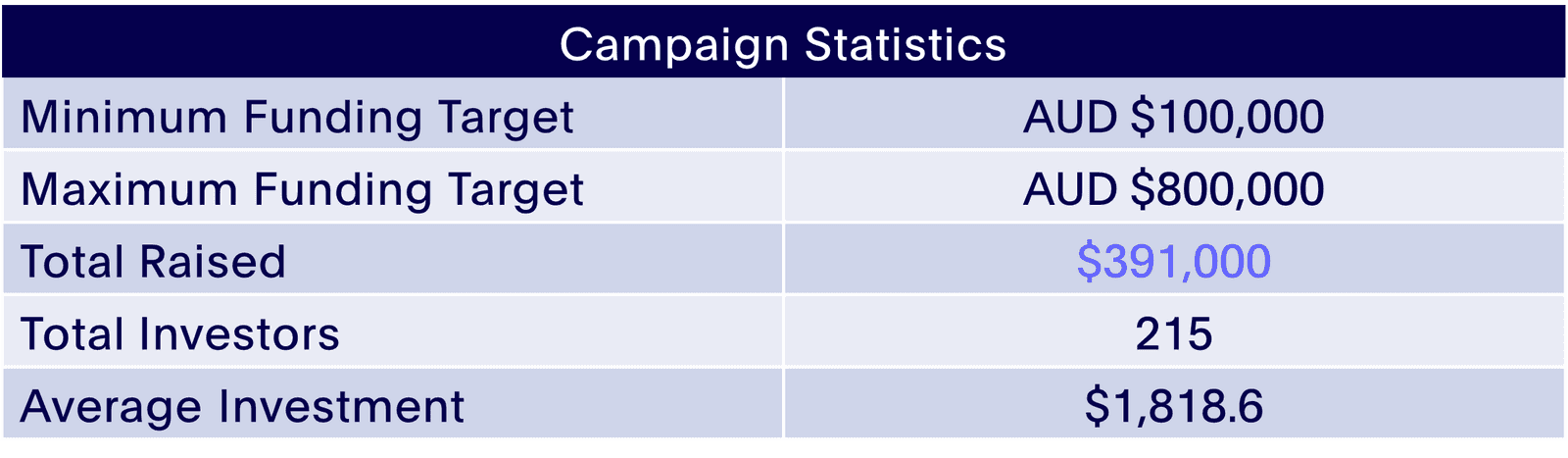

It’s no surprise that noobill has just closed out a successful raise well above their minimum. After impressive beta phase validation, the AI-powered smart account platform is ready to use the $391,000 raised towards launch and rapid scale. noobill raced past its minimum in a relatively short equity crowdfunding campaign to kick off 2021 as the first successful Australian offer.

Keys to Success

Artificial intelligence and smart technology are popular and fast-growing areas across the globe. It’s apparent that investors could easily relate to the problem noobill is trying to solve, to help consumers save money and time in their dealings with essential services like telecommunications, insurance and lending. As a result, investors were able to see the potential of the company in addressing a genuine and pressing need.

Investors are keen to jump on board with companies that solve real-world issues that are relevant in their own lives. It helps investors emotionally connect with the concept, and increases their confidence in the viability of the business. noobill solves a problem we can all relate to, paying bills and communicating with utilities, service and other providers.

noobill was also able to harness its strong community network to propel the offer towards its target. The company is based in the Stone & Chalk fintech hub, presenting it with a plethora of valuable business and investor connections. Notably, Jack Zhang, founder and CEO of fintech unicorn Airwallex, was on board as an early investor and advisor to noobill. The offer was also featured in press such as Startup Daily.

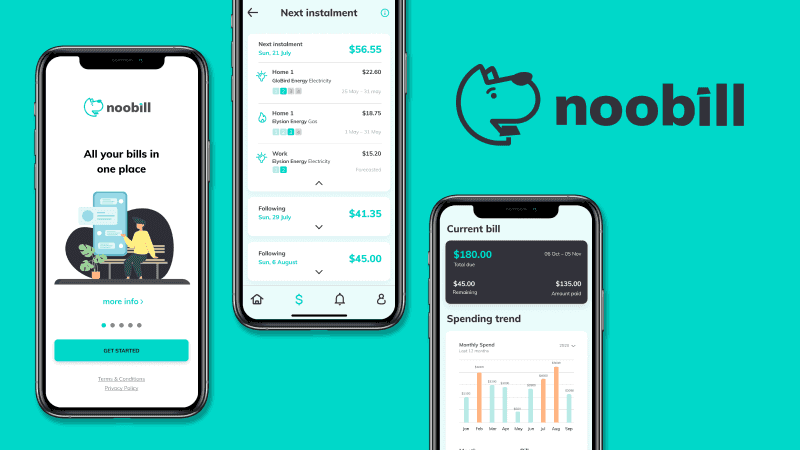

What is noobill?

noobill is an Australian fintech that aims to help people better their financial wellbeing by empowering them to take control of their household finances. noobill is building the only AI-powered smart account that allows for price-comparison, management and payment of all essential services within the one mobile app.

At a minimum, noobill’s smart account reduces time spent managing essential services by 10x compared to traditional management tools and empowers young people to build better financial habits, at zero out-of-pocket cost. The app offers a seamless experience that ensures essential services are always stress-free and paid on time through user (a.k.a. “member”) scheduled bite-sized instalments. At the same time, the AI-powered price comparison tool ensures that members always receive the best value rates available. Free for its members, noobill generates revenue by charging providers a transaction fee to process payments through the app. Unlike existing price-comparison tools, noobill connects providers with highly qualified leads, without any significant up-front investment in marketing or customer acquisition costs.

CEO George Wang explains the value noobill adds, saying “the proprietary algorithms we developed have been designed to help people build better financial habits by bill forecasting, learning income patterns and allowing for easy set-up of bite-sized instalments to pay bills stress-free and on time. We’ve also created a rainy-day savings feature that allows users to incrementally save small amounts from their spare change, and are providing a Pay Later Account to support users in times of emergency”.

Why We Liked the Company

First mover advantage

Using powerful AI technology, noobill has created the first smart account to make price-comparison, bill management and switching providers fast and straightforward. noobill’s AI also reviews individual usage consumption and history to provide customised products and provide recommendations to increase members’ lifetime savings on essential services.

Solving a widespread problem

noobill’s unique ‘ecosystem’ model aligns its business objectives with the long-term goals of consumers and providers, unlike the current ‘agency’ model employed by competitors that fail to deliver value for consumers, prioritises high-profits but also has high marketing and acquisition costs that ultimately get passed onto the end-customer.

Strong team & investors

The company is led by successful entrepreneur George Wang who founded a BRW Fast 100 company in 2013, with advisors including the likes of Airwallex founder, Jack Zhang. Interest in noobill’s disruptive product and significant market potential led to a successful pre-seed funding round with investment from prominent tech investors. noobill is also proud to be part of the Stone & Chalk accelerator and a member of Fintech Australia.

Early traction & market validation

noobill attracted 800+ registered users during the beta testing phase with zero marketing. The company also conducted over 400 interviews and surveys with its target market to assess its fit and fully understand the problem it was aiming to solve.

noobill is now gearing up for a big 2021 and is targeting 160k members over the next 24 months. With this capital raising complete, we’re excited to watch noobill grow and help thousands of Australians to reduce their bills and improve their financial wellbeing!