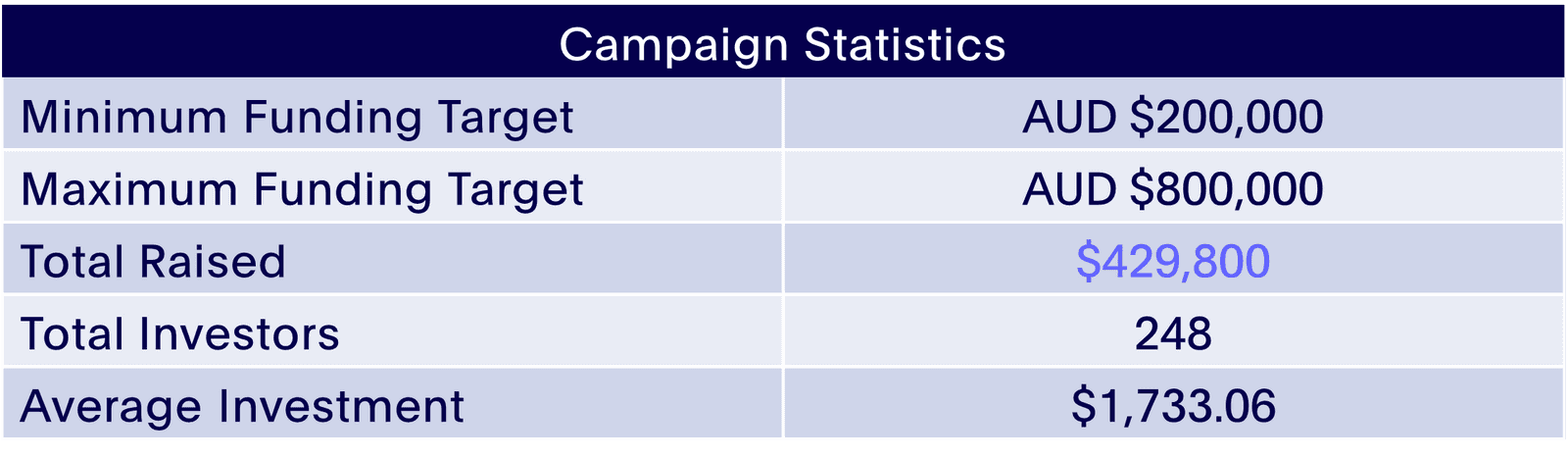

Humaniti recently closed a successful equity crowdfunding campaign during a difficult time of the year, raising $429,800, well above its minimum fundraising target of $200,000, reflecting 215% in overfunding. These funds will go towards scaling the business to a wider audience to rapidly grow the platform. With its technology already heavily invested in, the company is perfectly positioned to grow and expand.

Ben Dixon, CEO of Humaniti, said, ‘’Humaniti is disrupting the consumer data and marketing research industries by offering what we refer to as the ‘holy grail’ of consumer insight - the ‘what’ and the ‘why’ all seamlessly connected on one platform. Alongside this, we give everyday Australians the tools to budget better and the opportunity to earn extra cash.’’

He continued, ‘’We’re called Humaniti because we provide benefit to individuals, companies and the wider community (via our charitable donations). Undertaking an equity crowdfund is just an extension of this as we wanted to give our members the opportunity to share in our success.’’

What is Humaniti?

Humaniti is a next-generation financial budgeting platform and Data-as-a-Service (DaaS) company. Humaniti is a free personal finance app where people can earn money. Members (or "Humanitirans") can securely link all their accounts in one place and see a complete financial summary. Alongside insights to help them budget better, Humanitirians can also answer short surveys and polls to earn extra cash every month.

On the back-end, Humaniti generates revenue by connecting companies with accurate and affordable consumer data to help them make market-driven decisions. With the ability to conduct research on the platform, survey results can be seamlessly integrated with high-quality behavioural data to provide marketers with the “holy grail” of consumer insight. All data is de-identified, fully permission-based, privacy compliant, and updated daily.

Investment Highlights

- A highly impressive team with deep experience across key industries and in growing companies.

- Developed technology platform with over 10,000 members prior to the offer.

- Unique approach to the data-as-a-service industry with fully de-identified data and real cash rewards for surveys.

"It's been really successful for me, especially when it comes to keeping an eye on a monthly budget and setting a goal. Because all my bank accounts are linked to the profile, it makes it easier and more transparent to see what I am spending. Over the last 12 months, I definitely have saved an additional $200 to $500 a month just from watching my spending more closely.

Perhaps most importantly it's made me realise where I stand in comparison to people my age and gender regarding superannuation. Before Humaniti, I literally had no transparency over my super; I knew I had a BT account, but I had no clue how much was in there and how much I should have in there based on my age and gender. Humaniti showed me that I have double in there what people my age have, and that's made me feel a lot more confident about my retirement prospects."

Our Key Takeaways

A Good Member Base is Great for Traction

With over 10,000 members at the start of its raise, both teams were able to effectively tap into the company’s network of customers alongside our own investor audience of over 45,000. Based on a post-raise survey we conducted, over half of Humaniti’s investors were already members of the app. This shows how powerful an existing community can be when fundraising.

Perceived Strength of Opportunity is Key

The same survey also told us that investors were evenly split between their top reason for investing. Half invested as a means of supporting the company, while the other half invested due to the strong investment opportunity presented.

Challenges

Two things stood out to us. Firstly, that press was more difficult to obtain with COVID-19 taking up the majority of stories. Secondly, there was a lot of misunderstanding around marketing research with a lot of people not understanding the size of the market and how important it is to so many businesses. Unlike other personal finance apps, Humaniti doesn’t sell people’s data and believes that you should be rewarded for it - paying people the most of any platform to fill out optional surveys.

Quote from Ben Dixon, CEO at Humaniti

''We interviewed a number of ECF businesses but decided on Equitise because we liked the fit, the breadth of work they’d done ... and the opportunity to have a more liquid platform down the line. The process for us was really good.

The outcome was we had 292 new investors. Many of whom are members of our platform who are delighted to be part of our journey. Many have asked how they can invest again. But also having those brand advocates out there - giving us greater awareness in the public area - has been really good for us.''