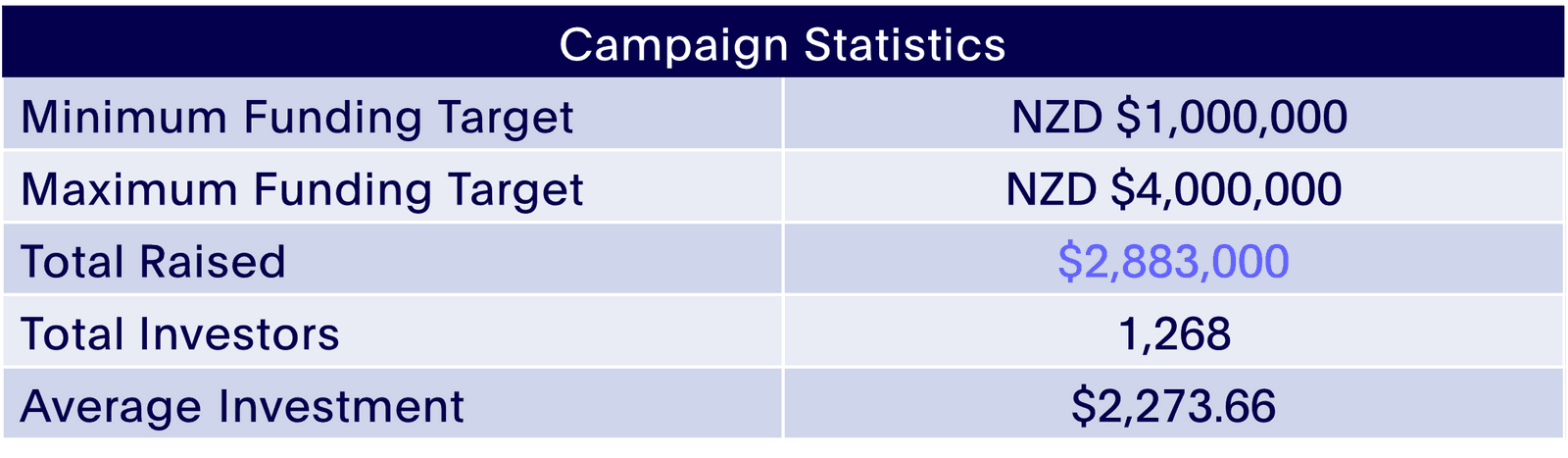

After a blockbuster campaign, New Zealand based Greenfern Industries has raised a whopping NZ$2,883,000 through Equitise, smashing the record for our highest ever New Zealand equity crowdfunding campaign. The offer actually hit the retail investment limit of NZ$2,000,00 for New Zealand, with the remaining NZ$883,000 coming from wholesale investors. Over 1,000 investors got behind the innovative company, backing its mission to produce sustainable products that genuinely improve the lives of its customers.

What is Greenfern Industries?

Greenfern Industries was established to support the emerging medicinal cannabis and hemp industries, in New Zealand and abroad. Based in Taranaki, New Zealand, the company produces therapeutic and medicinal products to service a rapidly expanding market. A focus on sustainability and quality sets the company apart, with extensive experience and innovation in research driving it forward.

Powered by a hydropower station at the base of Mount Taranaki, Greenfern held a medicinal cannabis licence to cultivate CBD and THC dominant strains for research purposes that were recently superseded by the new Medicinal Cannabis Scheme. The company is awaiting a site inspection for its new commercial cultivation licence application under the new scheme.

Why we liked the company:

An exciting competitive advantage

Greenfern’s main Taranaki facility is powered by an onsite hydropower station, providing the company with a source of sustainable energy at the base of the volcano. With electricity being the highest cost factor for cannabis producers, the ability to access this source of energy provides a substantial advantage. Greenfern currently has an agreement in place to access the station’s energy at a discounted rate, but is using the funds of this offer to purchase and upgrade the plant, increasing its output 4x. This is not only sustainable and more cost-effective, with electricity the highest cost of growing, but it also offers another revenue stream when Greenfern can sell the excess electricity.

Innovation at its core

Another key aspect of the business was its commitment to innovation. Greenfern already operates an innovative business model, engaging in the manufacturing, processing and production of cannabis products, for business and consumer customers. The company is continuing to innovate too, with research and development projects in a range of areas including hemp-based meat substitutes, CBD infused manuka honey and proprietary medicinal products.

A focus on sustainability

At the heart of Greenfern’s mission is its focus on sustainability. The company is ensuring it engages in sustainable practices across its supply chain. The cannabis industry has exploded in recent years, with the rapid growth characterised by a lower priority on sustainability at times. Greenfern wants to produce the highest quality product, using sustainable energy and methods, aligning with its overall mission of improving people’s wellbeing.

**Planned IPO

Greenfern had intentions to list on the NZX in 2021 in order to provide liquidity to its early backers and to ramp up its growth. We always like when companies can provide an exit opportunity for investors, with a listing allowing investors to buy and sell shares with ease.

Diversified business model

Greenfern has multiple sources of revenue, including local and international wholesale distribution of the hemp and cannabis flower, alongside consumer products such as its hemp body care product line (MaTo). It plans to only continue adding to its range of products and revenue streams to create a diversified and robust revenue model.

Looking Forward

We’re excited to see what comes next for the Greenfern team. The company should hopefully complete the purchase of the hydropower station to lower its costs even further. The industry is certainly one to watch, and Greenfern is well-positioned to lead the charge.

**Update (21.10.21)

Greenfern Industries (GFI) is now officially listed on the New Zealand Stock Exchange (NZX) - see their listing here!