Campaign Year: 2018

Campaign Type: AU - IPO

Campaign Duration: 20 days

Amount Invested: A$1,672,500

N° of investors: 289

Average Investment: A$5,787

identitii (ASX: ID8) is an emerging Australian software company providing enterprise software for financial services and banking institutions. Established in 2014, identitii has developed its own proprietary product called Serra, an application that enables the secure and trusted exchange of information (such as “Know Your Transaction” information) over financial networks, powered by a secure private blockchain. identitii developed Serra through a two and a half year in-house research and development program, and has a long term product roadmap for additional features or ‘add-ons’.

With Serra, identitii has taken the approach of utilising the benefits of blockchain and tokenisation to complement the established payment networks such as SWIFT, the international messaging network that facilitates the exchange of funds between correspondent banks. Serra aims at mitigating the shortcomings of these existing networks, primarily the way by which they share information, rather than trying to replace them, which is attractive to an industry that is risk averse when it comes to mission critical systems.

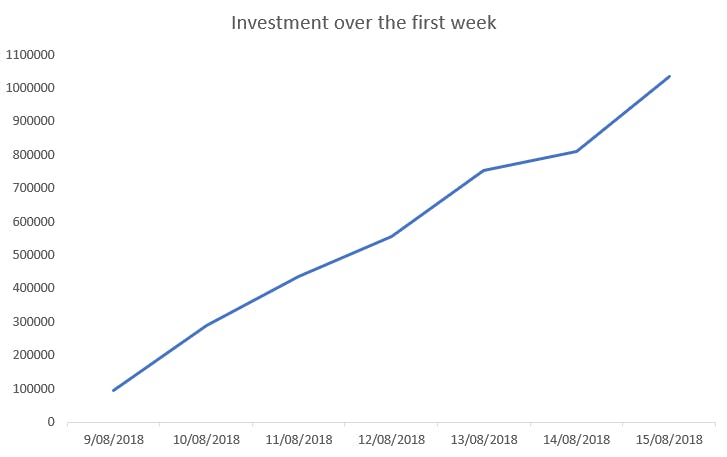

Equitise's allocation was filled in 20 days, oversubscribing the offer. Demand for shares was high, with over $1m being committed within a week of the offer going live. identitii comes as a time when blockchain technology is gaining mainstream attention, following the highs that cryptocurrencies made in December last year. According to a recent YouGov survey, 79% of people have heard of cryptocurrencies and almost half of millennials believe that there will be widespread adoption of cryptocurrencies in the next decade.

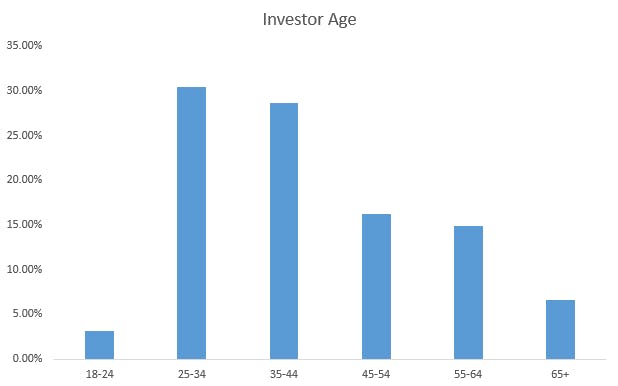

The enthusiasm of millenials for blockchain technology and its applications beyond cryptocurrencies is reflected in our investor makeup, with the largest age group being the 25-34 bracket, followed by the 35-44 age group. The offer also gained interest amongst older age groups; a sign of how blockchain is no longer only within the realm of tech-savvy millenials. Low turnout for the 18-24 age group is likely due to lower levels of savings and investment amongst students and those not working full time.

The funds raised in this offer will assist with ongoing development and commercialisation, appointing resources in business development, marketing, account management and professional services in key Asia-Pacific markets, costs of the Offer, corporate overheads and working capital. The shares were issued at a price of A$0.75, and listed at $0.95 on the ASX.

Quote from Nick Armstrong, Co-founder and Chairman at Identitii Ltd

"We engaged Equitise to manage the Chairman's list and also the retail spread requirements for our ASX listing.

The process of engagement and running the offer was very slick and we were very happy with the outcome.

The Equitise team worked extremely hard on the transaction and I was very impressed with their output. We would happily recommend Equitise to any future prospective client."