Lumiant Offer

- Type: Retail

- Total Round Size (min): AUD$250,000

- Total Round Size (max): AUD$1,500,000

- Price per share: AUD$0.95

Lumiant

Lumiant is now accepting investments.

- Fees paid by Issuer: 6.00% of funds raised

- Cooling-Off Rights: 5 working days

- Minimum Parcel Size: $250.8

Offer Overview

Share Reconciliation

Key Documents

What is Lumiant?

Lumiant is a holistic and interactive client experience SaaS solution, transforming the traditional financial advice process and driving better outcomes for advisers and their clients.

Research has highlighted a sizeable gap in the wealth management and retirement planning industry for a personalised yet automated system that combines values, goals, objectives and investment preferences into one client experience.

The Lumiant platform is being developed to fill this gap; to enable a novel and unique combination of psychographic data and granular financial data to perform multi-goal, multi-scenario analyses and to drive the optimisation and accurate calculation of data-driven financial advice.

Mission statement

Our purpose is to radically transform and excite the Financial Advice industry by partnering with advisers who seek to deliver on the promise of helping people lead extraordinary lives and want to build thriving, sustainable businesses.

Investment Highlights

- Revolutionises the Financial Advisory Experience for Clients

Lumiant’s Lifebook delivers a world-class customer experience focused on building deeper emotional and behavioural engagement and alignment on core values and goals. This is designed to appeal to both current future generations of clients.

- Futureproofs the Financial Advice Industry

Lumiant’s solution solves many of the problems faced by the industry, and centres the value of financial advice in meaningful long-term goals and values, creating an opportunity for advisers to retain clients for life, optimise sales conversion and improve profitability.

- Significant Market Traction to Date

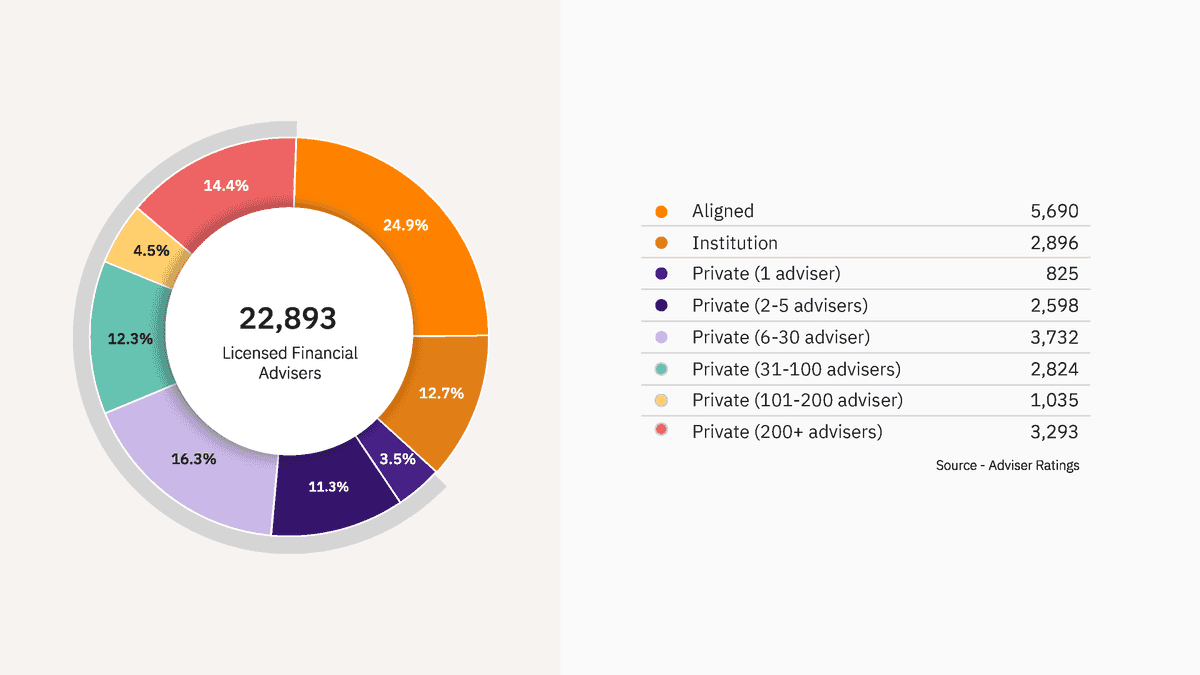

There are 22,893 licenced financial advisers in Australia. The target market is of a size that we don’t need unrealistic penetration to be commercially successful.

Lumiant has already signed Letters of Intent with groups representing 1,500 licensed financial advisers, roughly 6.5% of the total in Australia. Furthermore, the founding team and shareholder network are directly aligned with a total of 4,250 licensed financial planners representing 20% of the industry.

Strategic partnerships with Institutions, Industry Super, Dealer Groups, IPL and Wealth Connect Platform (built on Salesforce FSC) should amplify outcomes beyond the forecast case.

- Recurring SaaS Revenues

Lumiant generates recurring revenue through a SaaS subscription model framed around annual contracts to advisers. This consistent revenue provides a ready stream of cash flows to support further product development and business expansion efforts. The Company’s 1,500 LOIs already exceed the conservative assumptions for Year 5 of the business plan, with revenue of $35m expected.

The SaaS platform is designed to help advisers serve up to 100% more clients - driving scale and economic value, whilst assisting advisers to meet and exceed the regulatory requirements.

- Multiple Avenues for Expansion using Technology

This scalable SAAS/Cloud based platform allows for global expansion. Further growth potential can be realised through integration into Salesforce Enterprise Solutions through related partner businesses.

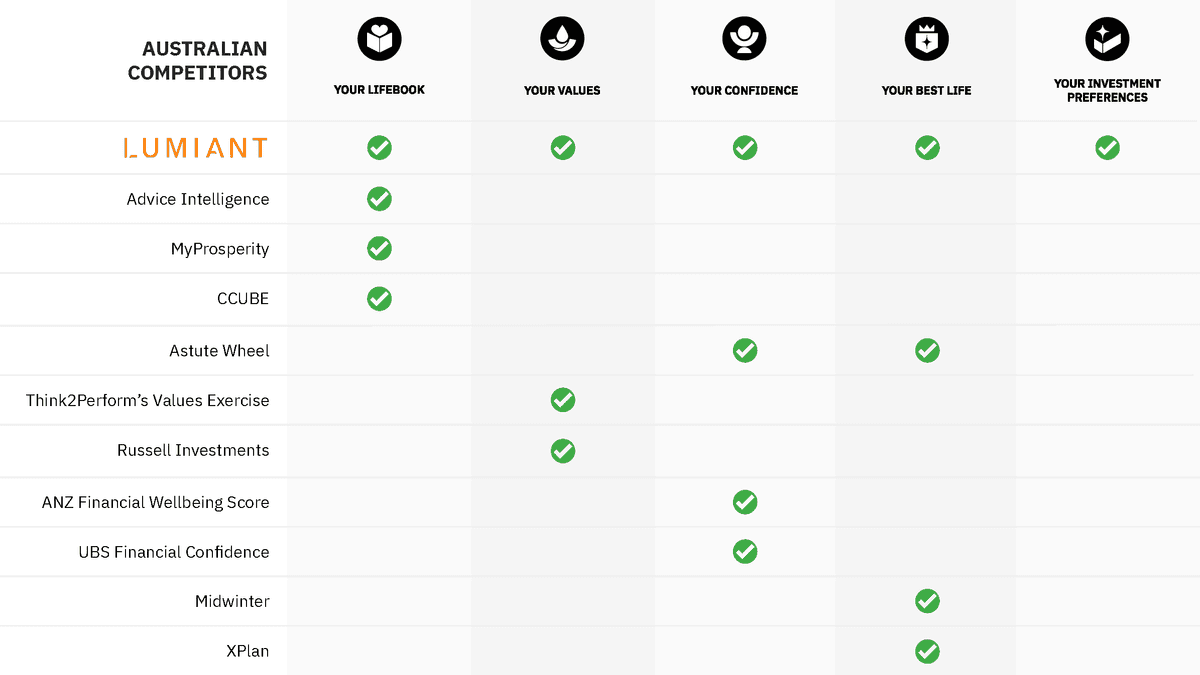

- No Direct Competition

There are no other known direct competitors operating across these capabilities in the Australian market.

- Experienced Management Team

The Board and Executive team have a proven track record of commercial success across the wealth industry, and in the design and delivery of digital products and services for both local and global brands.

The team have separately built proven disruption models over their careers and have a track record in technology, design, implementation, project management, financial services (including financial planning), start-ups and delivery. The team has experience in founding, managing, scaling and selling award winning businesses within the digital space.

The Problem

With only 20% of Australians receiving financial advice, the financial advice industry must evolve when it comes to the quality, cost and delivery of advice. The industry must also seek to engage clients and advice seekers on a more personalised, individual and meaningful level, so the true value of advice can be recognised.

Significant changes in regulatory requirements, client expectations and an increasing number of alternatives available, mean the industry must evolve if it wants to continue, grow and be perceived as a relevant by future generations of clients.

The specific challenges are:

- The industry has been people, pen and paper dependent, with limited scale and propositions anchored in product

- Regulatory friction has been persistent while the industry has been trained to deliver product-based advice

- Unfit, irrelevant consumer technologies which have driven poor decision making, and created friction in the adviser and client relationship

- Industry EBIT margins have been weak with limitations on the number of people an adviser can serve

- Appeal to a new generation of millennial investors who prioritise values-based investing, with a preference for a more digital interaction and service provision

There's an opportunity for advisers to forge client-centric, technology-enabled advice practices which will boost profits and help them scale.

The Solution

Lumiant addresses many of the biggest challenges facing financial planning businesses today.

Lumiant’s ‘Life Centred Advice’ process and sophisticated software-as-a-service (SaaS) platform combine to exceed the regulatory standards, drive consumer loyalty and advocacy and increase profitability, whilst delivering a meaningful, personalised experience to the end client - one they will truly value.

In addition to a world-class client experience, the service features a unique recommendation engine which will be underpinned by new financial logics and rules that can analyse psychological and financial data inputs in a structured and quantitative manner.

Its unique values-based approach shifts the consumer value proposition away from investment products. Rather, through an interactive guided process, Lumiant provides advice seekers a way to uncover what truly matters to them, in order to work with their adviser to design their best life.

This centres the value of financial advice in meaningful long-term goals and values, rather than just numbers and decimal points, creating an opportunity for advisers to retain clients for life.

Simply put, Lumiant is a seamless, holistic client experience management solution, driving better outcomes for both advice firms and their clients.

Product Overview

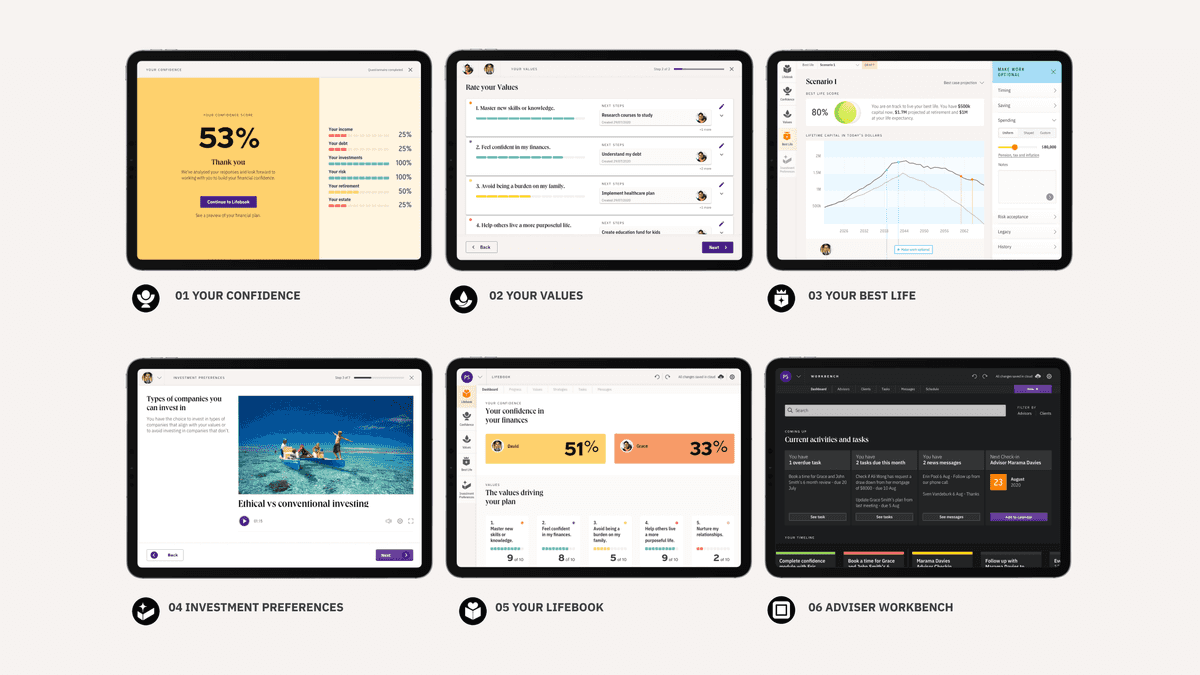

Lumiant provides advisers with a platform to drive measurable, meaningful and repeatable experiences which break down barriers, provide clarity, and open up communication.

Its interactive, personalised process helps identify what really matters, so advisers and their clients can identify priorities, shape strategies and drive action to ensure advice seekers achieve their best life.

The experience starts with a carefully crafted questionnaire which will help advisers and clients understand the client’s current levels of confidence across a range of important issues related to their financial well-being.

The adviser will meet with their clients to take time to understand what really matters to them (and their partner), their values and their needs.

Using Lumiant, they will then tailor an investment strategy for the client which maps to their values, goals and priorities

Everything will be captured for the client along the way in the Lumiant Lifebook. A rich source of information that helps clients track their progress toward their goals and ensures their money is being used to best effect and in a way that aligns with their values.

Lumiant's Unique Process

Lumiant is the product of state-of-the-art software engineering and a robust human-centred design process which places people's needs at the centre of the product design process.

As well as consolidating inputs from a range of disparate technologies currently in play across the wealth management industry, it is compliant by design - reducing compliance and reputational risks of the traditional model.

Growth Strategy

Lumiant will primarily focus on executing its current pipeline and those indicating existing interest from the centres of influence based LOIs. These early initiatives will underpin the economic model through the initial strategic planning cycle of FY21-23, providing a platform to launch into an accelerated growth plan during the second strategic planning cycle of FY24-26.

The accelerated plan for user acquisition will be to pivot into the institutional space and industry super fund markets. These markets have struggled to engage their investors and it is expected that the Lumiant process will be highly sought after by this segment. Equally, these groups are currently experiencing substantial change due to significant regulatory reform and remediation efforts. Accordingly, it is expected that their appetite for technological change will be heightened toward the end of FY21-23.

Lumiant will explore additional channel growth opportunities to leverage the platform alongside other SaaS vendors who have indicated an interest in collaboration. Further adjacent opportunities exist in other parts of the wealth sector including, but not limited to, the accounting profession and the mortgage broking sector.

Dependent upon Lumiant’s success through the FY21-23 strategic cycle, different growth scenarios may arise, including acquisitions, and entering offshore markets such as New Zealand, US, and Canada. However, these will not be leveraged until the local market has been successfully exploited.

Key Team Members

40 year industry veteran and commercial leader. Executive leadership roles across wealth and advice industry with Challenger, AMP and ANZ. Executive Chairman of IPL, NED of Creativemass (owner of WealthConnect).

22 years in Financial Planning industry as a practitioner and executive. Co-founder and Head of Sales at IPL which to date raised circa $1.5 billion FUM from advisers.

Fredrik has founded, built, managed, scaled and sold an award winning 100+ employee strong, high end digital/IT software consultant/platform company. With over 20 years of experience working as a leader and 10 years of experience working as an entrepreneur he has developed a finely tuned sense on how best to build high performing teams and deliver profit under high growth and constant change.

Historical Financials

Use of Funds

Key Risks Facing the Business

Lumiant is intending to provide a software solution to those who operate in a highly regulated environment and is therefore exposed to regulatory risk. Regulatory risk primarily arises for Lumiant in that it may not adequately deliver regulatory compliance to Best Interest Duty for financial planning businesses, making it liable to any legal alterations that may occur. Given that laws may also change in the future, this can impact Lumiant’s ability to meet its value proposition to industry.

Lumiant is in the process of raising funds (money) to achieve its strategic business objectives. Specifically, it is raising funds to build its technology and for marketing purposes. Without adequate funding, Lumiant may not achieve its strategic business objectives.

Lumiant has several key people that are important to the success of the business. If these people are to leave, the stated industry reach may not be realised. This will impact any future revenues and the overall success of the business. If these key people are to leave, they would need to generally be replaced in order to achieve the business objective.

Lumiant is intending to launch in the highly competitive enterprise SaaS solution market. Competition risk occurs whenever there are other players trying to win market share. The early nature of the business, alongside its pre-launch state, means that competitors can enter the market and gain a first-mover advantage.

Lumiant serves an end market which is currently undergoing a significant transition and at risk of substitution by Robo Advisers. There is a risk that automation of the Financial Planning industry will reduce the number of financial advisers and clients available to be served by Lumiant.

Upon launch, Lumiant may not prove as popular in the Australian market as it was during the testing phase. This could impact customer acquisition, impacting Lumiant’s ability to achieve its strategic business objectives.

Why Equity Crowdfunding?

Lumiant intends to radically transform and excite the financial advice industry. Crowd Funding allows us to access like-minded investors and Financial Advisers who want to be part of something truly transformational.

Lumiant’s core mission is to empower Australians to live their best financial life. We have partnered with Equitise to deliver an Equity Crowdfunding Campaign, which we see as a natural fit in allowing the community of Australian advisers and investors to join us on our journey to elevate the financial well-being of many Australians.

With Lumiant’s core technology in the final stages of development, and poised for rapid growth, we are raising capital to strengthen our team in the lead-up to our public market launch in early 2021.