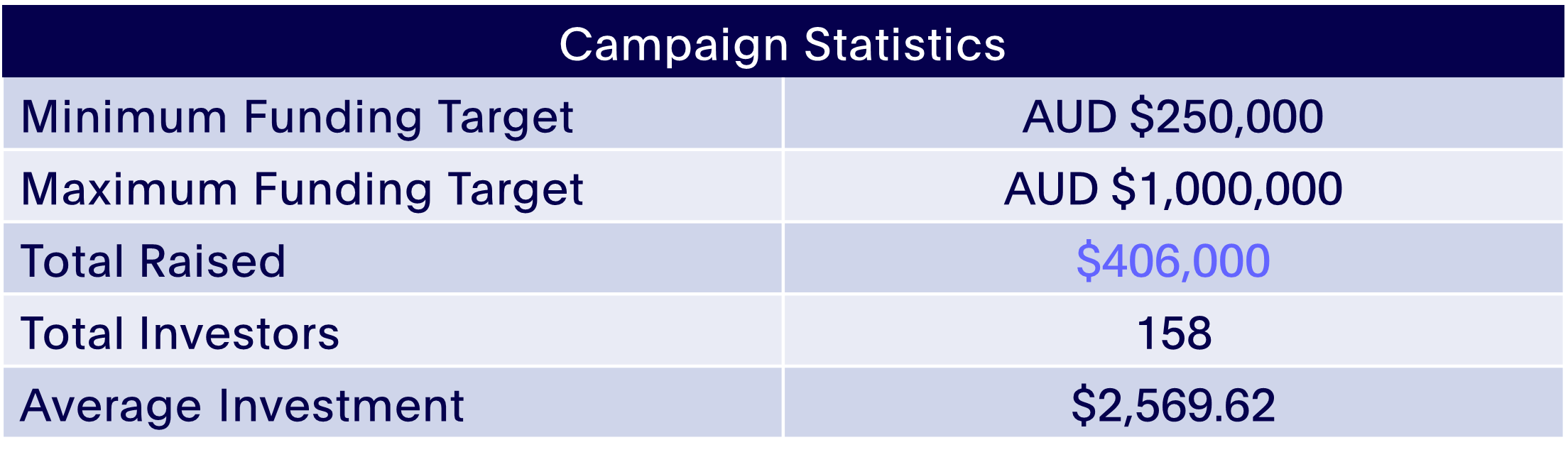

Botanic Wellness launched a very quick campaign through Equitise, with an intended IPO planned for November 2020. Despite only 18 days to complete the raise, the company smashed through its minimum target of $250,000 to raise $406,000. It plans to immediately put the funding towards a new crop plantation, in addition to preparing for an IPO on the ASX.

What differentiates Botanic Wellness from other cannabis companies is that rather than operating its own farms, Botanic Wellness established joint-ventures with existing farmers of other crops, and provides them with the expertise and seeds required to transition to cannabis farming. The two entities then share the profits, thus reducing Botanic Wellness’ exposure to risk factors and diversifying their operations. This also means the company can scale much faster than a traditional farming operation.

Our top reasons for investing in Botanic Wellness were:

- The company’s unique streaming business model allows it to keep risks low and expand fast

- The planned IPO for November provides a potential exit opportunity for investors in the raise

- Botanic Wellness was already generating strong revenues with big growth potential, including a highly scalable approach to farming

Our Key Takeaways

Investors Want Exit Opportunities

Being able to launch with clear intentions to provide an early exit opportunity through a potential November IPO presented investors with an attractive proposition to net a return shortly after investing. While some investors are happy to invest in longer-term seed round prospects, many desire to see an opportunity for a liquidity event in the near future.

The Cannabis Industry is Attractive and Exciting

Investors are getting excited about cannabis companies, and so are we. While the industry is starting to get busy, the potential for shifting regulations and big applications remain an enticing prospect. Many investors noted in our post-raise survey that they were still interested in even more cannabis investment opportunities, so we’ll keep our eyes out!

Forecasts Aren’t Everything

An interesting difference for our Botanic Wellness raise is that the company didn’t provide cash flow forecasts for the future. It did so because it didn’t want to mislead investors, given that its future projections were far too variable owing to the nature of its operations. Nonetheless, investors were still able to see the value in the company, showing that they don’t need to necessarily have numbers to understand the investment opportunity.

What is Botanic Wellness?

Botanic Wellness intends to become a leading provider of CBD hemp-based products, initially in the USA and Europe and, in the future, in Australia as laws in relation to importing, growing and consumption of CBD hemp-based products are changed and regulations are further relaxed.

The company has existing indoor and outdoor CBD hemp seed growing operations in Colorado, Arizona, and Texas, and over 500 acres of CBD hemp crops growing in Arizona and Texas in the USA and processes and sells wholesale and retail CBD products.

The company also has a seed import licence and hemp growing licences to grow hemp in NSW in Australia and will be planting its first 100 hectare Australian CBD hemp crop in early September 2020. It also has a licence to import and supply Schedule 4 and 8 drug products into Australia which can be supplied under the Special Access Scheme.

We’re excited to see what happens with Botanic Wellness over the next few months, including its intended IPO!

Quote from Cary Stynes, Chairman at Botanic Wellness

"Botanic Wellness conducted a capital raising in September 2020 in the midst of the COVID-19 pandemic. Despite this, and the fact that the offer was only open for less than 2 weeks, we raised over $400k from a group of investors who see as much potential in the CBD hemp sector as we do. With a legal and financial background, and having conducted numerous capital raisings, large and small, for public and private companies over 25 years, I was extremely impressed with the level of crowdfunding experience and knowledge that the Equities team had. They are extremely passionate about what they do and are very much driven to get the best outcome for the companies and investors that they take on. We would be delighted to work with the Equitise team again in the future and look forward to Equitise being involved in the Company’s upcoming ASX listing.''