Parpera

- Type: Retail

- Total Round Size (min): AUD$250,000

- Total Round Size (max): AUD$800,000

- Price per share: AUD$5

Parpera

Parpera is now publicly open for investments.

- Fees Paid by Issuer: 6.00% of funds raised

- Company: Parpera Pty Ltd

- Cooling-Off Rights: 5 working days

- Minimum Parcel Size: $250

- Security Type: Fully-Paid Ordinary Shares

Offer Overview

Investor Reward

- Limited-edition investor card, when the app is live and you sign-up

- Investor status in-app and on the community forum

- Parpera insider access to exclusive strategy and company performance updates

What is Parpera?

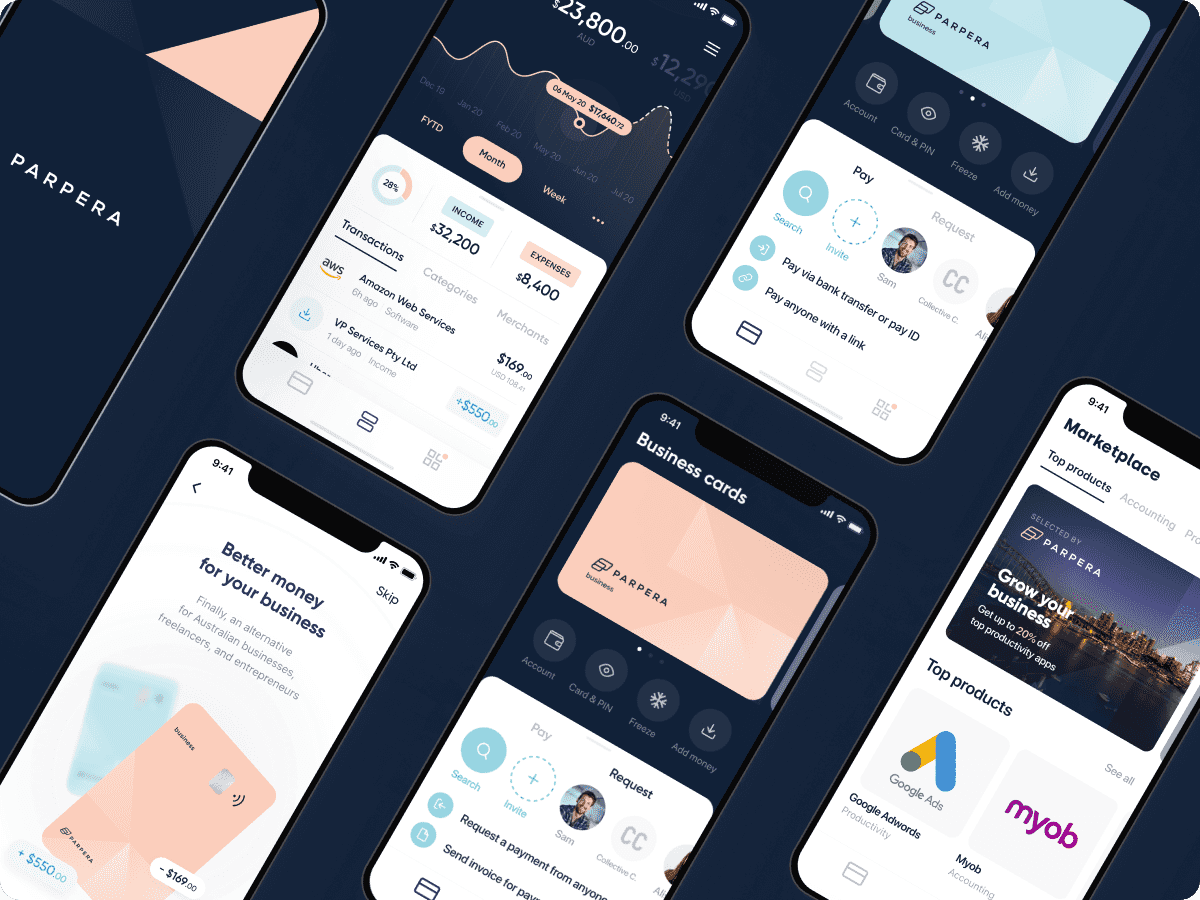

Parpera is an Australian fintech seeking to build an ecosystem of fair and transparent products and services that helps people to effectively setup, manage and grow their business in the new economy.

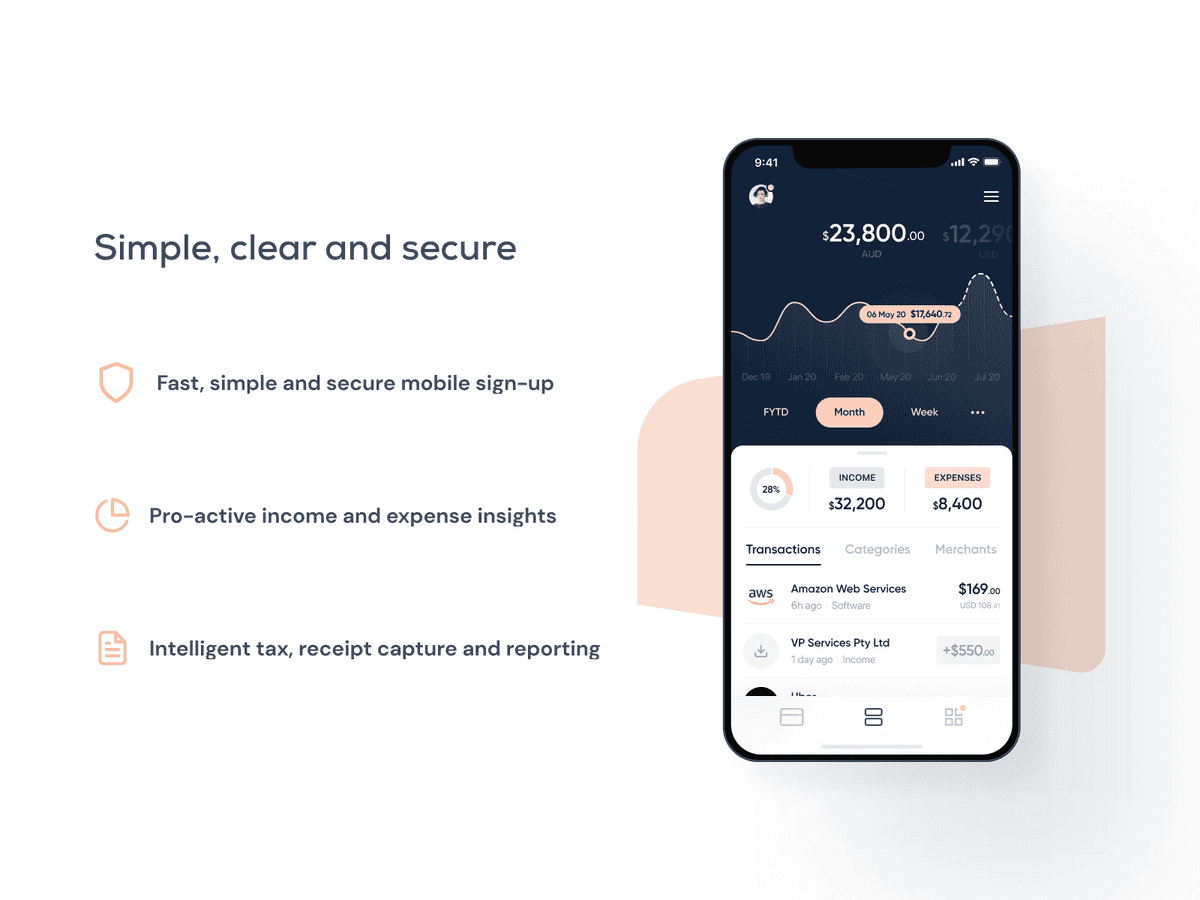

Parpera is developing a digital solution that will initially seek to provide digital wallet, card, payment, and money management capabilities. These features are co-designed with a community of Australian businesses to help them improve the way they do business.

"I will do anything to avoid more paperwork with my banking. Sending and receiving payments should be as easy as sending instant messages."

Key Achievements to Date

- Team – Founding Leadership and Advisors In Place

Parpera has a committed founding leadership and advisory team that is purpose-driven and values-aligned, and has global and local experience spanning from digitising global financial institutions, to leading the technology build and scale-up of neobanks and fintechs.

- Validation - Problem and Business Model Validated

The Company has performed over 500 business surveys and interviews, and has empirically validated the problem, its proposed solution, and its subscription-based business model, with a focus on freelancers as an initial beachhead segment.

- Community – Member Community and Advocacy

Parpera has achieved over 1,000 early waitlist sign-ups, acquired through digital marketing and referrals, and has established an engaged community that wants a better solution to their needs and is actively participating in co-designing Parpera and advocating for its mission.

- Strategic Partnership – Launch Partnership Secured

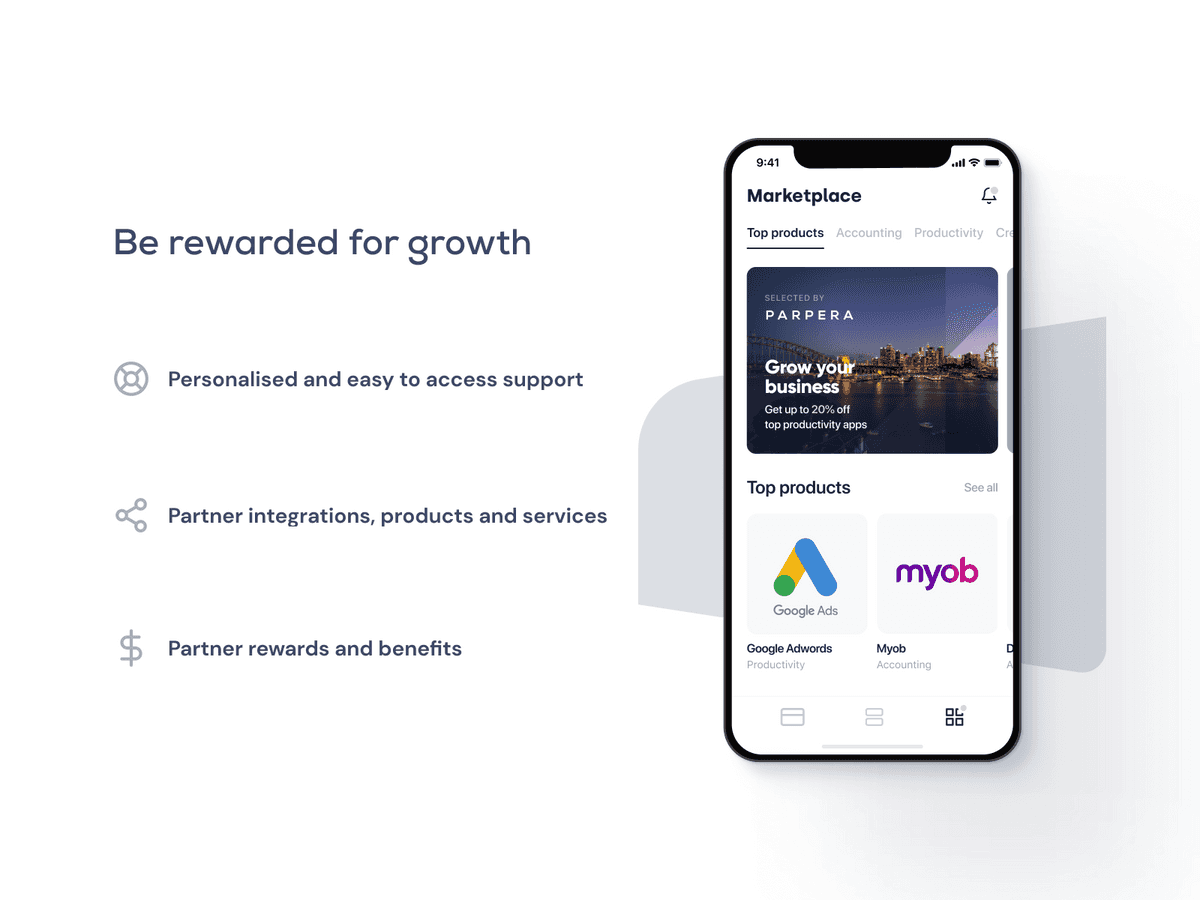

The Company has secured an initial strategic integration partnership with MYOB, a leading accounting software provider, which will provide Parpera with App Partner and App Marketplace integration and marketing access to ~1m Australian businesses.

- Successful Capital Raising

Parpera has successfully raised pre-seed funding through a private allocation. Investors comprised members of the founding and advisory team, key suppliers, experienced and successful entrepreneurs, and family and friends that believe in the team and proposition.

The Problem for Businesses

The global transition, from the old to new economy, has led to a significant shift in the way we live, work and transact.

This brings into question the propositions, practices, and legacy business models of incumbents. It necessitates the need for innovative, fairer and transparent products and services that help people build better businesses, and ultimately live better lives.

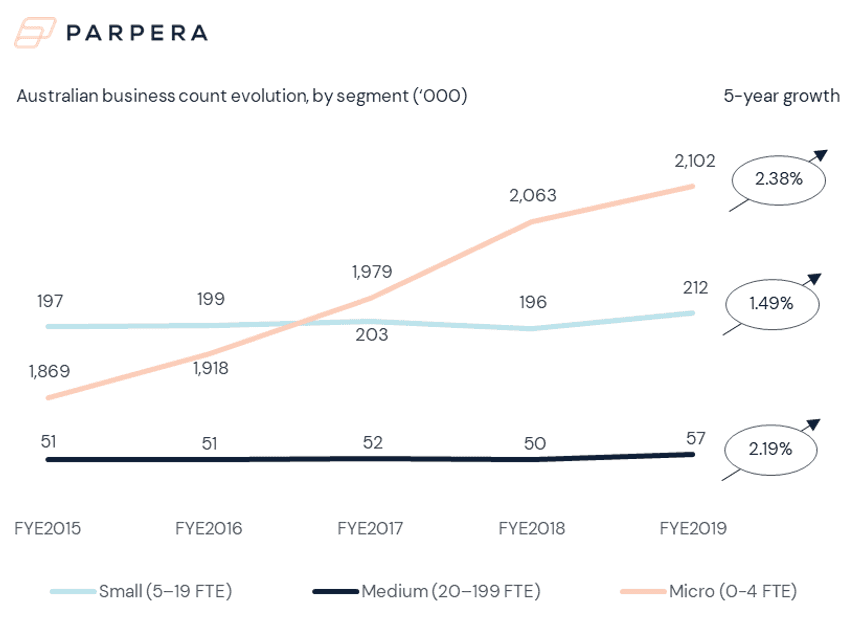

In Australia, there are ~2.4m businesses, ~2.1m (~88%) of which are micro-businesses (0 to 4 employees) and represent the fastest growing business segment (2.38%, 5-year growth rate).

Unlike those in other developed markets, Australian businesses - particularly sole traders, freelancers and entrepreneurs - remain underserved and undervalued by the traditional financial institutions, and new entrants have primarily focused on either larger businesses, lending or retail consumer segments.

"We pay a Big 4 bank $10 a month for basically nothing. We'd happily switch and pay for something better."

The Parpera Solution

"I love getting instant notifications for my personal banking - I've switched all my personal banking over from one bank to another service simply for this feature. I need this for my business account too!"

Business Strategy

Parpera is purpose-led and aspires to empower people and businesses. Parpera’s ambitions are global, and it is starting with Australia. Parpera is designed to be a platform business, which will build its foundations with a specific-product focus and evolve into an ecosystem of products and services, focused on building a competitive and sustainable business that delivers long-term value, for its members, team, investors, and external stakeholders.

Product Strategy

Parpera is adopting a jobs-to-be-done (JTBD) approach to ensure that the product it builds not only solves a real and urgent problem but also delights and is loved by its members. Parpera does not see its product in terms of features but rather the jobs that it can solve for its members.

Initial product development is focused on three key themes: instant access, better money, and smarter tools. The product will follow a similar approach to those successfully adopted by leading business propositions in other markets, such as the UK, and is focused on serving the most immediate needs of Australian businesses. For more information please see section 2.6.3 of the Offer Document.

Business Model

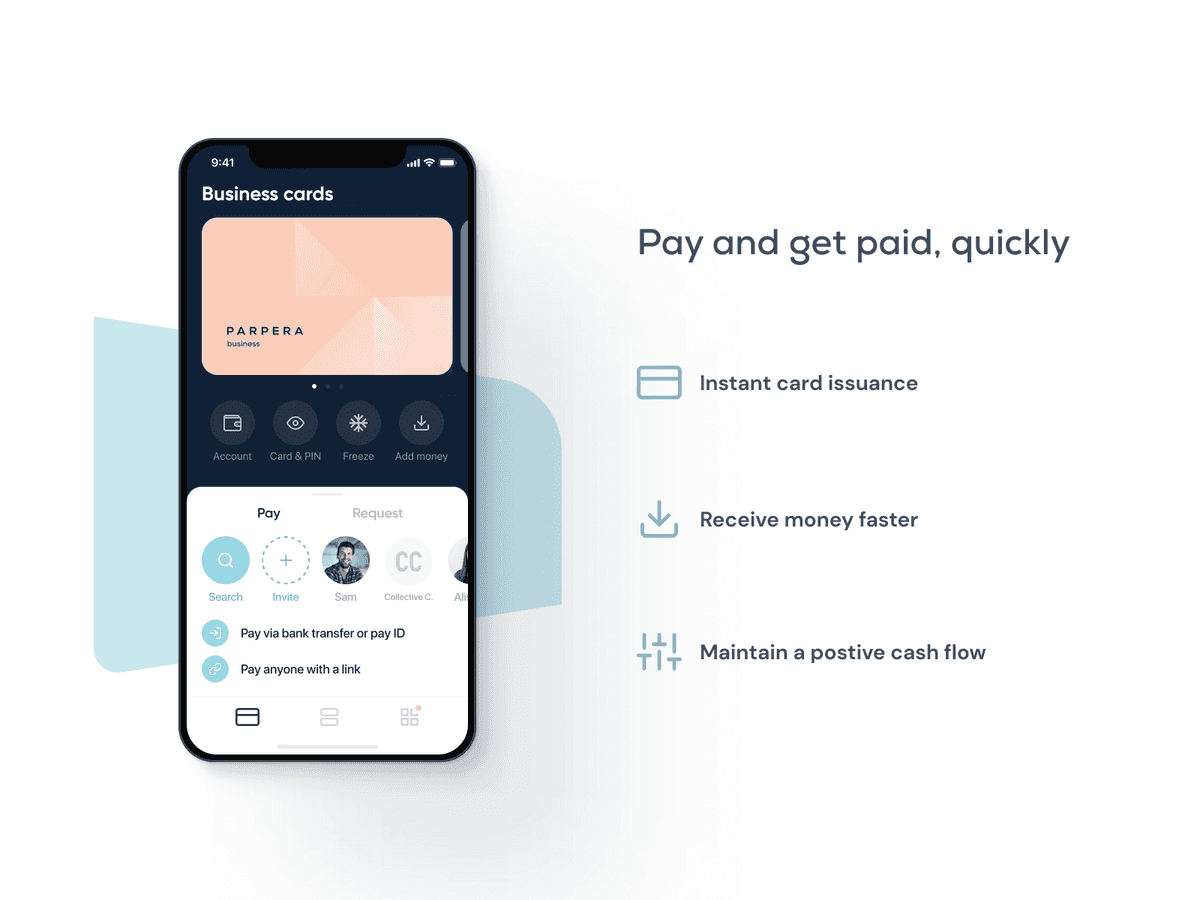

Parpera’s business model is less bank- and more SaaS-like (Software-as-a-Service). Parpera is not a bank, and is therefore not incentivised to make money off its members' money, but rather aims to make it easier for its members to setup, manage and grow their businesses. Parpera's initial business model will focus on generating recurring and transactional revenue from:

- Subscriptions - a monthly fee with tiered packages

- Wallets & cards - card interchange and foreign-exchange revenue

As the product develops, future revenue streams will extend to:

- Funding - a fixed funding access fee and late payment fees

- Marketplace - partner revenue share or referral fees

For more information please see section 2.7.1 of the Offer Document.

Go-to-Market Strategy

Parpera is adopting a community-led approach, which is focused on increasing share of mind (awareness, education, and trust in Parpera) and wallet (business funds and revenue) to drive growth over three key phases, in line with its planned product roadmap.

Phase 1 - Build and MLP

Parpera will initially focus on building and co-designing its solution with a community of businesses, to ensure it better captures, understands, and solves their problems. Parpera is continuing to build its early signup waitlist and will introduce referral incentives to bolster growth.

Phase 2 - Full launch

As Parpera's product continues to develop, the Company will shift its focus to financial literacy and strategic partnerships to accelerate member growth. Parpera's partnership with MYOB is the first step in its initiative to provide additional products, services, and functionality to members. These partnerships will open up cross-referral opportunities, which, when combined with viral acquisition initiatives, will encourage exponential member growth.

Phase 3 - Scale

By 2022, Parpera intends to scale and expand into new markets, member segments, and products. It will continue to grow its ecosystem to deliver value to its members and strategic partners. For more information please see section 2.7.2 of the Offer Document.

Market Opportunity

Overview

Parpera is targeting the micro-business segment whose growth has been driven by the disruption in traditional career pathways and an increase in non-employing businesses, such as sole traders, freelancers, gig-workers, and entrepreneurs. This segment represents 88% of the 2.4 million Australian businesses and is largely underserved and undervalued by Big 4 bank offerings due to having lower financial complexity in and low-to-no borrowing needs.

Competitive landscape

There remains a significant gap in the Australian market for the offering that Parpera is developing. International market participants have validated this approach, yet local competition remains weak.

Historically, the business segment has been dominated by the Big 4 banks, whose business arms tend to focus on driving profitability from lending activities, leaving micro-businesses, with no-to-low lending needs, undervalued and underserved. New banks and fintechs have mainly focused on larger businesses, lending, or retail consumer segments.

While new entrants are emerging in the business segment, micro-businesses present a significant opportunity for Parpera and the Company is well-positioned to better serve these businesses.

Key Team Members

Daniel Cannizzaro

Daniel has spent much of his life at the intersection of finance and technology and possesses global financial services and consulting experience, focused on solving challenging strategy, operations, technology, and risk issues for organisations, from early-stage ventures to large scale multi-nationals.

Daniel has successfully led and delivered organisational setup and improvement initiatives and new business development pursuits across Asia Pacific, North America, the United Kingdom and Continental Europe.

With global experience at a range companies, and an MBA from London Business School, Daniel is the ideal individual to lead and scale Parpera.

Andrew Davis

Andrew is a globally recognised fintech expert and thought leader, specialising in corporate innovation and fintech engagement.

Andrew possesses strong international banking and governance experience, having worked at HSBC and Citigroup for more than 16 years covering Country, Regional and Global responsibilities, including global fintech lead at HSBC.

Andrew is an Advisor to International Finance Corporation, the NSW Government and other large enterprises. Andrew is an Ambassador for Stone & Chalk and Advisory Board Member for The Fintech Institute.

Nathan Liu

Nathan has over 20 years experience in high-growth technology companies, spanning leadership and engineering roles across multiple industries.

Nathan is strategically located in London, to maintain access to leading fintech design and technology practices in the UK, a market that is 3-5 years ahead of Australia.

Prior to joining Parpera, Nathan built and scaled a successful UK fintech neobanking platform (Zeux) from the ground up and established the strong technical foundations of the business that allowed it to iterate, experiment and rapidly grow with confidence. Nathan has held other lead engineering roles at Just Eat and Investec.

Key Financial Information

Below is a summary of key historical financials for the period ending 30 June 2020. For more information, please see section 2.13 of the Offer Document.

Use of Funds

Key Risks Facing the Business

Below is a summary of the key risks facing the business. For more information, please see section 2.15 of the Offer Document.

Parpera is intending to launch in a highly competitive market. Market and customer risk occurs whenever there are other players trying to win market share. Typically, there is a high level of inertia in terms of switching in financial services, and fintechs may not prove as popular in the Australian market as they have been in other markets. Should Parpera be unable to acquire members, it will not achieve its strategic business objectives.

Parpera is implementing several key systems and processes to bring its business and product to life, presenting the following key risks:

- Development costs are significantly higher than budgeted

- Implementation times are longer than expected

- Implementation does not deliver a competitive feature set

Should the requisite systems and processes not be implemented within budget, on time and deliver what is required, Parpera may fail to achieve its business objectives.

Parpera relies on third party technology vendors and partners to provide the capabilities it requires to enable its key product features, such as onboarding, payments, virtual accounts, and regulatory licences.

This presents key partner risk. Should Parpera not be able to enter into a viable commercial agreement with one or more of its key partners, or if a partner fails to deliver on agreed services and timelines, Parpera may fail to meet it business objectives.

Parpera is intending to operate in a highly regulated environment and is therefore exposed to regulatory risk. Regulatory risk occurs primarily for Parpera in that it may not obtain relevant approvals from regulators or laws may change in the future that impact the Parpera business model.

Parpera will be required to hold an Australian Financial Services Licence (AFSL) or to be authorised under an AFSL. Parpera will seek to conduct its licensed activity as a Corporate Authorised Representative (CAR) of another AFS licensee that holds the appropriate licence authorisations.

Should Parpera not obtain its own AFSL or become a CAR, it will not be able to offer its planned products and services and the business would have to change. There are no guarantees that Parpera will obtain the above licences.

Parpera has hired and is in the process of hiring more people. Whenever people are introduced into a business, there is the potential that people will not follow all policies and procedures and not act in the best interests of members and this could impact Parpera’s ability to achieve its strategic business objectives. Parpera has several key people that are important to the success of the business. If these key people are to leave, they would need to generally be replaced to achieve the business’s objectives.

Parpera has set a fundraising objective to raise enough money to achieve the build and initial operation of its business and product and to demonstrate enough traction to attract a subsequent round of growth capital.

Should Parpera not achieve its fundraising objective, it may not realise its business objectives and/or demonstrate enough traction to raise further rounds of funding and may potentially cease to operate.

Key Documents

Why Equity Crowdfunding?

Parpera is raising seed capital to progress the build, deployment and initial operation of its minimum loveable product (first release), and cover the associated business, operational, technology, regulatory, and go-to-market activities that are required to achieve this milestone.

The team’s vision is to co-create Parpera with a community of people, businesses, and investors and the Company believes that equity crowdfunding is a powerful tool to achieve this.

Behind every business is a person. Parpera wants to give everyone the opportunity to own a part of the Company, so that they can help drive and share in its commercial and financial success.