Parpera is an Australian fintech company seeking to build an ecosystem of fair and transparent products and services that helps people to effectively set up, manage and grow their business in the new economy.

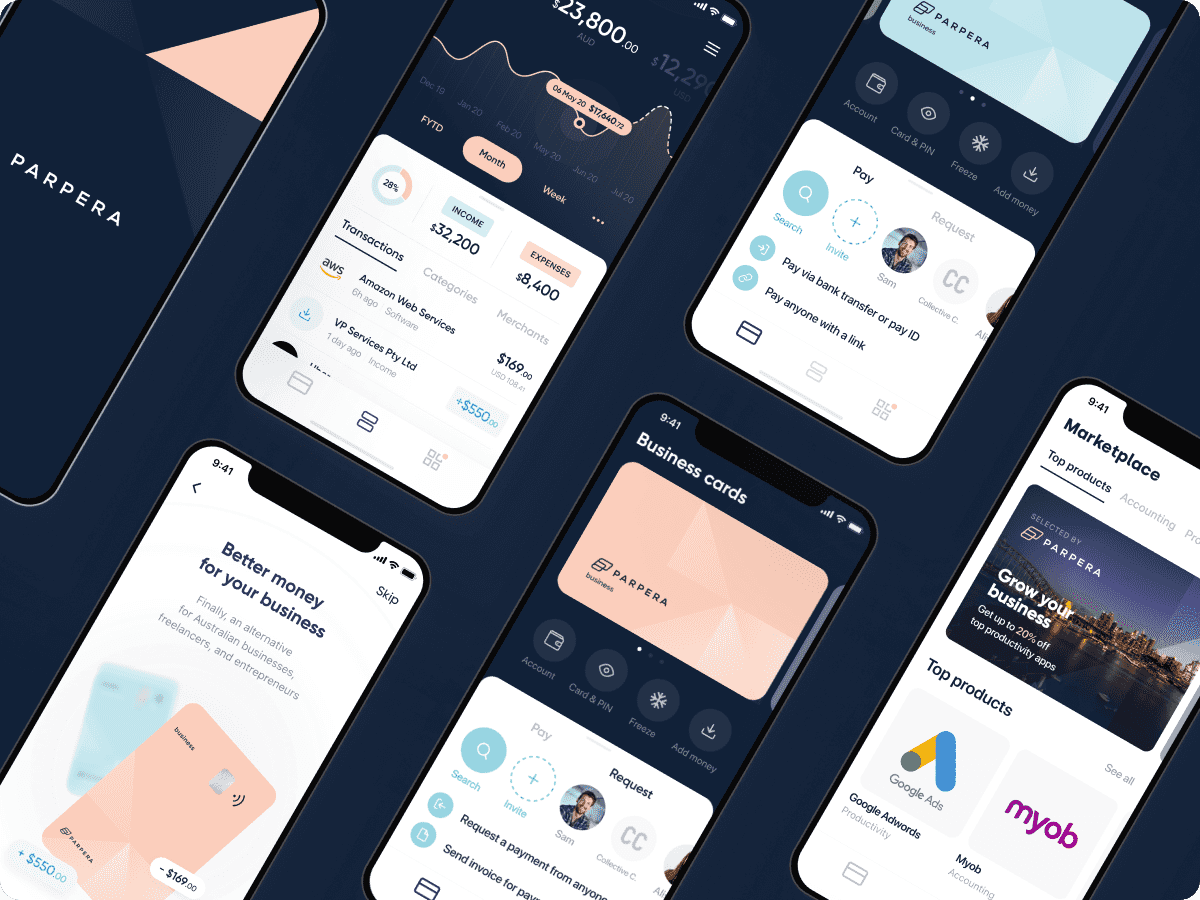

Parpera is developing a digital solution that will initially seek to provide digital wallet, card, payment, and money management capabilities. These features are co-designed with a community of Australian businesses to help them improve the way they do business. Parpera is not a bank, and is therefore not incentivised to make money off its members' money, but rather aims to make it easier for its members to setup, manage their money. Guided by international precedents of similar success stories in foreign markets, Parpera is hoping to change the way we do business.

Parpera's Success

Having successfully raised a pre-seed round through a network of entrepreneurs, HNWs and close connections, Parpera was ready to ramp up its capital raising and begin building a revolutionary product with those that believe in it. The company had already secured a robust and deeply experienced team of entrepreneurs and technological experts, across its management and advisory teams, led by founder Daniel Cannizzaro.

We chose to partner with Parpera not only because of its all-star team and business model, but also due to the validating research it had undertaken, despite the application still being in development. The company had performed over 500 business surveys and interviews to empirically validate the problem facing businesses. As a result, Parpera is being built as a clear solution to a clear problem and had achieved over 1,000 early waitlist sign-ups before commencing its campaign on Equitise.

Facebook advertising played a major role in building a list of over 1400 potential investors who had expressed interest in getting in on the ground floor. To complement its transparent product, Parpera also launched a community forum to answer all questions on the business and equity crowdfund open and honestly.

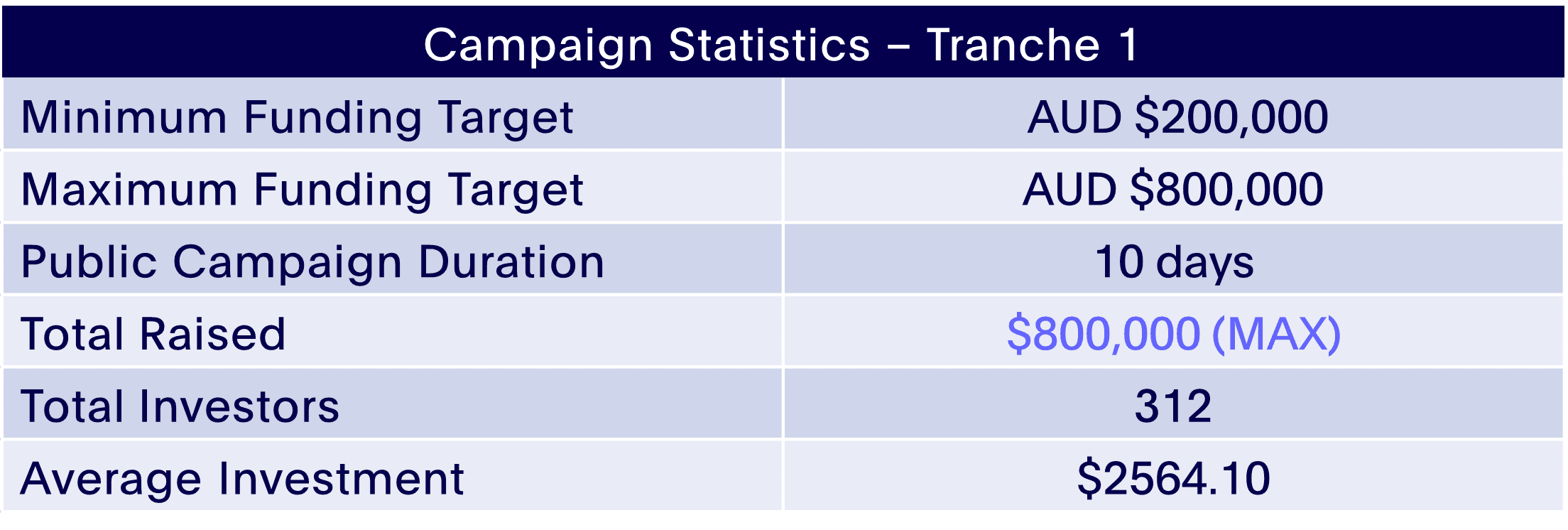

Owning a slice of the Parpera pie started at only $250. The company only took 10 days to hit its maximum funding target of $800,000, welcoming 312 investors as shareholders. The speed of the raise left a lot of investors wanting more, with a high amount of excess demand immediately following the campaign’s successful close.

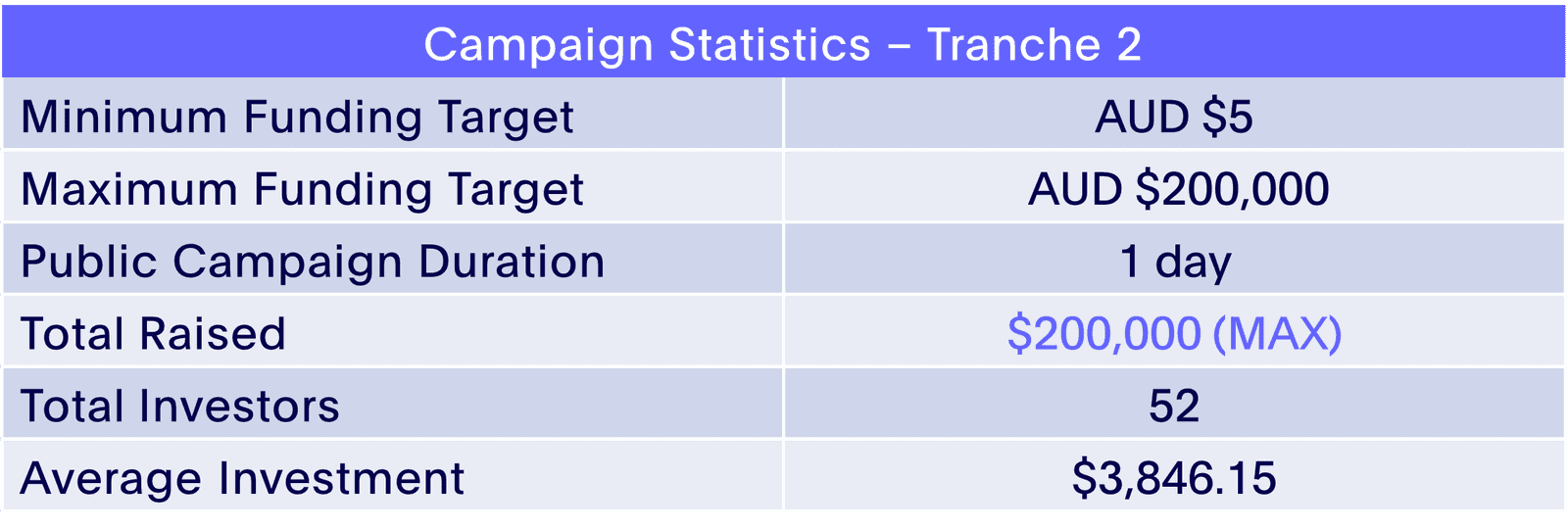

As a result, Parpera decided to open up a limited second tranche of $200,000 to be further put towards growth and development. Just a few hours after opening to expressions of interest, this second tranche hit its maximum target and closed successfully.

The success of the raise provides another proof of concept for Daniel and his team as they work hard towards giving entrepreneurs, small businesses and freelancers a better alternative for managing their money.

Hats off to Daniel and the team, we’re so excited to watch this company grow and make a positive impact on the world around it.