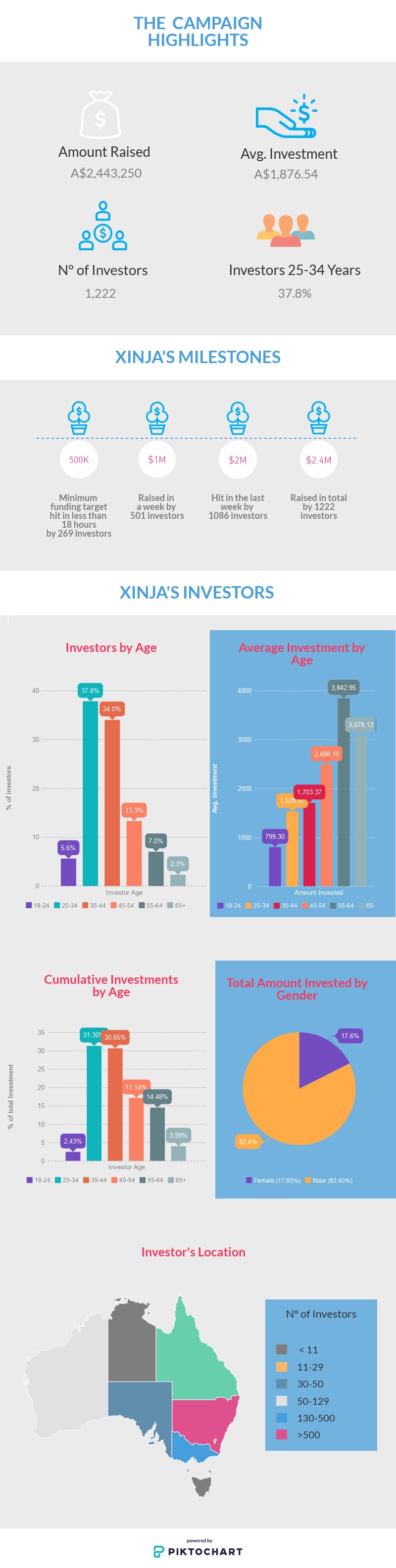

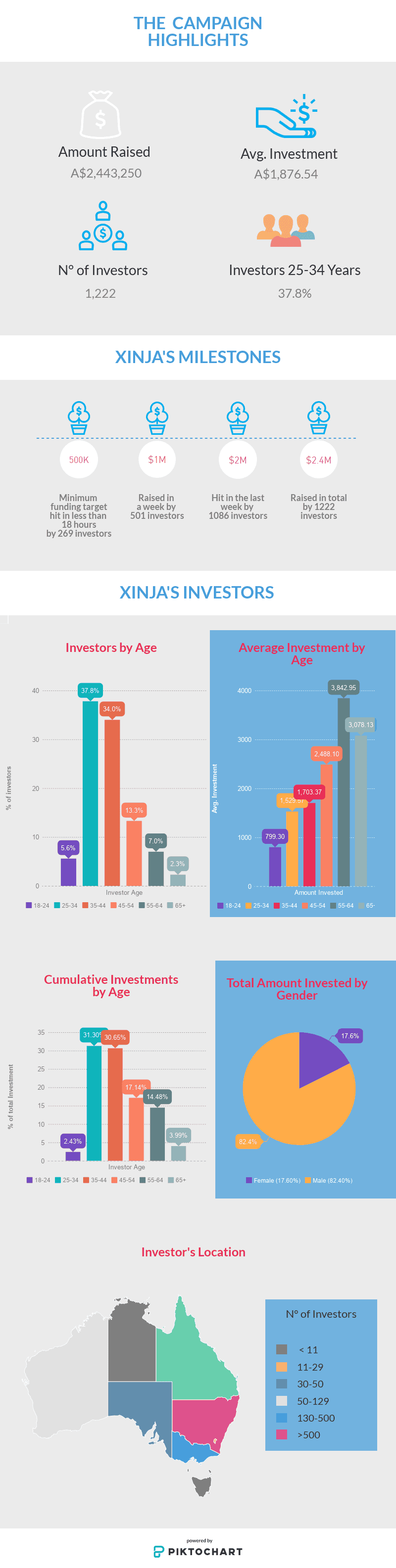

A little more than a week after the close of Xinja, we are happy to share what we learnt from Australia’s first retail equity crowdfunding offer.

Having closed with a total investment of A$2,440,250 (488.1% overfunded) the success of the raise underlines the willingness of everyday Australians to gain a foothold in cutting-edge companies. Whilst this was once an opportunity previously open only to wealthy investors, Xinja’s capital raise has kick started the era of investments coming from ‘the crowd’.

So, what did this crowd look like and how did they invest?

Firstly, they were of all ages with those aged between 25-34 years investing most frequently. The most common amount invested was A$250 accumulating to 26.5% of the total investors and demonstrating that equity crowdfunding really is democratising investing.

Looking at the investors’ location, 99% are Australian and are mostly located in the larger states of New South Wales and Victoria.

As for gender, 17.6% of investors are female - a figure perhaps to be expected when examining female investment behaviour. They were also older than their male counterpart with the youngest age bracket of 18-24 being almost non-existent.

For more insights, have a look at our infographic below: