How do I make money from a private company investment?

Aside from the other benefits of investing in startups and early-stage businesses, we understand that visibility on how you make a return is still key.

There is uncertainty when it comes to making money from any investment in a company but even more so with ones not yet listed on the stock exchange.

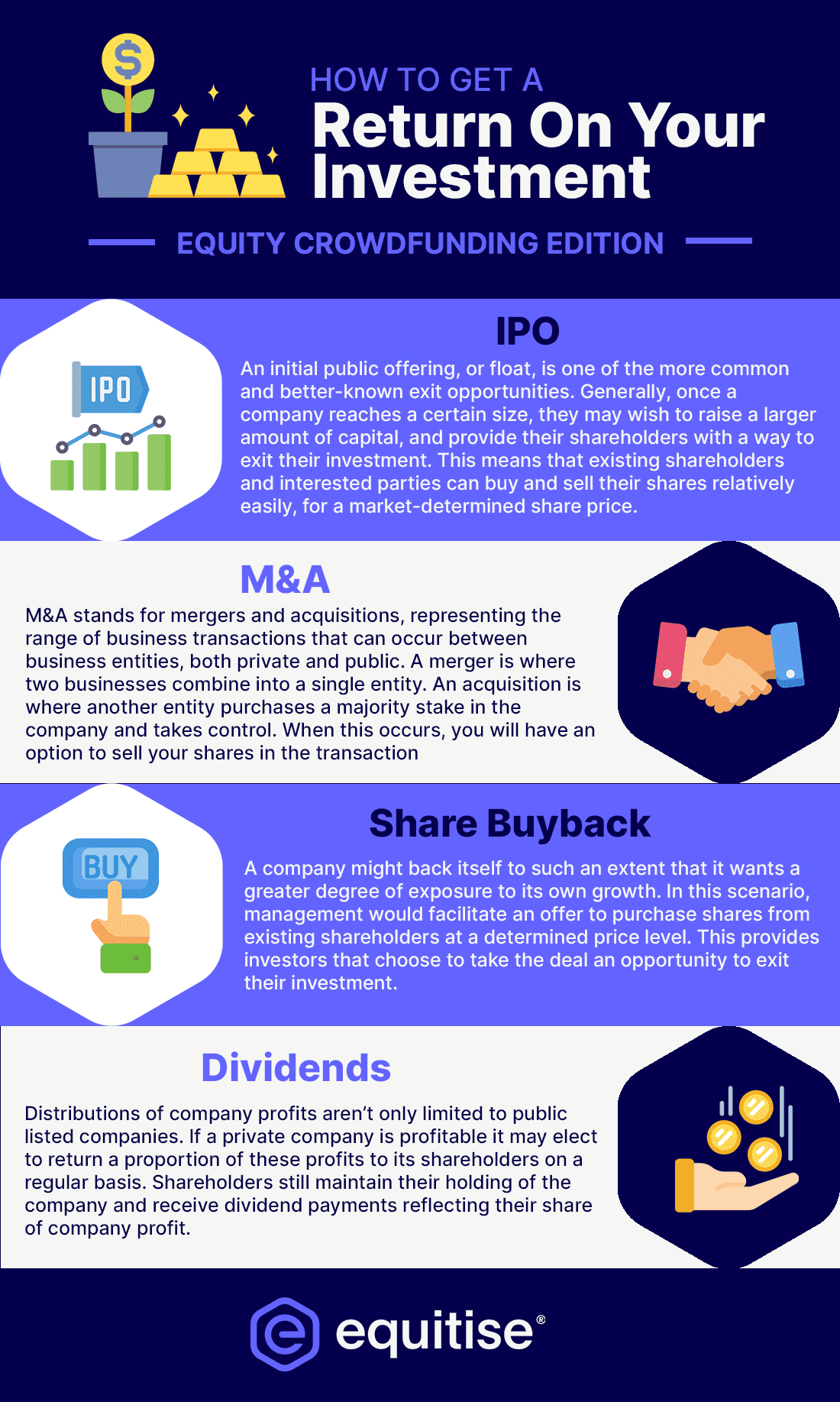

This is because equity crowdfunding investments are relatively ‘illiquid’ (meaning you can't easily sell your shares) so a return can’t be made until what we call an ‘exit event’ occurs whereby you can sell your shares. However, high school economics teaches us that with greater risk, comes greater returns, generally. It’s the same principle here. Early-stage investing in startups is usually seen to be riskier than investing in more established businesses as there are a lot more unknowns however because you’re getting in on the ground floor, there can also be higher returns.

Here are two more ways of getting a return on your investment with equity crowdfunding which are less common:

Private Secondary Market

The ASX or NZX are examples of public secondary markets where existing shares can be traded between buyers and sellers. Private secondary markets allow private company shareholders to exchange shares with one another should they elect to exit their investment, or desire to increase their holding. Whilst this option is not available right now, we anticipate it will be soon.

Off Market Transfer

Similar to a private secondary market but in a more manual sense, if two individuals decided to make an exchange of a shareholding and cash, they can do this privately in accordance with their relevant shareholder agreement.

Equity Crowdfunding Exits

Given the relative youth of the equity crowdfunding industry, and standard early-stage company and startup timeframes, it’s unsurprising that we’re yet to see many exit events resulting in a return on investment. What we have seen is a lot of success so far from the companies we’ve raised for. Several of our portfolio companies have experienced uprounds, which is essentially an increase in their valuation or share price. You can read more about the 2018/19 uprounds, and their average share price increase of 109%, here.

Nonetheless, we can take confidence in the success of international equity crowdfunding markets that have existed for several years longer than ours. Not only are these markets seeing ongoing growth, higher amounts raised, and greater attention, they have also started to see exit events!

Examples of Successful Exits

Here are three examples of exits from UK equity crowdfunding platform Crowdcube (Crowdcube has been raising capital through crowdfunding for several years longer than we have, owing to the UK’s earlier regulatory shift):

Camden Town Brewery

One of London’s biggest breweries raised £2.75m back in 2015 and was privately acquired just 8 months later, providing investors with an undisclosed multiple return on their investment.

Revolut

The neobank has offered two exit opportunities in 2016 and 2018, with investors receiving a 19x return on their original investment at the later exit. These two opportunities have provided a return of £1.76m to investors.

Mettrr Technologies

From a 2012 raise, investors in April 2017 realised a 9x return on their original investment through a secondary share sale through Crowdcube.