P2P Lending in Australia

Morgan Stanley recently published a blue paper titled Global marketplace lending: Disruptive innovation in financials where it highlighted the impressive growth in the peer-to-peer lending (P2P) in Australia. Our reaction can be hardly expressed as surprised. We have highlighted in a previous article the momentum that this industry has been experiencing globally.

It is estimated that the value of loans will reach $22 billion in 2020 with consumer lending amounting to $10.4 billion. The total consumer lending market in Australia is approximately $173.33 billion. It would not be an exaggeration if the estimation is perhaps humble and P2P could compromise more than 6% in 5 years. What is holding back the industry, perhaps, not the quality of service or other competitive products but the lack of a wide spread awareness of such technology.

The report also estimated that the growth rate for P2P lending to SMEs would be slightly higher than that of consumer lending. The white paper that we, Equitise, have recently published, Alternative Finance in Australia, pointed out that SMEs are not receiving the necessary finances to grow and establish their businesses. Equity crowdfunding and P2P lending are to fulfil that gap.

SocietyOne, the Australian P2P lender, has recently reported that it had received loan demand of $100 million, and have loan balances around $25 million. Carsales.com.au and Stratton Finance bought 20 per cent stake in RateSetter Australia. MYOB took 30% stake and distribution agreement in OnDeck which has recently launched in Australia.

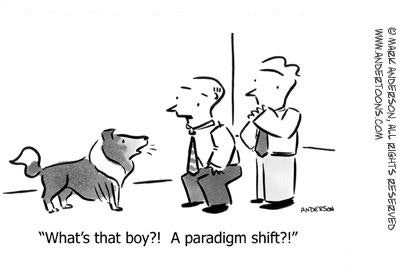

The Big Banks' Reaction

The report also noted that the big banks have the strength and the infrastructure to compete with such technology, however the report noted: "At this stage, we doubt that the response will be particularly quick or aggressive."

Commonwealth Bank of Australia chief executive Ian Narev said recently: "Unlike the US and UK, there is no real-life scenario that can be used to 'stress test' potential credit losses."

RFI has recently conducted a research on global retail banking and one of the findings is that Australia has the worst score in improving the customer experience.

Furthermore, Morgan Stanley proposed different business models that the banks can use to compete or embrace P2P. The banks could outsource different services to the market place lenders including credit underwriting and customer prospecting. With the current service quality of the big banks, that can be a bit difficult to achieve. The big banks relies on key performances indicators (KPIs) for credit worthiness analysis. Using only KPIs can hurt customers and SMEs to obtain loans as it does not provide a comprehensive picture on the credit worthiness of the applicant.

On the other hand, P2P lending platforms, such as OnDeck, conduct more comprehensive analysis to provide more accurate credit scores by using innovative ways. P2P are improving the finance accessibility by providing more loans.

The major banks are underestimating the threat of P2P. Especially when a recent survey reported that 71% of the millennials, one of the banks major customer base, would rather go to the dentist than listen to what banks are saying.